What Will Rent a Center Do If You Don’t Pay? The Full Breakdown

What Will Rent a Center Do If You Don’t Pay? The Full Breakdown

When rent payments fall behind at a managed housing center—be it assisted living, student accommodations, or subsidized apartments—a sequence of escalating actions unfolds, designed to recover owed costs while preserving legal and policy boundaries. Understanding what happens next is crucial for tenants navigating financial strain and for property managers ensuring compliance with contractual and regulatory obligations. From formal notices to legal remedies, the process reflects a balance of accountability, due process, and enforcement.

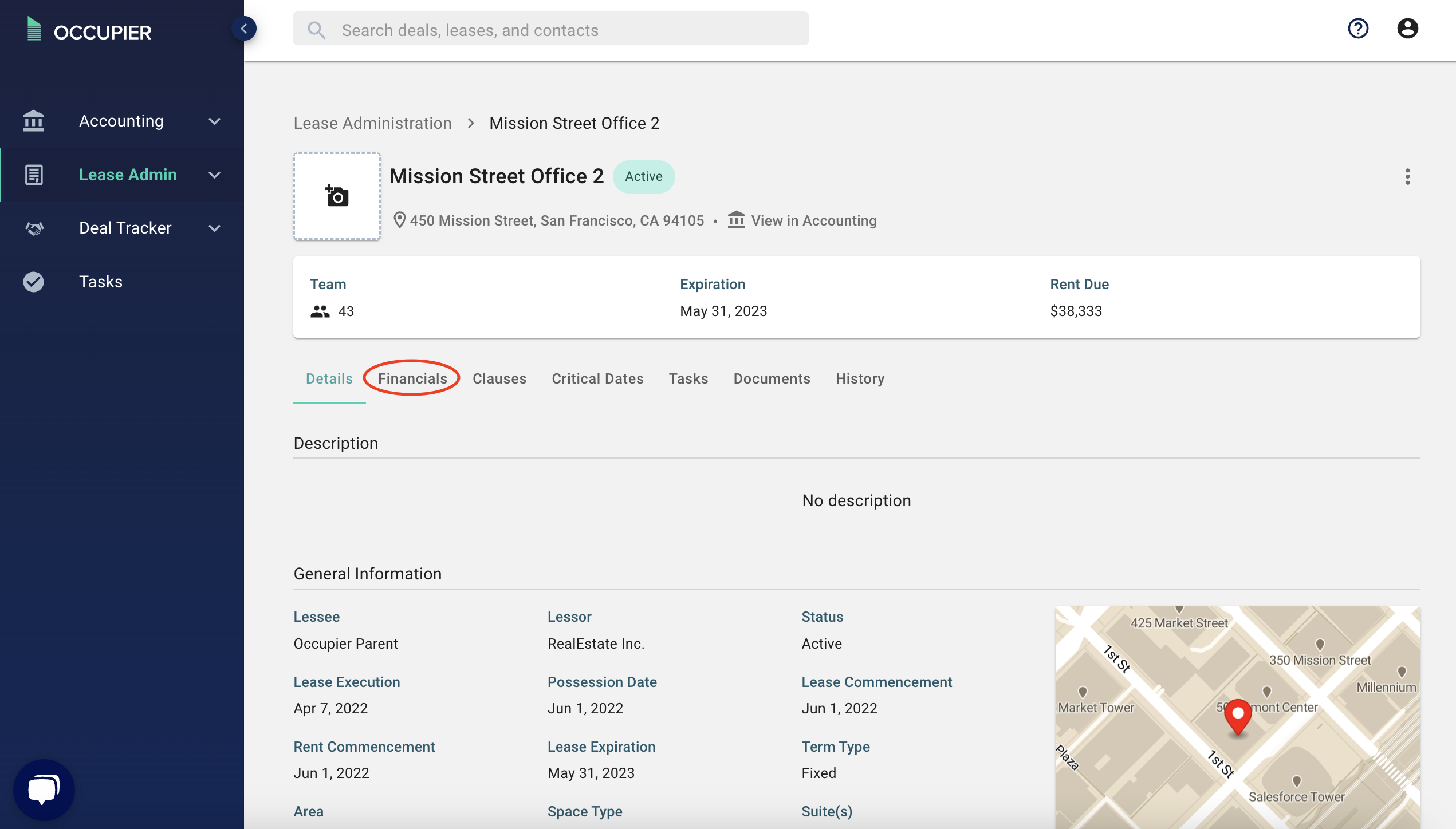

At the first sign of missed rent, rent-a-center operators initiate a structured escalation protocol rooted in written communications. Tenants receive formal reminders—often via email, mail, or phone—detailing the overdue amount, timely payment due dates, and consequences of non-response. These notices are not arbitrary; they are legal prerequisites mandated by housing laws in most jurisdictions.

As noted by housing policy expert Dr. Elena Torres, “Written documentation establishes a clear audit trail, protecting both parties and setting a factual foundation for further steps should payment remain unmet.” These initial warnings typically extend 7 to 14 days, depending on local regulations and the center’s internal policy, giving tenants a tangible window to settle balances without immediate fallout. Should rent remain unpaid after the initial notice window, the next phase involves intensified enforcement through payment holds and credit reporting.

Most verified rental centers implement automated payment tracking systems that flag delinquencies in real time. When rent is three days overdue, many facilities freeze lessees’ access to building services, key returns, or amenities—such as laundry access, gym use, or card-key privileges—signaling partial restriction as a deterrent. Beyond service limitations, credit bureaus are notified in many regions, and a late payment can begin appearing on the tenant’s credit report, impacting future financial opportunities.

For persistent non-payment, centers may escalate to debt collection agencies. These specialized firms operate under strict legal guidelines but pursue outreach with greater intensity, including phone calls from third-party collectors, settlement offers, and demands for immediate resolution. While aggressive, such measures remain within legal bounds—though they can compound financial and emotional strain.

Tenants facing this level of enforcement are strongly advised to seek legal counsel or housing advocacy support before reaching this stage. In cases of prolonged default—typically 60 days or more—the rent-a-center may pursue legal action. This commonly begins with a **sent stay of eviction**, offering a grace period for resolution before formal court proceedings.

However, if payment remains uncollected after this window, the center may file for **deficiency judgment**, seeking court-ordered repayment including unpaid rent, late fees, and administrative costs. In extreme instances, where fraud, forged documents, or repeated violations are confirmed, **legal eviction proceedings** can be initiated through municipal courts, potentially resulting in removal from the property and lasting criminal or civil reporting. For tenants, proactive communication remains the most effective defense against escalating consequences.

Reputable housing centers often allow payment plans, hardship waivers, or temporary liquidity options before default triggers full enforcement. “We prioritize dialogue over confrontation,” says Jennifer M., resident services director at a community housing provider. “Many balances can be resolved through early counseling—avoiding legal action that damages trust and stability.” Understanding one’s rights and responsibilities, maintaining timely contact, and exploring available support programs are critical steps in preventing severe outcomes.

The mechanics of non-payment enforcement hinge not only on policy but on transparency. Centers must comply with fair housing laws, ensuring actions do not discriminate and that communications remain respectful. For tenants, awareness means knowing leads: written notices precede every enforcement step, credit impacts accumulate incrementally, and legal options exist—but often come at escalating personal cost.

The protocol is clear: timely payment prevents consequences; ignored obligations invite structured, legally supported consequences. Ultimately, what a rent-a-center will do if you don’t pay is a deliberate, multi-step process grounded in contractual clarity and legal requirements. It begins with notice, evolves through service restrictions and credit impact, and may culminate in legal action—each stage backed by documentation and regulatory oversight.

Navigating this system requires both tenant diligence and institutional accountability, ensuring housing stability remains attainable, but accountability consistently upheld.

Staged Response: From Warning to Legal Action

The sequence of enforcement actions follows a predictable arc, designed to maximize compliance while minimizing unnecessary upheaval. Each phase is triggered by specific payment milestones and governed by statutory frameworks.1. **Initial Notice – The First Formal Demand** Within 7 to 14 days of missed payment, tenants receive a written notice detailing the overdue balance, original due date, and required payment instructions. This document serves as both a legal reference and a communication tool to encourage prompt resolution.

Failure to acknowledge receipt does not immediately activate harsher measures but signals a shift from courtesy to accountability. 2. **Service Limitations – Gradual Restrictions** After 21 days of non-payment, most centers restrict non-essential services.

These may include key ceding for regulated rentals, laundry access suspension, gym key deactivations, or card-reader limits. The intent is to

Related Post

What Will a Rent Center Do If You Don’t Pay? A Deep Look into Tenant Accountability and Consequences

What Will Rent a Center Do If You Don’t Pay? The Full Chain of Consequences

What Happens When You Skip Rent: The Latest on Rent Centers and Gaslighting Evasions

Top Indian News Feeds Expose Rising Tensions: How RSS Feeds Are Shaping Real-Time National Discourse