Decode Every Detail: What You Must Know About Navy Federal Routing Numbers

Decode Every Detail: What You Must Know About Navy Federal Routing Numbers

At first glance, a Navy Federal routing number may appear as just a string of digits, but beneath its structure lies a globally recognized system that powers thousands of financial transactions across the U.S. Navy Federal, one of the largest federal financial institutions, relies on precise routing numbers to securely process payments, manage employee disbursements, and maintain operational integrity. Understanding how these numbers work, assign them, and use them is essential for employers, service providers, and individuals navigating government and military-affiliated financial networks.

This article unpacks everything from format and structure to security implications, proving that Navy Federal routing numbers are far more than transactional identifiers—they’re vital components of modern fiscal infrastructure.

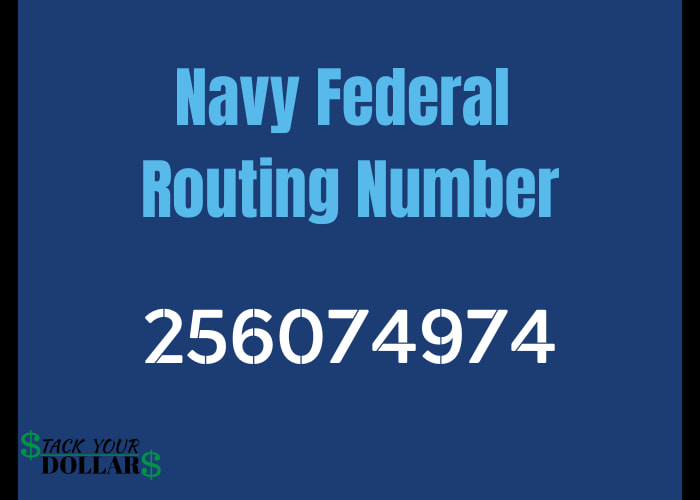

What is a Navy Federal Routing Number? A Navy Federal routing number is a unique nine-digit identifier assigned to financial institutions operating under the Navy Federal Financial Services.

These numbers function much like the ABA routing numbers used nationwide but are formally tied to Navy Federal’s internal and external payment processing systems. Introduced decades ago to standardize federal financial flows, these routing numbers enable secure, efficient routing of funds across checking accounts, direct deposits, wire transfers, and automated clearing house (ACH) transactions. Unlike private banks, Navy Federal leverages its own routing framework tailored for government employees, military families, and authorized partners, ensuring identity verification and compliance with stringent federal regulations.

The Anatomy and Format of Navy Federal Routing Numbers

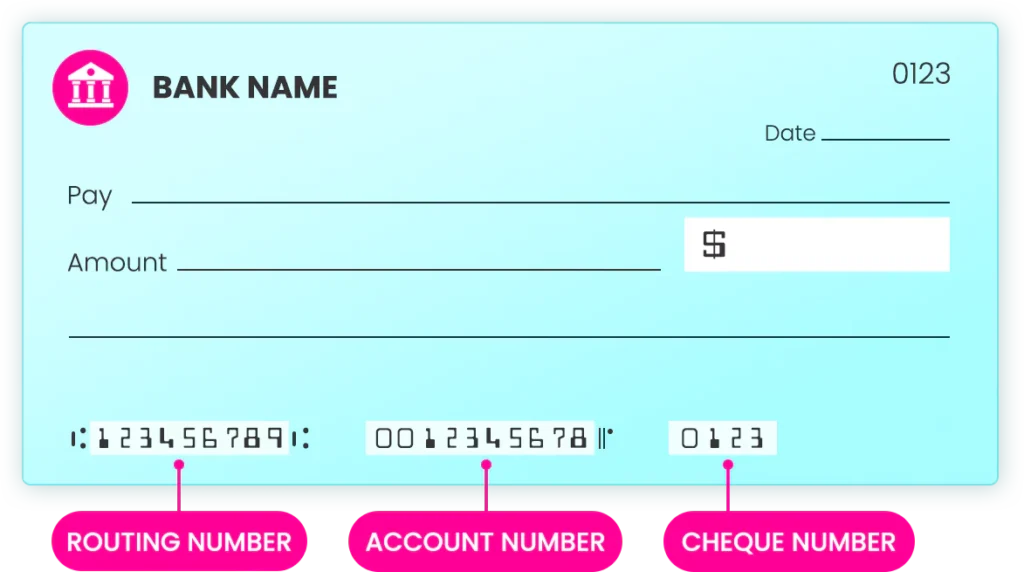

Structure Breakdown: Education for Accuracy While Navy Federal routing numbers follow a consistent nine-digit pattern, their internal structure reveals layers of operational precision.Unlike arbitrary identifiers, each number is systematically allocated based on legal and administrative criteria: - The first digit serves as an institutional category code—typically signaling a federal or government-affiliated entity. - The second and third digits refine geographic regions, linking numbers to specific Navy Federal branches or regional service centers. - Digits four through nine form a sequential serialization code, uniquely assigned to individual accounts or account types, ensuring no duplication across transactions.

This structured format isn’t arbitrary; it ensures compatibility with legacy financial systems and supports automated transaction routing without ambiguity. For instance, a routing number like 111222333 may route first to a Washington, D.C. headquarters branch, then to a dedicated employee disbursement system, all while maintaining full auditability.

Key Variants: DA, RA, and Special Assignment Routing Codes

Navy Federal incorporates several specialized routing prefixes within its broader routing number system, most notably DA and RA.Although precise internal usage is confidential, publicly available guidance indicates that: - **DA** typically identifies accounts linked to active-duty military personnel or federal government employees, streamlining payroll and benefit disbursements. - **RA** likely refers to accounts associated with retirement plans, healthcare benefits, and service-related financial services. Important: These assignment codes are not publicly disclosed, a deliberate measure to prevent unauthorized access and preserve transactional integrity.

Despite the opacity around DA and RA, users can safely confirm routing number validity through standard ABA verification methods, including direct checks via Navy Federal’s online account portals or official financial messaging systems.

Why Navy Federal Routing Numbers Matter Beyond the Basics

For employers setting up payroll systems, financial institutions processing government disbursements, and individuals managing federal accounts, Navy Federal routing numbers serve as linchpins in transaction accuracy. Unlike generic routing numbers, these identifier assignments reflect deep integration with federal financial protocols—ensuring funds reach correct accounts with minimal delays and maximum security. Example in practice: A federal contractor receiving quarterly payments from Navy Federal must utilize the exact routing code; even a slight deviation risks fund rejection or processing errors, potentially delaying critical payments.

Moreover, Navy Federal’s routing framework supports compliance with federal standards such as Social Security Number (SSN) matching and Treasury Direct payment mandates.

These routing numbers are not merely identifiers—they’re gatekeepers that authenticate eligibility, prevent fraud, and uphold reporting integrity across government financial ecosystems.

Setting Up and Using Navy Federal Routing Numbers: Step-by-Step Guidelines

For organizations integrating Navy Federal routing numbers into their financial workflows, following standardized setup procedures is essential. Begin by verifying the number’s format through official sources: Navy Federal’s website configuration, ABA database checks, or direct communication with their finance division. Always validate routing codes before initiating payroll, vendor payments, or employee account setups.

Key practical steps include: - Confirming assignment codes (DA, RA) with internal financial teams if applicable. - Entering routing numbers in the precise nine-digit format without spacing or prefixes. - Testing transactions via mock transfers to confirm successful routing.

- Maintaining records of routing number assignments for audit trails and compliance checks.

For individual account holders, accessing routing numbers requires authorization through Navy Federal’s secure portals. Direct access is restricted to account owners, payroll processors, and designated government finance personnel, ensuring privacy and security remain paramount.

Security, Fraud Prevention, and Verification Protocols

In an era of financial cyber threats, Navy Federal takes routing number security seriously.

Misuse of these identifiers can enable unauthorized access, fund diversion, or identity theft—particularly risky given the high-volume military and federal benefit transactions. The institution employs multi-factor authentication, encrypted transmission channels, and real-time transaction monitoring to safeguard routing data.

Verification remains a shared responsibility.

Using ABA’s official routing number lookup tools, checking digital SSL-certified portals, and cross-referencing with official Navy Federal communications help users detect fraudulent attempts. Employers and service providers must also train staff on proper handling of these numbers, avoiding email-based sharing and using secure messaging platforms exclusively.

Why Transparency Around Routing Codes Is Limited

Despite growing need for openness, Navy Federal maintains confidentiality over specific routing code assignments.

Full disclosure could expose the system to exploitation, undermining operational security. Instead, the institution relies on standardized industry practices for validation, supported by active fraud detection systems and internal audits. This balance of accessibility for authorized users and robust protection keeps networks resilient against evolving threats.

The Broader Ecosystem: Navy Federal Routing Numbers in Federal Finance

Beyond individual

Related Post

Jim Cornette Keeps Attorney Stephen P New Very Busy

Cristiano Ronaldo’s Number 7: More Than a Jersey, a Legacy Forged in Fire

Andrew Zimmern Bio Wiki Age Wife Bizarre Foods Shows and Net Worth

Understanding Boob Drop: What You Need to Know Before Watching the Body Language Turn Heads