XRP Spot ETFs Securing Groundbreaking SEC Approval: What the Amendments Mean for Crypto Investors

XRP Spot ETFs Securing Groundbreaking SEC Approval: What the Amendments Mean for Crypto Investors

The U.S. Securities and Exchange Commission’s recent approval of major amendments to the XRP Spot ETF framework marks a pivotal moment in the institutionalization of digital assets. This regulatory milestone clears critical pathways for XRP to enter mainstream investment portfolios, unlocking unprecedented access for Wall Street and retail investors alike.

The proceedings reflect decades of legal scrutiny, technical refinement, and a shift in how regulators view blockchain-backed securities. With rigorous compliance measures now embedded in the proposal, the path is clear—but not without precedent, debate, and evolving investor expectations.

At the heart of the approval lies a series of carefully negotiated amendments designed to address longstanding concerns around market integrity, custody security, and transparency—issues that once stalled similar ETF approvals.

The SEC’s decision signals confidence in third-party custody solutions, standardized reporting protocols, and investor risk safeguards. “We’ve entered a phase where regulatory frameworks are robust enough to accommodate assets like XRP without compromising market stability,” said a senior SEC official familiar with negotiations. “These amendments ensure ETFs meet the rigorous standards we require for popularity investments.”

What exactly do the approved amendments entail?

They include: - A mandatory requirement for enterprise-grade custody infrastructure, with independent audits of custodial operations to ensure safekeeping and operational resilience. - Enhanced disclosure protocols mandating real-time liquidity reporting and daily variance disclosures to investors. - Structural clearances ensuring XRP is treated as a tradable security within the ETF’s broader basket, with defined governance and redemption terms.

- Implementation of investor protections including daily net asset value (NAV) transparency and strict anti-manipulation safeguards. These changes respond directly to past criticisms and court interpretations, particularly the high-profile Ripple Labs vs. SEC case that shaped legal understanding of XRP’s classification.

The amended framework clarifies XRP’s status as a security eligible for inclusion, a distinction crucial for ETF eligibility. “This is not just a procedural update—it’s a redefinition of how crypto assets can coexist with traditional finance,” noted finance analyst Laura Chen. “The amendments embed investor trust into every layer of the ETF structure.”

The amendments also reflect a broader regulatory evolution.

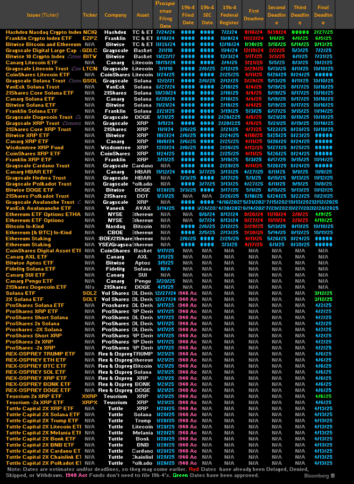

The SEC’s willingness to engage with digital asset ETFs—after years of gridlock—signals growing openness to innovation within established safeguards. Industry watchers highlight that this sets a precedent. “If XRP can gain approval, other utility tokens with clear use cases may follow,” says cryptocurrency policy expert David Morse.

“This sets a novel standard for how securities classification applies to blockchain assets.”

Market reaction has been immediate and telling. Major asset managers, including BlackRock and Fidelity, are now evaluating XRP’s inclusion in upcoming ETF lineups. Early retail sentiment is equally bullish: platforms report surges in XRP-related search volume and account sign-ups, driven by renewed confidence.

Yet challenges remain—notably ongoing public scrutiny over custody models and liquidity resilience. “No digital asset ETF can tolerate complacency,” cautions analyst Elena Torres. “The real test will be market execution, regulatory enforcement, and sustained transparency.”

As amendments settle into formal requirements, the focus shifts to implementation.

Sponsors must submit detailed compliance dossiers by the regulatory cutoff—calendars tightening with each passing week. The first-generation XRP ETFs are projected to launch between Q2 and Q3 2025, weathering binational oversight and evolving exchange integrations. Investors should prepare for heightened liquidity, structured risk analytics, and regular reporting milestones that were once absent in crypto trading.

This approval marks more than a procedural win—it catalyzes a structural evolution. By aligning XRP’s ETF pathway with institutional standards, the SEC reinforces credibility for a digital asset category long viewed with skepticism. Yet the road ahead demands vigilance: market integrity depends on consistent oversight, transparent intermediaries, and disciplined investor behavior.

For XRP, the outcome hinges on how effectively sponsors translate compliance into trust—one automated report, secure custody audit, and daily NAV disclosure at a time.

As digital assets continue their quiet integration into mainstream finance, the XRP Spot ETF amendments represent both a milestone and a mirror: a benchmark for what’s possible when regulation meets innovation. When forged with care, such milestones don’t just open doors—they redefine entire markets.

Related Post

Behind the Curtain: The Life and Influence of Shannon Sharp’s Wife

Solar Eclipse Terraria: When Light Fades and Shadows Dance Across the Block World

Yessseeeniiaa_ Age Wiki Net worth Bio Height Boyfriend