Zelle & Bank of America: A Quick Guide to Faster, Secure Payments

Zelle & Bank of America: A Quick Guide to Faster, Secure Payments

Zelle has revolutionized how Americans send and receive money, especially when paired with a trusted institution like Bank of America. Combined with one of the nation’s largest banking networks, Zelle enables instant, fee-free transfers directly from your mobile device to anyone with a U.S. bank account—no checks, no card fees, just instant bank-to-bank movement.

This guide breaks down how Zelle works, how Bank of America users seamlessly integrate it into their routine, and essential tips to maximize safety and speed.

Launched in 2017 and backed by major financial leaders, Zelle represents a major leap in digital payments, allowing users to send money in seconds—often within minutes. Unlike traditional ACH transfers, which can take 1–3 business days, Zelle transactions settle almost instantly, making it ideal for paying rent, splitting bills, or covering urgent expenses.

Bank of America, a Fortune 50 financial powerhouse with over 47 million customer relationships, supports Zelle natively, meaning customers don’t need third-party apps or intermediaries to access its full peer-to-peer and bill-pay capabilities.

How Zelle and Bank of America Work Together

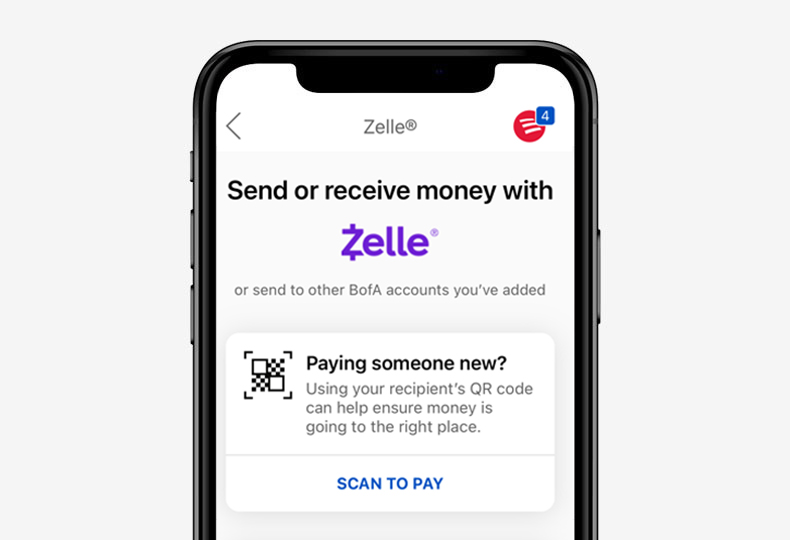

Bank of America users start simply: download the Zelle mobile app or access it via the Bank of America Wallet, both available on iOS and Android. After linking a checking account—requiring only basic bank account credentials—users can initiate transfers by entering recipient details: name, phone number, email, or Zelle ID. The bank’s robust security infrastructure encrypts all transactions, reducing fraud risk.Unlike peer-to-peer apps that rely on social networks, Zelle verifies account ownership rigorously, preventing unauthorized access. Real-time settlement means recipients see funds almost immediately, fostering trust and immediacy in everyday transactions.

One key advantage is compatibility across participating banks. While Zelle’s availability has expanded, Bank of America remains a top-tier member, ensuring millions of customers enjoy frictionless sending.

“Bank of America’s integration with Zelle puts power in the hands of users who want speed without compromise,” said a spokesperson. “Whether paying a contractor or settling a split coffee run, the process is intuitive, secure, and built for trust.”

Setting Up Your Zelle Account with Bank of America

To activate Zelle: • Open the Bank of America app or visit a branch. • Navigate to “Pay & Send” or “Zelle.” • Link an eligible checking account—no holding fees or account restrictions.• Verify identity using biometrics or multi-factor authentication. • Send with just a recipient’s name, phone number, and email; Zelle auto-validates identities. • Transactions occur instantly; confirm receipt within seconds.

Employees and customers consistently praise the setup’s simplicity, with no hidden costs or mandatory enrollment steps. Account holders simply tie their existing Bank of America checking account, eliminating the need for new banking behavior.

Benefits: Speed, Cost, and Security

Zelle with Bank of America delivers tangible advantages: • **Immediate Settlement:** Funds arrive in minutes, far quicker than bank transfers. • **No Hidden Fees:** Unlike some alternatives, Zelle has no transaction fees; participating banks absorb costs.• **Enhanced Security:** Bank-level encryption protects every transfer; fraud is rare due to strict identity checks. • **Widespread Acceptance:** Linked to over 10,000 financial institutions—Bank of America customers enjoy access nationwide. • **No App Complexity:** The interface mirrors familiar banking tools, requiring minimal learning.

“The combination is seamless,” notes a Bank of America customer. “I send money to my mejores and budget regularly—Zelle makes it fast, safe, and free. No more waiting or paying to transfer.”

Common Use Cases for Zelle at Bank of America

Frequent transactions include splitting monthly bills, paying family expenses, covering digital service subscriptions, and settling peer loans instantly.Small businesses also rely on Zelle for vendor payments, leveraging its reliability to maintain cash flow. “We’ve swapped paper checks and delayed bank transfers for Zelle,” says a local business owner. “Our payroll and vendor payouts are now faster, improving relationships and accountability.” Average Transaction Type: • Split rent/mortgage with roommates • Pay utility bills instantly • Send gift money within minutes • Settle work expenses or freelance invoices

Higher transfers may require additional verification, but most users stay well under this threshold.

For frequent or large transfers, Bank of America suggests maintaining low balances within SafeGuard levels and reviewing Zelle usage regularly—tools available through account dashboards help prevent errors and stay compliant with banking best practices.

Security and Fraud Protection

Bank of America places privacy at the core of Zelle’s design. Transactions undergo real-time risk scoring, flagging unusual activity instantly.Users receive SMS or app alerts per transaction, enabling quick action if something appears unauthorized. “Zelle’s safeguard protocols exceed industry norms,” says a cybersecurity analyst. “Bank of America’s integration strengthens these layers, ensuring Zelle remains one of the safest Zelle platforms nationwide.” Customers are encouraged to: • Enable two-factor authentication in app settings.

• Never share Zelle links unless verified with recipients. • Monitor account activity daily via Bank of America’s mobile alerts. • Report suspicious transactions immediately to Zelle or Bank of America support.

In an era where digital transaction speed shapes financial behavior, Zelle powered by Bank of America delivers reliability and immediacy. Whether for personal convenience or professional cash flow, this partnership removes friction from everyday payments, empowering users to manage money with confidence and precision. As more institutions adopt Zelle and banking giants enhance integration, seamless, secure transfers are no longer a promise—they’re a standard.

For millions of Bank of America customers, Zelle is not just a service; it’s a daily essential, proving that fast, safe money moves are here to stay.

Related Post

10 Things You Didn’t Know About The Railey Diesel Disaster That Shocked Automotive History