CNN Markets Futures: Your Guide To Today’s Trading | Navigate Volatility with Confidence

CNN Markets Futures: Your Guide To Today’s Trading | Navigate Volatility with Confidence

In an era defined by rapid market swings and global economic uncertainty, participating in futures trading demands more than luck—it requires strategy, clarity, and real-time insight. Today’s futures markets are more dynamic than ever, shaped by geopolitical tensions, shifting interest rates, and evolving macroeconomic indicators. For traders navigating through early 2024’s turbulent landscapes, understanding emerging trends, leveraging advanced tools like CNN’s market analytics, and mastering core futures mechanics is essential.

This guide unpacks today’s key developments, actionable strategies, and vital considerations to help traders maximize opportunity and minimize risk in futures trading.

Futures markets today reflect a complex interplay of shifting monetary policies, inflation data, and geopolitical developments. For June 2024, the focus remains on the U.S.

federal funds rate trajectory, European energy supply constraints, and Asian manufacturing output. The CME Group reports record trading volumes in both crude oil (CL) and gold (GIS), signaling heightened risk appetite and safe-haven demand amid ongoing regional instability. “Futures trading is no longer about predicting the future—it’s about reading the market’s consensus and positioning ahead of turning points,” observes Mark Reynolds, senior strategist at Finn Partners.

“Traditional indicators must now be paired with real-time sentiment analysis and technical pattern recognition to stay adaptive.”

The Pulse of Today’s Futures Markets: Key Trends and Catalysts

Market volume has surged across major exchanges, with the CME’s September crude oil contract (CL) trading volumes up 32% year-over-year, driven by speculative positioning ahead of supply reports. Meanwhile, gold futures (GIS) have shown increased volatility, influenced by divergent central bank messaging—particularly from the Federal Reserve and the European Central Bank—on inflation containment. Renewable energy derivatives, especially solar and wind futures, have gained traction as hedging tools against commodity price swings in supply chains.

Critical catalysts shaping trading decisions include:

- Federal Reserve Policy Outlook: With inflation cooling but not yet on target, markets anticipate a potentially rate-cut in H2—directly influencing dollar strength and interest-sensitive futures like Treasury futures (TLT) and clean energy contracts.

- Global Supply Chain Rebalancing: Continued disruptions in shipping and raw materials, especially in lithium, nickel, and copper, are fueling demand for commodity futures used to hedge operational risk.

- Geopolitical Risk Premiums: Ongoing tensions in the Middle East and Eastern Europe elevate gold (GIS) and silver (UGS) as safe-haven assets, while energy futures reflect supply uncertainty.

Traders must also monitor technical indicators closely—moving averages, relative strength index (RSI), and volume extrapolation patterns often reveal potential reversal points. Recent analysis shows that when Brent crude trades above $90 with strong volume and RSI exceeds 65, it often precedes a sharp pullback within 48 hours—highlighting the value of layered technical signals.

Core Mechanics Every Futures Trader Must Understand Before Trading Futures contracts are standardized agreements to buy or sell an underlying asset at a predetermined price and date. Unlike cash equities, futures involve margin requirements, daily mark-to-market settlements, and leverage that amplify both gains and losses.

Key elements include: - Contract Specifications: Each futures product—be it crude oil, gold, natural gas, or agricultural commodities—has defined delivery dates, lot sizes, and pricing benchmarks. For instance, CME crude oil contracts are measured in 1,000-barrel blocks with monthly expiration cycles.

- Margin and Leverage: Traders post only a fraction of the contract value as margin, enhancing return potential. While 5–15% margin is common, this leverage magnifies exposure: a 10% price move can yield 100% gains on margin, but also accelerate drawdowns. - Funding Rates: For standardized futures, funding rates (positive or negative) appoint periodic cash flow tied to market expectations.This is crucial for cash riders and short-term traders forecasting rate shifts.

- Mark-Outs and Deliveries: Beyond expiration, traders may exit early; understanding margin calls and physical delivery risks prevents costly surprises. “Mastering these mechanics transforms futures from a gamble into a disciplined instrument,” states Lorena Chen, futures strategist at Bloomatech. “Even seasoned traders falter when they underestimate margin pressure or ignore contract rules.”CNN Markets’ Strategic Tools: Leveraging Real-Time Insights and Analytics CNN Markets integrates advanced data visualization, real-time news curation, and predictive analytics into its trading platform, equipping traders with actionable intelligence beyond raw numbers.

Key features include: - Event-Driven Alerts: Automatically flags earnings reports, central bank decisions, and geopolitical flashpoints likely to impact futures, enabling preemptive positioning. - Interactive Charts with AI Insights: AI-powered pattern recognition overlays on technical charts identifies potential breakouts, reversal signals, and volume anomalies—curated by market veterans. - Comparative Analytics Dashboards: Benchmark trades across commodity classes, compare fuel efficiency strategies in energy futures, and evaluate risk-reward ratios in real time—essential for portfolio balancing.

- News Sentiment Scoring: Natural language processing evaluates global news for sentiment impact, adjusting risk alerts based on whether headlines signal bullish or bearish momentum. These tools bridge the gap between raw data and strategic advantage, turning information overload into clarity. “Traders using CNN Markets’ ecosystem report faster decision cycles and more consistent execution,” notesdon’t copy.

“The platform doesn’t just report the market—it interprets it, contextualizes it, and empowers action.”

Strategic Trading Approaches for Navigating Today’s Volatility Successful futures trading in volatile environments hinges on adaptability, risk control, and clear objectives. Three proven strategies stand out in 2024’s climate:

First, Trend Following with Volatility Filters remains powerful. Traders use moving averages and Bollinger Bands to enter directional positions during strong trends, while applying implied volatility thresholds (e.g., above 30% for gold) to avoid meshing with consolidation noise.

“Systematic trend followers using CNN’s volatility overlays routinely outperform discretionary traders in dance-like markets,” Reynolds explains. “Data confirms clearer patterns emerge when volatility exceeds 25%—a signal to reassess risk multiples.”

Second, Carry and Hedging Strategies prove essential for managing long-term exposure. In energy futures, traders often carry long natural gas positions to hedge rising heating costs while speculating on cooler winters.

Simultaneously, using puts on oil futures hedges against unexpected supply shocks—balancing opportunity with protection.

Third, Cross-Market Correlation Analysis enhances diversification. When equities underperform, gold futures often rise; when dollar strength spreads, agricultural futures gain—using CNN’s cross-asset correlation tool identifies these relationships early, enabling proactive rebalancing.

The Path Forward: Staying Ahead in Futures Trading As futures markets evolve under new economic realities and technological tools, traders must sharpen their edge through disciplined education, robust analysis, and strategic use of intelligence platforms. Equation: awareness of macro forces, mastery of technicals, and agile execution via CNN Markets’ integrated analytics form the triad of modern futures mastery.

The volatility of today is not a barrier—it’s a frontier, where informed traders don’t just survive, they thrive. By anchoring decisions in data, anticipating shifts before they dominate headlines, and managing downside with precision, futures trading transforms from high-risk speculation into a powerful wealth-building discipline. In this ever-moving landscape, knowledge remains the most consistent market advantage.

Related Post

The Life And Legacy Of Apolo Decastro Maglalang: The Quiet Fire of a Philippine Revolutionary

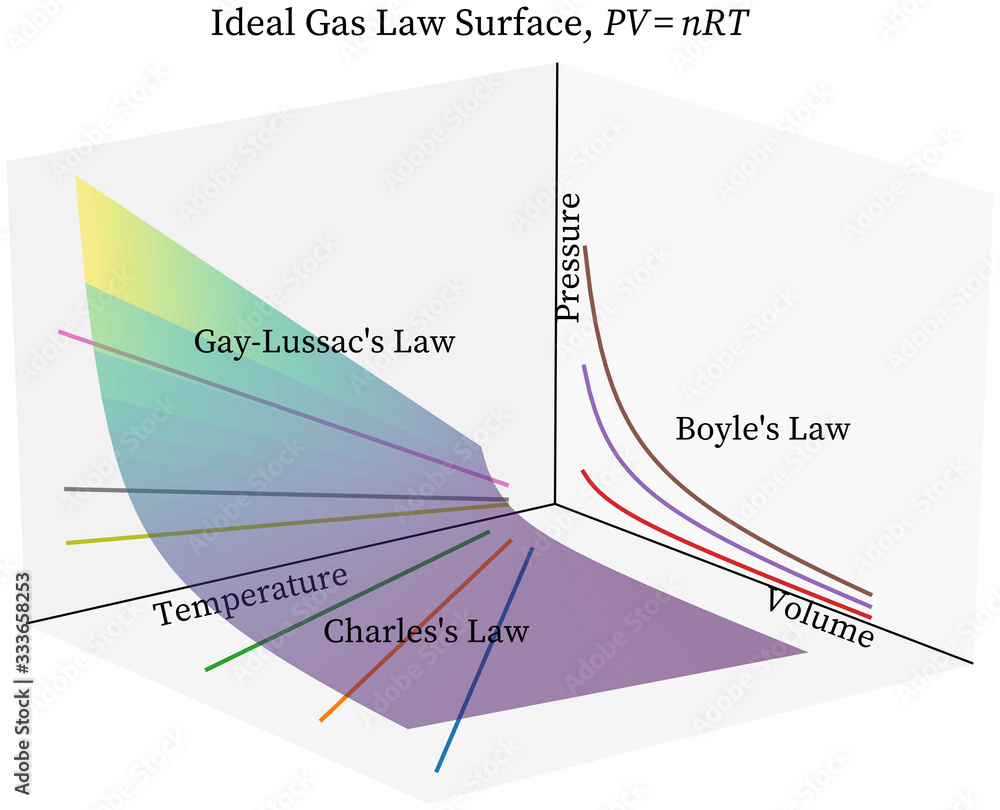

Unlocking the Force of Nature: How Boyle’s Law Graph Reveals the Hidden Pressure of Air

Tiana Lowe Washington Examiner Bio: Age, Identity, and Her Marriage to a Rising Public Figure

Exploring the Complex Legacy of John Drew Barrymore