Honolulu Property Tax Your Ultimate Guide

Honolulu Property Tax Your Ultimate Guide

Owning a home in Honolulu means navigating one of Hawaii’s most distinctive and influential fiscal obligations: the property tax. With rapidly appreciating real estate values and a tax system shaped by Hawaii’s unique legal framework, understanding how commercial and residential property owners are assessed and billed requires clarity and precision. This guide delivers the definitive breakdown of Honolulu property tax—what it is, how it’s calculated, who benefits from exemptions, and essential strategies for managing your tax burden effectively.

The Foundation of Honolulu Property Tax: Structure and Purpose

Honolulu’s property taxation system is rooted in a dual mandate: to fund essential city services while balancing fairness across diverse property types.Local governments impose annual property taxes to support infrastructure, public safety, education, and municipal operations—critical functions in a scenic island economy dependent on both tourism and stable civic operations. The tax is levied on both residential and non-residential properties, though rates and assessments vary significantly. The Hawaii Constitution caps property taxation with a statewide approach, yet Honolulu applies localized valuation and administrative frameworks.

At the core of the system lies the concept of **ad valorem taxation**, meaning property taxes are calculated as a percentage of a property’s assessed value. Unlike market-driven tax models elsewhere, Hawaii’s system places heavy emphasis on equitable appraisal and regular reassessment to reflect true market conditions. According to the Office of Tax Appeals, assessed value is determined by the Hawaii Real Property Assessment Center (HRPAC), which evaluates market data, property characteristics, and location-specific factors.

“No property is taxed at par market value,” explains revenue analyst Kimo Yamamoto. “Instead, assessments are adjusted for differences in wear, location, and building quality—ensuring fairness across Honolulu’s diverse neighborhoods.”

Breaking Down the Tax Rates: Who Pays What and How Much

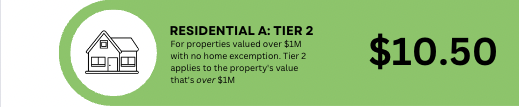

In Honolulu, property taxes are set annually by the city council and the County of Honolulu Board of Revision—two separate but complementary authorities. The most relevant rate is the **millage rate**, expressed in thousands of dollars per $1,000 of assessed value.As of 2024, the city’s effective tax rate hovers around 0.70 mills (i.e., $0.70 per $1,000 of assessed value), though the total effective rate including state and county levies can climb to approximately 1.5% or more. Residential Properties: Homeowners benefit from targeted exemptions designed to ease financial pressure, especially for seniors, veterans, and low-income residents. The most notable is the Senior Citizen Exemption, reducing the taxable assessment by up to 100% for qualifying homeowners over 65 who occupy their home as primary residence.

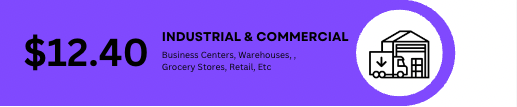

The Homestead Exemption further lowers taxes by removing a fixed dollar amount (currently $35,000) from assessment: “This exemption is pivotal,” notes tax attorney Lani Sato. “It directly reduces annual burdens—translating into thousands of dollars saved over time.” Commercial Properties: Businesses and investors face higher effective rates due to varied classifications—from retail and office spaces to industrial zones. Rates typically range from 0.90 to 1.30 mills, adjusted upward for property age, location desirability, and amenities.

“Commercial assessment factors include rental income potential and market rent benchmarks,” clarifies revenue specialist David Chen. “Additionally, certain zones receive incentive rate structures designed to encourage economic development—benefiting employers and job creators.”

Assessment Process: How Your Property Gets Valued

The journey from market value to tax bill begins with annual reassessment. Every three years, the HRPAC evaluates all taxable properties, accounting for sales data, construction updates, and physical conditions.This reassessment cycle ensures tax equity but can trigger bill shocks: homeowners must review notifications and dispute valuations through formal appeals if discrepancies arise. Key steps in assessment:

- Property identification using official parcel records from Honolulu’s GIS mapping system.

- Comparative market analysis against recent sales of similar properties in the immediate area.

- Adjustment for building condition, land size, roof age, and added infrastructure (e.g., pools, extra units).

- Public availability of assessment data online, allowing transparency and taxpayer scrutiny.

According to the city’s tax review process, appeals must be filed within 120 days of notice and supported by comparable sales or expert appraisals. The appeal board reviews evidence, often conducting site inspections, awarding a revised assessment and adjusting taxes accordingly.

Exemptions and Relief: Maximizing Savings on Your Tax Bill

Honolulu’s tax code embeds multiple relief mechanisms to support vulnerable and responsible homeowners.Bucking the myth that property tax is a rigid burden, the system actively rewards equity and community contribution. Senior Homeowners: Beyond the homestead exemption, seniors age 65+ qualify for additional rate abatements on qualifying commercial or rental holdings, incentivizing continued occupancy or community reinvestment. Veterans and Disability Recognition: Qualifying veterans may receive targeted deferrals or credits, reflecting Hawaii’s commitment to service-connected needs.

Low-Incomeargets: The County administers a property tax deferral program for households below 80% of area median income, offering temporary payment postponements tied to income thresholds. Energy Efficiency In

Related Post

Bratty Gbaby Naked: Culture, Controversy, and the Evolution of Youth Expression in Nigerian Media

What Time Is It Now in Colombia? The Precise Moment Across Time Zones

Rylie Rowan Unveiling The Life Achievements And Influence Of A Rising Star

Water 101: How precise hydration powers success across industries and ecosystems