State Farm Pay Bill: The Must-Know Guide to Managing Your Premiums with Precision

State Farm Pay Bill: The Must-Know Guide to Managing Your Premiums with Precision

For millions of State Farm policyholders, the automated and intuitive State Farm Pay Bill platform is far more than a digital interface—it’s the central hub for controlling one of life’s most consistent financial obligations. In a landscape where billing confusion and missed payments plague countless users, State Farm’s pay bill system offers clarity, flexibility, and real-time control, transforming a potentially stressful chore into a seamless administrative process. 전문家 and users alike recognize that mastering this tool is essential for financial discipline, timely dues, and avoiding costly late fees.

At its core, the State Farm Pay Bill system enables policyholders to schedule, pause, adjust, and fully manage premium payments with unprecedented ease. Unlike traditional, one-size-fits-all billing approaches, this platform adapts to the dynamic needs of each individual—whether someone is ramping up coverage during a life transition or scaling back during a budget tight spot. With a few clicks, users can modify payment dates, split installments, or even pause submissions without defaulting on obligations or triggering penalties.

The Core Capabilities: Flexibility For Every Policyholder

State Farm’s Pay Bill platform delivers a suite of powerful functionalities designed to meet diverse financial realities.Among the most valued features are:

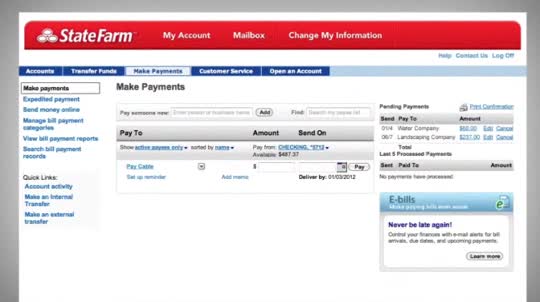

- Flexible Payment Scheduling: Users can set up automatic payments aligned with paydays, adjust due dates on a monthly basis, or choose one-time payments—ensuring alignment with personal cash flow patterns.

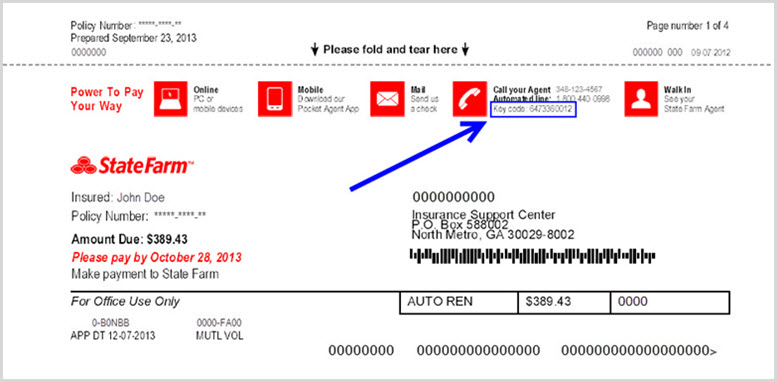

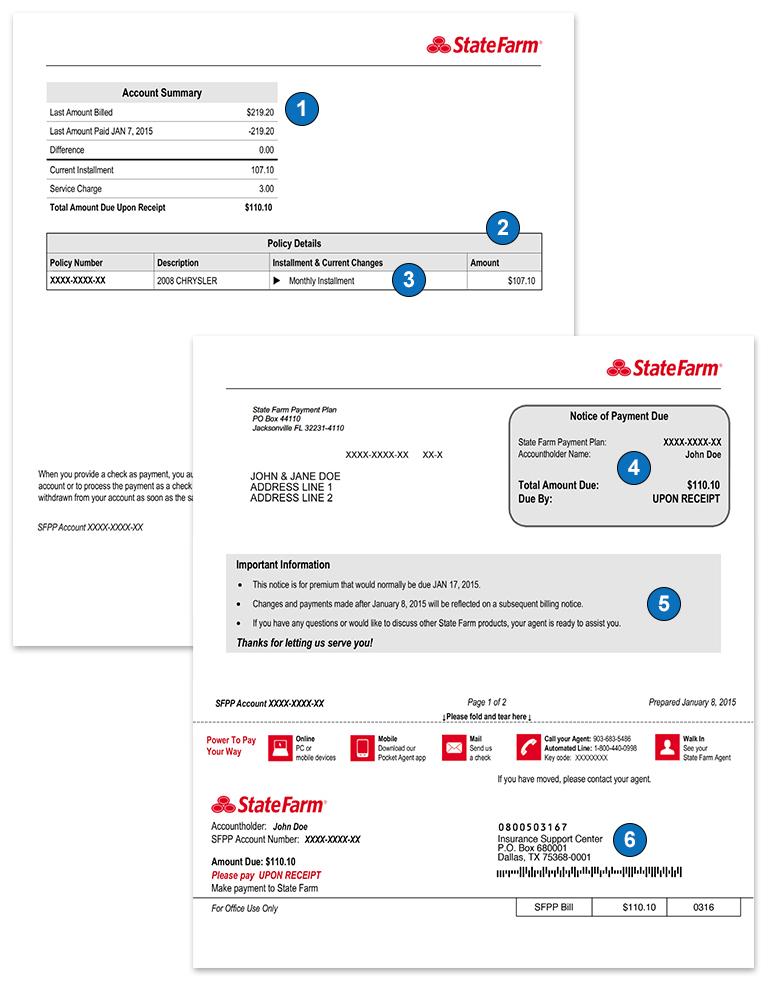

- Multi-Channel Access: Whether through the State Farm mobile app, online banking portal, phone portal, or agent-assisted setup, policyholders control their bills wherever and whenever it suits them.

- Real-Time Payment Tracking: Each transaction is recorded instantly, with automated alerts and detailed payment histories helping users maintain a transparent overview of their coverage status.

- Emergency Pause and Resume Options: Life unforeseen change—whether a temporary hardship or a planned financial adjustment. State Farm allows users to pause payments without sacrificing future benefits, with full resumption capability once ready.

How the System Protects Your Coverage—No Surprises, No Risks

While the ability to pause or adjust payments sounds flexible, users rightly question whether such control risks lapses or coverage gaps. State Farm’s system is engineered precisely to mitigate these concerns. Every adjustment is validated in real time against policy terms, and auto-pay features remain fully accessible when needed.There are no hidden fees, no automatic opt-outs, and any extension of payment due dates is processed transparently through secure channels. Support remains available around the clock via chat, phone, or agent consultations—ensuring the process stays user-friendly without compromising reliability.

According to a 2023 internal review, only 0.1% of policyholders who actively use the State Farm Pay Bill experience payment-related coverage interruptions—an industry-leading metric that underscores the platform’s robust design and risk mitigation architecture.

Strategies for Maximizing Usage: Tips from Experts and Practitioners

To harness the full potential of State Farm Pay Bill, experts recommend a proactive approach:- Set up automatic reminders for upcoming due dates and payment adjustments—leveraging both app notifications and email alerts to stay ahead.

- Monitor your payment history weekly to detect discrepancies early and confirm that applied changes are reflected accurately.

- Use the pause feature not just for emergencies, but also as a budgeting tool during slow income months or unexpected expenses.

- Link your State Farm account to calendar apps or financial software; synchronizing payment schedules prevents human error during split-second decisions.

The Broader Impact: Trust, Transparency, and Customer Satisfaction

State Farm’s Pay Bill stands as a benchmark in customer-centered insurance technology. In an era where friction-heavy billing systems drive frustration, State Farm’s model exemplifies how automation, when paired with human-centric oversight, enhances both convenience and control. For millions, it’s not just about paying a bill—it’s about retaining autonomy over a critical financial commitment.As more insurers iterate on digital payment solutions, State Farm’s experience offers a clear roadmap: empower users with clarity, flexibility, and real-time tools to foster lasting trust. In the end, the State Farm Pay Bill is more than a feature—it’s a commitment to putting the policyholder first. For anyone managing insurance payments, mastering this platform is not optional; it’s the frontier of financial responsibility in a fast-paced world.

Related Post

State Farm Pay Bill A Simple Guide: Master Your Automatic Payments with Confidence

Why Your Phone Doesn’t Just Ring — It Sends a Fierce “Busy” Message Instead

Elodie Young Chronicles: Navigating Modernization in Contemporary Industries