Unlocking Trust: The Critical Role of the Navy Federal Routing Number in Modern Financial Infrastructure

Unlocking Trust: The Critical Role of the Navy Federal Routing Number in Modern Financial Infrastructure

Every financial transaction, from small business payments to corporate fund transfers, relies on precision—especially when it comes to routing systems that ensure money moves securely and correctly. At the heart of this reliability lies a specialized identifier known as the Navy Federal Routing Number (NFI routing number), a silent but powerful engine driving clarity across the U.S. banking network.

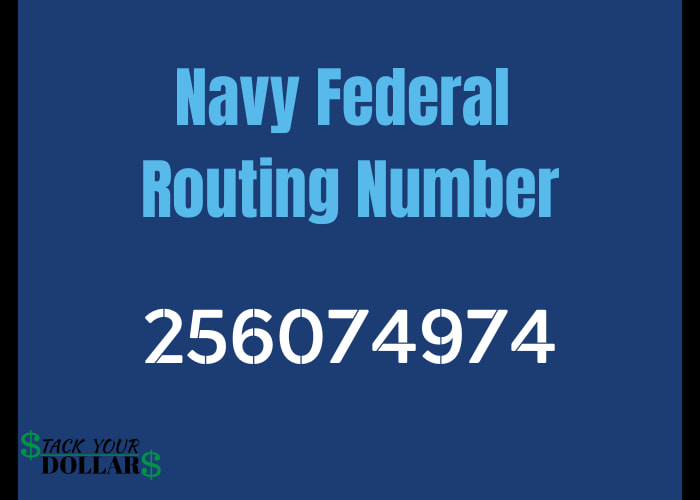

Far more than a digit sequence, this 9-digit code enables accurate routing of funds between Navy Federal Credit Union, financial institutions, and federal systems, reinforcing both security and trust in digital finance. The Navy Federal Routing Number is not one of the widely publicized ABA routing numbers used for mainstream banks; it is a specialized identifier exclusively serving Navy Federal’s internal and partner transaction processing. Though not publicly advertised in everyday banking apps, its significance is profound.

Utilized primarily in federal credit union operations, military-affiliated financial networks, and secure government-adjacent transactions, it streamlines the flow of payments while safeguarding compliance and audit integrity.

Used within the broader Federal Reserve’s ABA routing framework, the Navy Federal routing number functions as a precise coordinate for financial messaging. Unlike general routing codes, it enables Navy Federal to maintain tight control over transaction paths, reducing errors and fraud risks.

According to Navy Federal’s corporate finance division, “The routing number ensures every dollar delivered reaches its intended recipient with full accountability, even in high-volume environments.” This level of control is essential—military members, defense contractors, and federal employees depend on flawless transaction tracking, and the routing number forms the backbone of this reliability.

A defining feature of the Navy Federal Routing Number is its integration with secure messaging standards used across the financial sector. Transactions tied to this number flow through encrypted channels aligned with federal banking regulations, minimizing exposure to cyber threats.

Financial institutions nesting within Navy Federal’s network—from regional credit unions to military branches—leverage its anonymity and consistency to streamline reconciliation processes. As one certified treasury specialist noted, “Using a dedicated routing number like Navy Federal’s cuts down on interoperability issues and ensures full traceability, something civilian banks sometimes struggle to maintain during third-party integrations.”

Beyond transaction accuracy, the routing number plays a vital role in compliance and audit trails. For a service serving over 2 million Navy Federal members and government employees, every transfer must be fully documented.

The Navy Federal Routing Number ensures auditors can trace each transaction back to its originating branch, routing center, and final destination with unassailable precision. This transparency builds institutional trust—critical in a financial ecosystem where security and accountability define success.

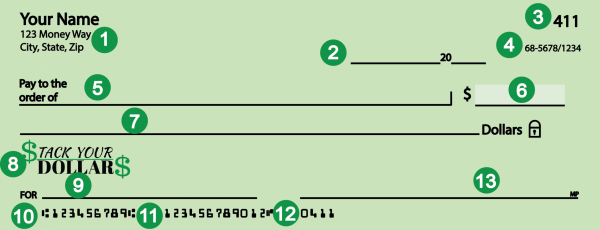

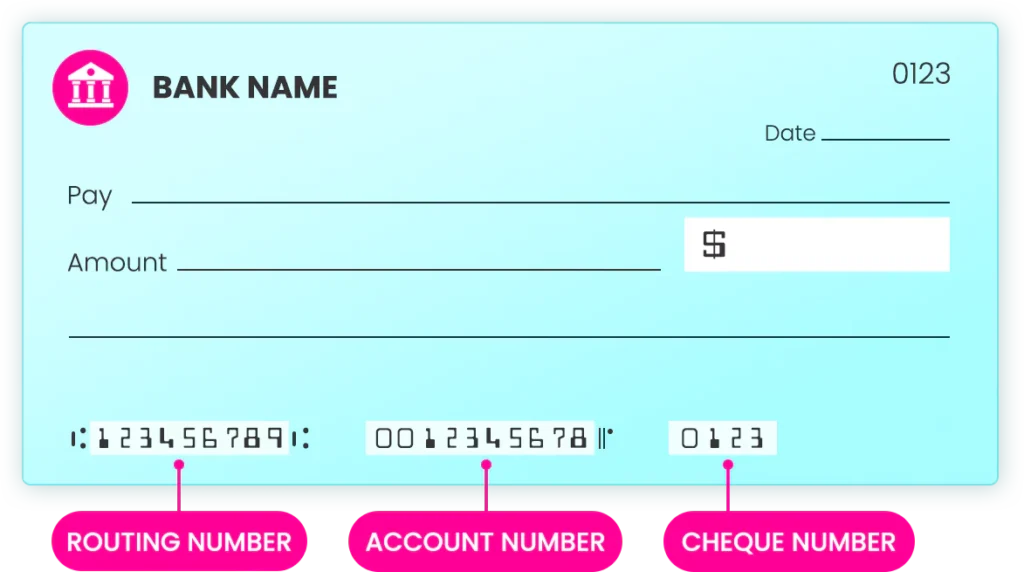

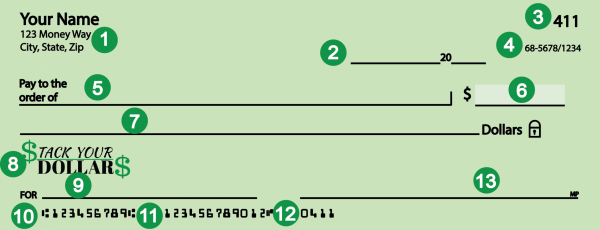

Key details underscore its operational distinction: the Navy Federal Routing Number measures 9 digits, includes no variable zones common in other routing systems, and is embedded directly within the ABA’s authorized numbering area (Az.

041 through 043, with specific assignment to Navy Federal). Transactions using this number bypass general routing ambiguities, ensuring funds move along designated paths with guaranteed verification at each hop. For businesses engaging Navy Federal as a financial partner, this predictability reduces settlement delays and operational friction—benefits that directly impact cash flow and client satisfaction.

Practical examples illustrate the routing number’s impact: when a military contractor sends payment to a Navy Federal credit union, the routing number instantly identifies the credit union’s Federal Reserve routing center, route code, and institution-specific sub-identifier. This micro-level precision ensures the transaction bypasses erroneous destinations and clears through the automated clearinghouse (ACH) network with minimal latency. Similarly, direct deposits for military pay—often processed through Navy Federal—depend on this routing number to land in servicemembers’ accounts reliably, even across multiple Federal Reserve districts.

While ABA routing numbers are familiar to most bank customers, the Navy Federal routing number exemplifies specialized financial engineering tailored to unique institutional needs. It reflects a broader trend in banking: toward segmented routing systems optimized for member experience, security, and regulatory alignment. Navy Federal’s adoption of its routing number is both a strategic and operational commitment—one that strengthens its role as a trusted partner in government and defense finance.

In sum, the Navy Federal Routing Number is more than a technical code. It represents a cornerstone of secure, efficient, and compliant financial infrastructure—ensuring every payment flows exactly where it should, protected by a system built for reliability. For millions relying on Navy Federal services, this number reinforces trust, reduces risk, and keeps the financial engine running smoothly.

Its quiet but essential role underscores a vital truth: in the world of money, precision isn’t just preferred—it’s paramount.

Related Post

Decode Every Detail: What You Must Know About Navy Federal Routing Numbers

KTM RC 125: Unlocking the Mystery of Pops and Bangs in Premium Young Riders