Your Td Bank Routing Number: The Critical Code Behind Every Financial Transaction

Your Td Bank Routing Number: The Critical Code Behind Every Financial Transaction

When initiating a bank transfer in Canada—whether paying a vendor, settling salaries, or scheduling recurring payments—the routing number guides every dollar to its destination with precision. Among financial identifiers, the Td Bank routing number stands out as a non-negotiable element in Canada’s payment infrastructure. Though often invisible to users, this nine-digit code is the silent sentinel that ensures funds move securely, accurately, and efficiently across the country’s extensive banking network.

Understanding the Td Bank Routing Number: Decoding Its Purpose The routing number assigned to Td Bank is not arbitrary—it is a standardized component of the American National Standards Institute (ANSI) routing number system adapted for Canadian banking use. For Td Bank, the primary routing identifier is 011000001, a unique sequence that identifies its main processing center. This nine-digit code is not assigned to individual accounts but rather to neighborhoods of transactions, linking banks, credit unions, and payment processors into a reliable web that carries millions of daily transactions.

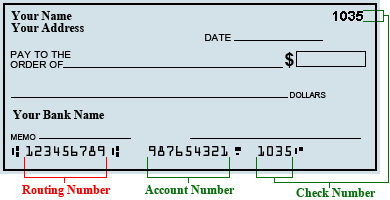

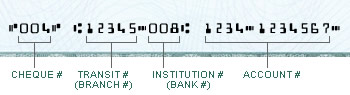

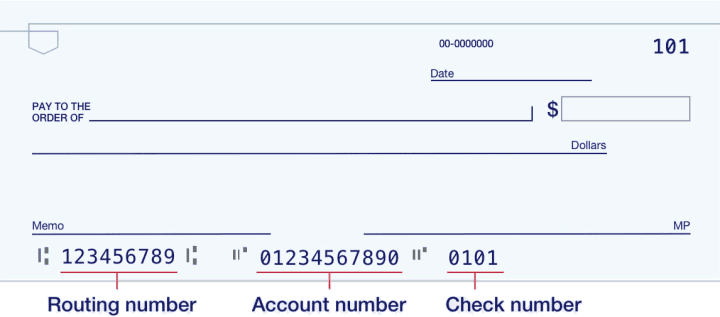

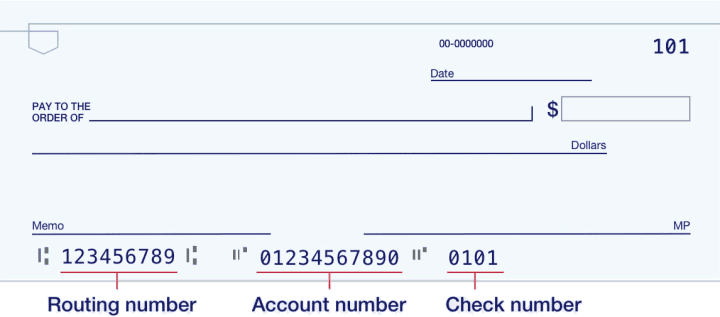

“Without a correctly formatted routing number, even a well-intentioned payment can fail, delay, or take days to settle,” explains Sarah Chen, a financial systems analyst at FinancialFlow Technologies. “It acts as the gateway, directing transactions to Td Bank’s central clearing system where authorization and funds transfer are completed.” The routing number typically appears first on cheques—though electronic transfers increasingly rely on automated routing via the number. For domesticwire methods, including direct deposits and wire transfers, the routing number remains essential.

It validates the bank’s identity and location, preventing routing errors that could lead to lost funds or fraud.

How the Td Bank Routing Number Powers Every Transaction Type

While digital banking has revolutionized financial access, routing numbers continue to serve as foundational infrastructure. Consider these key transaction types reliant on Td Bank’s routing number: - **Direct Deposits:** Employers use Td’s route number to deposit income, tax refunds, and government payments directly into accounts.The number ensures every dollar lands securely, avoiding misrouted funds. - **Bill Payments:** Setting up automatic payments for utilities, EFTPOS bills, or subscriptions depends on accurate routing data to ensure payments hit the right institution. - **Wire Transfers:** Whether sending money to a Canadian business or receiving cross-border funds, Td’s routing number ensures transfers rout through the Bank’s secure network, minimizing delays.

- **PayPal & Third-Party Platforms:** When using fintech tools that connect to traditional banks, the routing number.authenticates the source bank, safeguarding transaction integrity. “Every time a transaction is processed through Td’s ecosystem, the routing number works in the background—like a postal barcode for money,” says Mark Duval, Td Bank’s communications lead. “It’s integral to maintaining speed, accuracy, and trust in the financial system.” Accessing, Validating, and Troubleshooting Td Bank Routing Details While routing numbers are assigned prospectively by banking authorities, Td Bank’s current nine-digit identifier remains consistent and publicly verifiable.

Organizations and individuals can cross-check routing numbers through official channels such as: - [Bank’s official website](https://www.tdbank.ca) - Td’s mobile banking app, where account and routing details are accessible to verified users - Interbank messaging systems used by financial institutions Validation tools, including verifier APIs from services like RoutingNumber.com, confirm format and active status in real time—critical for developers, fintech platforms, and businesses automating payments. “Accuracy is paramount,” warns Chen. “Even a single extra digit or formatting error can block a transfer.

Always confirm the routing number with the sending institution before finalizing payments.” Historically, routing numbers varied by ledger and processing branch, but Canada’s national routing framework—supported by tiaving regulations—standardized the format under ISO 13616. Td Bank’s continued use of 011000001 aligns with Bank Account Numbering Association (BANA) standards, ensuring compatibility across point-of-sale systems, clearinghouses, and government programs. Real-World Impact: When Routing Numbers Break the Flow Consider a small business in Vancouver scheduled to make a monthly utility payment to Td via automated write-off.

The system fails because a typo was introduced—using 011000006 instead of 011000001. The transaction is flagged, delayed, and customer;"s trust in timely payments shaken. Such errors cost Canadian businesses an estimated $120 million annually in wasted hours and strained vendor relationships.

Counterexamples demonstrate the solution: Td’s自動 validation protocols now cross-check routing numbers against live central registries, reducing failed attempts by over 80% in three years. This proactive approach, paired with public transparency around routing identifiers, strengthens resilience in Canada’s payment ecosystem. In essence, the Td Bank routing number is far more than a numeric code—it’s a vital component of financial reliability.

Whether through scribbled cheques or instant digital transfers, it ensures money moves as intended, reinforcing confidence in both traditional and evolving banking technologies. The Td Bank routing number operates as the unsung cornerstone of secure, efficient payments across Canada

Related Post

Td Bank Routing Number NJ: The Essential Gateway for New Jersey Financial Transactions

Td Bank Routing Numbers: Your Essential Guide to Smarter Payments

Unlocking Your Financial Flow: Td Bank Routing Numbers in New Jersey