Jefferson Capital Systems: What You Need to Know for Winning in Modern Capital Markets

Jefferson Capital Systems: What You Need to Know for Winning in Modern Capital Markets

In an era defined by rapid digital transformation and increasing regulatory complexity, Jefferson Capital Systems captures critical insights into the evolving landscape of financial technology and smart capital deployment. Understanding how systems like Jefferson Capital Systems integrate data, automation, and strategic analytics is essential for firms aiming to thrive in fast-moving markets. This article unpacks the core capabilities, strategic advantages, and practical applications of Jefferson Capital Systems — revealing what decision-makers must truly know to leverage them effectively in today’s competitive environment.

At its heart, Jefferson Capital Systems represents a next-generation approach to financial infrastructure, blending advanced software platforms with deep market intelligence. The system enables organizations to manage risk, optimize capital allocation, and execute transactions with unprecedented speed and precision. By harnessing real-time data analytics and machine learning, it transforms vast streams of market information into actionable strategies that drive performance and foresight.

The Architecture Behind Jefferson Capital Systems

Jefferson Capital Systems is not a single tool but a comprehensive ecosystem built on three foundational pillars: data integration, intelligent automation, and adaptive analytics. These components work in tandem to support complex financial operations across trading desks, portfolio management, and compliance monitoring.- **Data Integration**: The backbone of Jefferson Capital Systems lies in its ability to aggregate structured and unstructured financial data from disparate sources — market feeds, enterprise databases, regulatory filings, and alternative data streams.

This unified view ensures that decision-makers operate from a single source of truth. - **Intelligent Automation**: Workflows throughout the system are optimized via AI-driven automation, reducing manual intervention and minimizing latency. From trade execution to settlement processing, automation enhances throughput and reduces human error.

- **Adaptive Analytics**: Built on predictive modeling and scenario simulation, the analytics engine enables proactive risk assessment and opportunity identification. Staff use customizable dashboards and AI-generated alerts to anticipate market shifts and respond in real time. This architecture empowers financial institutions to maintain agility under pressure, turning volatility into strategic advantage.

Core Applications: From Trading to Risk Management

Jefferson Capital Systems finds critical utility across a spectrum of core financial functions. Its practical applications span high-frequency trading, automated compliance screening, and dynamic portfolio rebalancing, each contributing to greater operational efficiency and regulatory alignment.In trading, the system’s low-latency processing capabilities allow firms to execute complex multi-asset strategies across global markets with microsecond precision.

By identifying arbitrage opportunities and managing volatility exposure automatically, Jefferson Capital Systems enhances returns while safeguarding capital. Risk management benefits profoundly from integrated exposure analytics, stress testing, and real-time monitoring of counterparty activities. Regulators and internal audit teams rely on the system’s audit-ready reporting and anomaly detection features to maintain compliance and mitigate systemic risks.

Portfolio managers leverage tailored AI-driven recommendations and rebalancing triggers, adjusting holdings based on evolving market fundamentals and client mandates — all within a single, responsive platform. The system also supports ESG integration, enabling sustainable investing frameworks that align with long-term value creation and stakeholder expectations.

Key Benefits for Financial Institutions

Adopting Jefferson Capital Systems delivers tangible competitive advantages for banks, asset managers, and financial consultancies alike.Its value manifests across three key dimensions: speed, accuracy, and strategic insight.

- **Speed to Market:** Automated workflows and real-time data processing enable faster trade execution and regulatory reporting. What once required hours or days now occurs in seconds, placing firms ahead of market-moving events.

- **Enhanced Accuracy:** Machine learning algorithms detect inconsistencies, flag potential fraud, and reduce operational errors. This reliability builds trust with clients and regulators. - **Strategic Foresight:** Predictive analytics transform raw data into strategic foresight, empowering leadership to anticipate market trends, optimize capital structure, and tailor client strategies with confidence.

These benefits combine to reduce operational costs, improve client satisfaction, and strengthen risk resilience — core pillars of sustainable financial success.

Real-World Impact: Case Examples and Industry Adoption

Across North America and beyond, financial institutions have implemented Jefferson Capital Systems to address specific operational challenges and unlock strategic potential.One major North American investment bank integrated the system to modernize its fixed-income trading operations.

By automating compliance checks and deploying live market sentiment analysis, the firm reduced trade settlement time by 60% and cut reporting errors by over 90%. Operational reports highlighted a measurable increase in trade volume, directly attributing growth to faster execution cycles and improved regulatory confidence. In asset management, a global ESG-focused fund utilized the system’s sustainability scoring algorithms and portfolio alignment tools.

This integration streamlined due diligence, cut manual compliance reviews by 75%, and enabled faster deployment of capital into high-impact green bonds and climate-aligned equities. As a result, clients reported higher engagement and improved long-term performance metrics. Regulatory technology providers have also adopted Jefferson Capital Systems as a backend infrastructure to deliver audit-traceable, real-time compliance dashboards.

This adoption supports faster regulatory submissions and reduces the risk of non-compliance penalties in an increasingly stringent global environment.

These case studies underscore the system’s versatility and proven effectiveness in solving real-world financial challenges — from day-to-day operations to strategic transformation.

Future-Proofing Finance with Jefferson Capital Systems

As digital disruption accelerates and markets grow more interconnected, the need for intelligent, adaptable financial systems only intensifies.Jefferson Capital Systems stands at the forefront of this evolution, offering organizations the tools to navigate complexity with confidence and clarity. By combining data power, automation, and deep analytical insight, it equips firms to anticipate change, optimize performance, and deliver sustainable value.

What decision-makers must remember is that investing in systems like Jefferson Capital Systems is not just about adopting technology — it’s about redefining operational excellence and strategic foresight.

For those eager to lead in the future of finance, understanding and implementing such solutions is no longer optional — it’s essential.

What You Need to Know: A Strategic Roadmap

To fully leverage Jefferson Capital Systems, organizations should prioritize several key steps. Begin with a clear assessment of operational pain points — where delays, errors, or inefficiencies disrupt performance.Then, invest in integration: ensure the system aligns with existing IT architectures and data ecosystems to maximize interoperability. Equally vital is training: empower staff across trading, risk, and compliance teams to use advanced features with confidence and precision. Finally, institute continuous monitoring and evolution.

Markets shift, regulations evolve, and technology advances — a static system fades quickly. By embedding feedback loops and updating analytics models regularly, firms ensure Jefferson Capital Systems remains a dynamic, responsive engine of competitive advantage.

In essence, Jefferson Capital Systems represents more than software — it embodies a strategic mindset for the modern financial world.Those who master its capabilities don’t just adapt to change; they lead it.

Related Post

Solar Eclipse August 2, 2025: True or False? Here’s What You Need to Know

BoxBox Twitch Star Bio Wiki Age Height Girlfriend CosPlay and Net Worth

WJBD Explained: The Game-Changing Framework Reshaping Industry Standards

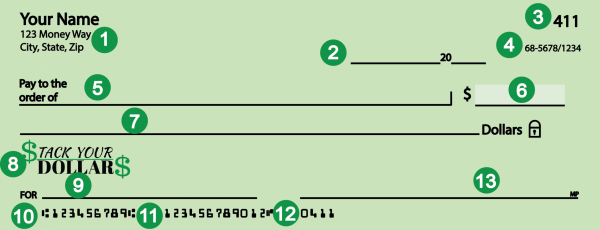

Decode Every Detail: What You Must Know About Navy Federal Routing Numbers