Withdrawal Transfer Stopped? Here’s Why It Happens—and How to Fix It Fast

Withdrawal Transfer Stopped? Here’s Why It Happens—and How to Fix It Fast

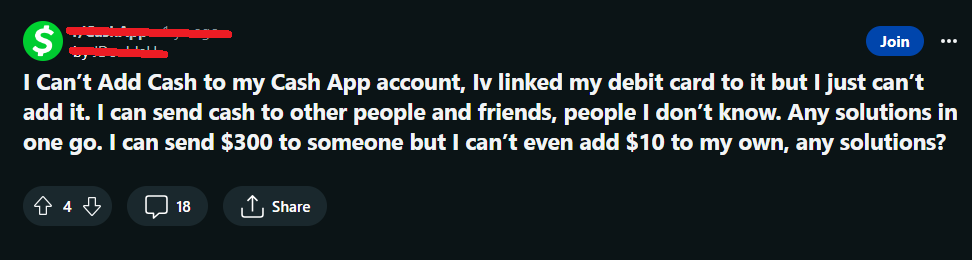

When your scheduled withdrawal transfer simply stops—without warning or clear explanation—it disrupts cash flow, stirs uncertainty, and challenges trust in financial systems. Whether initiated by the user or blocked by banks or payment platforms, a frozen transfer disrupts personal budgets and business operations alike. But why does this occur, and more importantly, what steps can restore your funds before lasting damage sets in?

The answer lies in recognizing the common triggers and precise actions to take when a withdrawal transfer halts.

Withdrawal transfers—the lifeblood of digital finances—can be halted due to a range of technical, compliance, or policy-driven reasons. Recognizing these causes is the first step toward resolution.

Common triggers include failed identity verification, mismatched transaction amounts, outdated bank details, regulatory holds, failed connectivity to financial networks, or system-level security protocols. Banks and fintech platforms often suspend transfers preemptively to comply with anti-money laundering (AML) policies or to verify recipient authenticity—actions that, while necessary, can leave users in limbo.

The Top Reasons Transfer Withdrawals Are Stopped

Many interventions stem from robust compliance frameworks designed to protect the financial system. Transfers may be blocked when identity documents fail real-time validation or when the transaction pattern raises red flags—common automated safeguards against fraud.For instance, a sudden large transfer from a low-activity account might trigger a system alert. Outdated or incorrect bank information also ranks as a frequent culprit: a misentered routing number or an expired IBAN code can prevent funds from reaching the intended recipient. Regulatory holds represent another serious cause, often imposed when authorities request enhanced due diligence.

Such holds, while lawful, stall transfers for days until documentation is verified. Finally, network connectivity issues between banking partners can silently disrupt transfer workflows, especially in cross-border transfers dependent on regional clearing systems.

Beyond policy and technology, human error plays a role.

A user might inadvertently enter invalid account details, or consent forms might lapse—both of which halt automated flows. Importantly, awareness of regional jurisdiction impacts matters: transactions involving sanctioned countries, politically exposed persons, or high-risk sectors attract extra scrutiny, increasing the probability of blocking. Understanding these triggers transforms helplessness into action—and is essential for effective problem-solving.

Immediate Steps to Diagnose and Resolve a Stopped Withdrawal

When your transfer is halted, swift diagnosis unlocks resolution.Start by checking the official notification—whether automated or from your bank—where reason codes or error messages often appear. Common error codes include “ insufficient funds,” “identity mismatch,” or “compliance hold.” Referencing a clear internal resolution matrix can streamline this: refer to the bank’s troubleshooting flowchart, typically accessible via mobile apps or online dashboards. Begin by confirming identity and documentation.

Access secure verification tools—using biometrics, digital notarized docs, or official ID uploads—and ensure banks’ systems sync with current, valid data. Verify recipient bank details against publicly available databases or contact customer service for proof of authorization. If the transfer was initiated via a third party (like a P2P platform or cross-border service), confirm any pending authorizations or institution-specific held policies are cleared.

Misconfigured export controls or missing beneficiary fees commonly induce holds in international transfers. Next, contact support promptly. Most institutions provide dedicated channels—live chat, toll-free lines, or ticketing systems—to escalate blocked transactions.

During this outreach, present clear facts: include transaction IDs, timestamps, error codes, and supporting files. Request a formal reason code, as this enables documentation for account status recovery and internal audits. Banks often offer temporary holds release pathways when clarification is provided within 24–72 hours, particularly if identity issues are resolved quickly.

For persistent holds tied to compliance or regulatory scrutiny, verify if end-user due diligence is current and consult your institution’s AML department. Transparency in sharing necessary KYC (Know Your Customer) updates can minimize delays. Finally, monitor your transaction history and connectivity: network restarts, application updates, or firewall settings on the originating device may block internal routing.

Proactive measures reduce recurrence: maintain updated banking information, regularly refresh identity records, and engage in platform-specific training on compliance requirements. When systems halt transfers, knowing the why and having a clear action plan ensures timely recovery.

Final Thoughts: Taking Control of Stopped Withdrawal Transfers

A halted withdrawal transfer is far from irreversible—it’s a signal demanding attention, clarity, and decisive action. By understanding the core causes—from identity verification gaps and outdated details to compliance holds and technical snags—individuals and businesses can identify solutions faster than waiting in uncertainty.Responding with verified documentation, coordinated communication with financial institutions, and adherence to regulatory best practices turns a disruptive pause into restored financial continuity. With vigilance and structured problem-solving, even the most frustrating bank transfer stoppage can be resolved efficiently and on your terms.

Related Post

Mike Tyson and Robin Givens’s Divorce Settlement Revealed: What the Cautionary Tale Reveals About Wealth, Loss, and Legal Precision

Michael Jackson Before and After: The Transformative Journey of a Musical Revolutionary

Exploring the Elevation of Ebonee Noel: A Professional Review