What Happens When You Skip Rent: The Latest on Rent Centers and Gaslighting Evasions

What Happens When You Skip Rent: The Latest on Rent Centers and Gaslighting Evasions

Renters who fail to pay rent face a carefully structured yet evolving consequence system enforced by property managers and rental centers—from automated payment warnings and credit reporting to eviction proceedings. While landlords often emphasize formal processes, the reality of default often unfolds behind the scenes with tactics ranging from persistent reminders to legal action. Understanding what rent centers do when payments go unpaid is essential for tenants navigating financial hardship—and landlords seeking clear compliance pathways.

When rent remains unpaid, the first response by most rent centers is not immediate eviction but a prescribed sequence of communication and enforcement steps designed to resolve defaults before escalation. Property managers typically initiate a timeline of escalation, beginning with formal written notices. These warnings serve dual purposes: documenting non-payment and outlining potential futures if the balance remains unpaid.

For instance, a “28-day notice” explicitly states that rent is overdue and outlines penalties if payment isn’t forthcoming. As a common real estate industry standard, such notices are legally required in many jurisdictions to protect both tenant and landlord rights. Under state and local laws, rent centers maintain the authority to report late payments to credit bureaus, which can severely damage a tenant’s credit score.

This reporting, usually initiated after the initial notices, remains confidential during the grace period but becomes part of a tenant’s financial history if payment is withheld. “Credit agencies see delinquencies as red flags—missing rent signals inability to manage obligations,” explains housing attorney Maria Chen. “This can affect future lending for cars, mortgages, or even new rentals.” Built into modern rental operations is an automated monitoring system that tracks late payments, due dates, and compliance status.

Rent centers deploy digital tools to flag overdue balances in real time, triggering follow-up communications via email, text, or phone. These automated reminders are not merely formality—they are legally strategic, preserving evidence of efforts to resolve the issue amicably before court intervention. If rent remains unpaid beyond the grace period—typically 5 to 30 days depending on jurisdiction—landlords and rent centers may escalate to payment lodgement.

This legal step involves formally transferring overdue rent payments into publicorial systems, marking the debt as secured and increasing the risk of enforcement actions. While the precise timing varies by state, such lodgement signals the landlord’s intent to protect their financial interests through official channels. The threat of eviction looms large, though it is preceded by a formal eviction handshake—a court-authorized process requiring due process.

Before filing for eviction, rent centers must prove genuine default after a documented series of warnings, explaining the near-certain legal pathway to property repossession. This process underscores that eviction is not abrupt but the culmination of structured enforcement. A common tactic by some rent centers is psychological pressure, often described pejoratively as “gaslighting evasions”—whether minimizing consequences or invoking fear of sudden action.

While such language is controversial and sometimes used subconsciously by overburdened staff, landlords must balance enforcement with transparency. Aggressive communication without clear context can damage trust, yet clear expectations remain vital. Effective centers use measured, factual messaging: “On October 15, your rent of $1,800 remained unpaid.

Failure to settle by November 15 may result in escalated actions, including legal referral.” Cap at what rent centers can formally demand varies by region, but late fees, penalties, and increased interest are nearly universal. These additional costs compound the original debt, pressuring tenants toward swift resolution. In some cases—especially with late payments exceeding 60 days—rent centers may seek a “pay-or-remove” ultimatum: pay immediately or prepare to vacate.

This ultimatum, while legal in many states, often walks a fine line between enforcement and coercion, raising questions about equitable practice. Throughout this cascade of actions, tenant rights endure. Most states enforce strict notice periods, ensure due process, and prohibit retaliatory eviction attempts.

Renters subjected to inconsistent or fear-based tactics can document communications, seek legal counsel, or contact tenant advocacy resources. “Understanding the calendar and consequences is key,” advises housing expert James Wright. “A written log of every reminder and notice protects your position in disputes or legal challenges.” The rent center’s role is not merely enforcement but compliance management.

Automated systems, legal adherence, and escalating protocols ensure landlords recover owed rent while maintaining orderly operations. Yet the real power lies in clarity: tenants who know the rules—and when breaches trigger them—are better positioned to act responsibly. Ultimately, the process underscores a delicate balance: protecting property rights without exploiting procedural gaps.

When rent goes unpaid, the rent center’s response follows a precise, legal trajectory—from formal warnings to potential legal action—designed not for intimidation but to uphold mutual accountability. For renters, awareness equates to empowerment; for landlords, clear systems ensure fairness and reliability in a high-stakes relationship.

Through automated alerts, formal notices, and escalating enforcement, rent centers maintain a structured response to unpaid rent—protecting landlord interests while navigating legal requirements and tenant rights.

This clear, stepwise framework defines modern rental enforcement, offering transparency in an often-complex dynamic.

From Grace Periods to Legal Action: The Enforcement Timeline

Upon unpaid rent, rent centers begin with a 10- to 28-day grace period, during which landlords send formal written notices. These documents do more than request payment—they formally record the default and outline potential consequences if balance remains unpaid. In California, for example, landlords must provide a 30-day notice before uaring a lease violation; failure to issue such notices can invalidate future legal claims.After this window, the landlord transitions to active collection efforts, often lodging payments with county recorders or filing lien documents, which can impact a tenant’s credit report as part of public record.

If rent remains due past the grace period—typically 30 to 60 days—defaulted balances are reported to credit agencies.

This damage to credit scores, ranging from 70 to 150 points depending on duration, significantly affects a tenant’s financial future, limiting access to loans, new rentals, or even employment in some cases.

By 60 to 90 days, many rent centers escalate to “pay-or-leave” notices or formal eviction filings, initiating court proceedings designed to lawfully reclaim possession. Each step balances legal compliance with practical enforcement, minimizing unnecessary court burden while ensuring landlords can recover owed payments through due process.

This phased system prevents abrupt or arbitrary eviction but maintains urgency—ensuring tenants face consequences proportional to the delay, preserving fairness while protecting property rights.

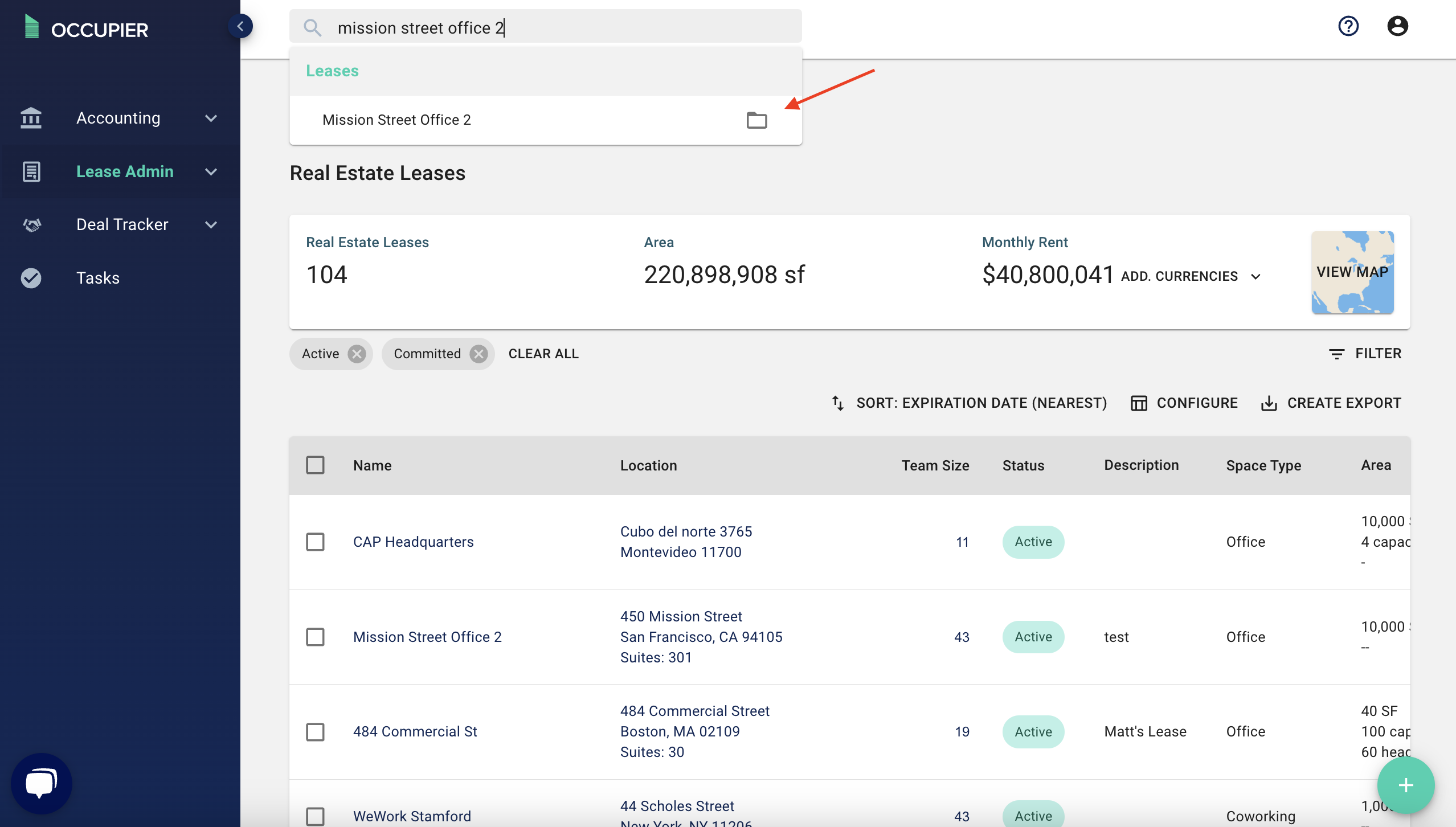

Automated Systems: The Backbone of Modern Rent Collection

Contemporary rental centers rely heavily on technology to manage late payments and default warnings. Digital platforms track due dates, send automated reminders via email or SMS, and flag at-risk accounts in real time.These systems reduce human error, ensure consistent communication, and preserve a verifiable audit trail. Leading property management companies now integrate AI-driven analytics to predict payment delays based on tenant history and local payment patterns. “Proactive digital alerts aren’t just efficient—they’re critical compliance tools,” explains data analyst Lisa Foster.

“Early reminders often prompt voluntary payments before escalation is needed.” Such automation supports both landlords and tenants: landlords maintain organized, timely records; tenants receive clear, repeatable reminders that can be reviewed during disputes. But reliance on automated systems also raises concerns about digital access—tenants without reliable internet or phone service may face challenges in responding to warnings. Prospective reforms call for hybrid approaches blending digital and physical notifications.

Automation promises clarity, but equitable access remains a key consideration.

The Psychology Behind the Pressure: Gaslighting or Clarity in Rent Enforcement

While enforcement protocols are standardized, the tone and delivery often spark debate. Some renters describe landlords or centers as using coercive language—phrases like “This is your last chance” or “You’re heading straight for eviction”—labeling such messaging “gaslighting evasions.” While not always intentional, emotional pressure can cloud judgment and strain tenant-landlord relationships. Housing specialist Clara Mendez notes, “Even when technically legal, high-stress communication erodes trust and can lead to defensive actions.Landlords intent on fairness balance firmness with respect—clear timelines, documented proof, and graceful escalation work better long-term.” Professional rent centers emphasize training staff in empathetic but firm communication. Script examples provided include: *“We’ve noticed your rent of $1,250 is overdue by 15 days. We aim to resolve this through a payment plan—would this work for you?”* Such phrasing maintains control without inducing panic.

The shift toward respectful urgency aligns with growing tenant advocacy, promoting accountability without fear-based manipulation.

Transparency saves relationships; fear-based tactics breed mistrust.

Tenant Rights and Recovery: Safeguarding Against Unfair Pressure

Despite aggressive enforcement, legal protections shield tenants from exploitation. Most states mandate specific notice periods—ranging from 15 to 30 days—before any collection step, ensuring tenants receive adequate notice of overdue obligations.Failure to provide required warnings invalidates formal eviction attempts. Beyond timing, tenants retain rights to challenge incorrect charges, request mediation, or contest reported delinquencies through local housing authorities. In 2023, over 40% of rent disputes in major U.S.

metros were resolved through mediator intervention, avoiding costly litigation. Moreover, collected rents must comply with state usury laws, limiting interest rates that landlords can charge

Related Post

What Will a Rent Center Do If You Don’t Pay? A Deep Look into Tenant Accountability and Consequences

What Will Rent a Center Do If You Don’t Pay? The Full Breakdown

What Will Rent a Center Do If You Don’t Pay? The Full Chain of Consequences

Revolutionizing Communication: How Hindi Typing in English Fonts Transforms What We Write