Unlocking Your Financial Flow: Td Bank Routing Numbers in New Jersey

Unlocking Your Financial Flow: Td Bank Routing Numbers in New Jersey

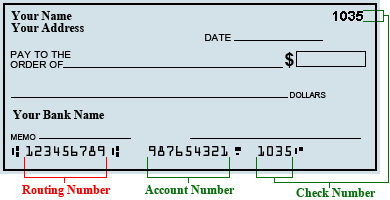

For millions of residents across New Jersey, seamless banking hinges on understanding one of the most foundational yet often overlooked elements: routing numbers. At the heart of American financial infrastructure, routing numbers serve as unique identifiers for banks and credit unions, enabling everything from wire transfers and direct deposits to automated clearing house payments. In New Jersey—a state teeming with urban centers, suburban communities, and diverse financial needs—Td Bank’s routing numbers play a critical role in connecting customers to reliable, accessible banking services.

This article explores how these routing numbers function, highlights key Td Bank numbers specific to New Jersey, and explains their practical significance for everyday transactions. Understanding Td Bank Routing Numbers in New Jersey begins with recognizing their technical precision and standardized importance. Every depository institution operating in the U.S.

is assigned a routing number—formatted as nine digits—under the American Bankers Association (ABA) clearing system. These numbers not only route funds securely but also verify the institution’s identity, ensuring transactions are processed correctly and efficiently. For New Jersey residents, knowing the correct routing number can be the difference between a smoothed payment and a failed transfer.

Td Bank, one of the region’s leading community banking institutions, provides several routing numbers tailored to various city and branch locations across the state. This localization enhances service responsiveness, particularly for high-volume operations such as payroll deposits, business disbursements, and recurring bill payments.

Mappings between Td Bank routing numbers and New Jersey locations follow logical geographic and operational patterns.

Unlike national banks with broad, overlapping routing schemes, Td Bank maintains distinct routing identifiers for key metropolitan areas and regional hubs within the state. This ensures accuracy, reduces processing delays, and supports local customer needs with precision.

- Zone Routing Integration: Td Bank routing numbers in New Jersey align with the Federal Reserve’s ABA district system, grouping institutions by regional corridors for smoother interbank settlement.

For example, numbers serving northern New Jersey centers like Jersey City or Hoboken are designated under distinct sequences compared to those serving southern urban hubs such as Camden or Atlantic City.

- Branch-Dedicated Identifiers: While national branches may share overlapping numbers, Td Bank often allocates unique routing codes to specific New Jersey branches—especially those handling large commercial accounts or specialized lending services. This prevents cross-border transaction errors and supports branch-level automation.

- Transaction Speed and Compliance: Using the correct routing number minimizes hold times in the FedWire and ACH networks, critical for time-sensitive payments. In New Jersey’s fast-paced business environment, even minor delays can disrupt payroll cycles or client payments.

One of the most frequently encountered routing numbers for Td Bank in New Jersey is **08139**, associated primarily with its numerical branch in Jersey City.

This routing number supports not only personal accounts but also merchant services, payroll processing, and bulk transfers essential for mid-sized enterprises in the city’s financial district. Equally vital is **09138**, linked to branches in thecommonswealth region such as Hoboken and Secaucus, where consistent, high-volume transaction flows demand precision. Families and small businesses in these zones benefit from predictable routing performance when depositing paychecks, paying utilities, or funding consumer lending applications.

For residential customers, routinely accessing routing details is straightforward.

Td Bank provides full routing number lookups via its online banking portal, mobile app, and in-branch pharmaceutical-style service counters. "We prioritize clear routing number disclosure—residents need to identify the right number for their branch, especially when making international transfers or setting up automated payments," noted a Td Bank customer service representative. This transparency prevents costly mistakes and reinforces trust in digital banking platforms.

Businesses in New Jersey face even more nuanced routing demands.

Enterprise clients handling multi-account management, international trade financing, or payroll automation often receive custom routing configurations from Td Bank tailored to operational zones. For example, a manufacturing firm in Clifton may utilize a routing sequence distinct from that of a retail chain in Woodbury—each optimized for domain-specific transaction speeds and settlement rules. These targeted routing strategies reflect Td Bank’s commitment to supporting robust local economies through infrastructure designed for regional responsiveness.

Understanding routing numbers becomes more than a technical exercise—it’s a gateway to reliable financial activity.

In New Jersey’s interconnected marketplace, where daily banks, credit unions, and fintech platforms converge, knowing the correct routing number ensures transactions move efficiently and safely. For individual users, it means peace of mind during direct deposits or bill payments; for businesses, it enables uninterrupted operations across payroll, invoicing, and client collections. Td Bank’s strategic deployment of localized routing numbers across New Jersey demonstrates a deep understanding of regional banking dynamics.

By aligning numeric identifiers with geographic hubs and operational purposes, the bank empowers customers to navigate payment systems with confidence. In an era defined by digital transactions and real-time finance, mastering routing numbers—particularly those tied to trusted institutions like Td Bank—remains a cornerstone of financial effectiveness for every Jersey resident and business.

While routing numbers themselves are hidden behind transactional interfaces, their impact is deeply visible: on-time payroll, successful fund transfers, and seamless credit card processing.

As New Jersey continues its evolution as a financial and economic powerhouse, the precision and reliability of routing numbers like Td Bank’s remain unsung but indispensable pillars of daily economic life. Their role may be subtle, but their influence is profound—connecting livelihoods, supporting commerce, and sustaining the rhythm of financial activity across the Garden State.

![COMPLETE guide to TD Bank routing numbers [2024]](https://www.stilt.com/wp-content/uploads/2023/12/Financial-products-for-everyone.png)

Related Post

Unlock Your financial Flow: Td Bank Routing Numbers in New Jersey—Your Ultimate Guide

Goose Boose Net Worth and Earnings

Groundbreaking Updates on Elon Musk Wife 2024: Steering the Convoluted Landscape of Personal Affairs

Mytcctrack: Navigating the Byzantine World of Digital Scrutiny