Why Can’t You Find Snickers Mass Market in Indonesia? The Hidden Logistics Behind a Global Icon’s Absence

Why Can’t You Find Snickers Mass Market in Indonesia? The Hidden Logistics Behind a Global Icon’s Absence

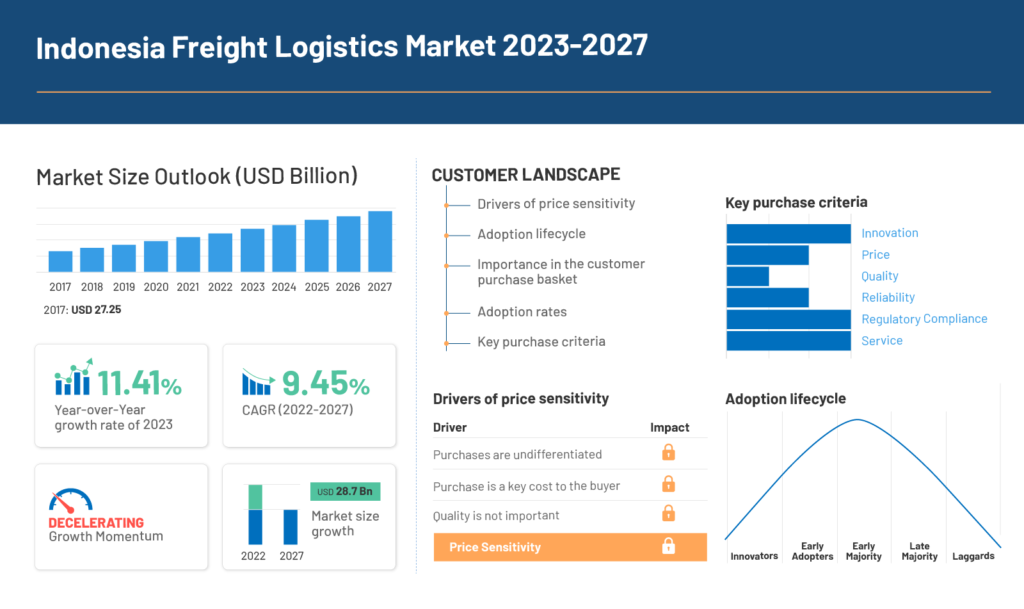

Indonesia, with its vast population of over 270 million and growing urban centers, represents a key market in Southeast Asia. Yet, despite its economic significance, the popular chocolate bar Snickers remains notably absent from mainstream supermarkets and convenience stores across the archipelago. This curious gap between global brand ubiquity and local inaccessibility reveals a complex interplay of supply chain dynamics, regulatory hurdles, and shifting consumer preferences.

While the world’s most recognized candy bar enjoys shelf-space in many developed nations, Indonesia’s locals often turn to alternatives—yet Snickers remains conspicuously absent, sparking persistent curiosity and debate. The primary reason lies not in consumer demand, but in logistical and structural challenges that shape distribution effectiveness. Indonesia’s geography—with over 17,000 islands—poses a formidable obstacle to streamlined supply chains.

Delivering packaged snacks to remote and densely populated areas alike demands sophisticated transport networks and substantial investment, factors that often deter global manufacturers from prioritizing underserved regions. As Dr. Adi Prasetyo, a supply chain expert at Jakarta’s Institute for Retail Analytics, notes: “Reaching rural Andaman or Papua requires navigating fragmented infrastructure, limited port capacity, and unpredictable weather—all of which inflate costs and delay delivery.” _added: Logistics expenditures in island archipelagos average 20–30% higher than in continental regions, according to recent industry reports, directly impacting a brand’s shelf presence.

Without dense urban demand concentrations, multinational firms assess market feasibility cautiously, deferring expansion into markets deemed too costly or operationally unstable._ Beyond distribution, Indonesia’s strict food regulations introduce additional complexity. Snickers, a processed confectionery containing palm oil derivatives, certain preservatives, and specific lecithin-based emulsifiers, must comply with local safety and labeling standards enforced by Badan Nasional Penagihan (BNP). Manufacturers must undergo extensive testing, product reformulation, and bureaucratic approvals—processes that are time-consuming and financially taxing.

“Each registry alteration, ingredient declaration, and nutritional claim audit slows market entry significantly,” explains Dr. Siti Aminah, a regulatory affairs consultant in Jakarta.

While Snickers enjoys strong presence in Indonesia’s urban centers—available in malls like Banco Malutin and online platforms such as Tokopedia—the absence from traditional retail giants amplifies its enigmatic profile.

Urban Indonesians readily access Snickers through modern trade channels, but those farther from metropolitan hubs encounter scarcity, often forced to seek alternatives like local confectioneries or imported grocery stores with limited international shelf space. “It’s not a lack of interest—Snickers is familiar, trusted—but access is the barrier,” says Budi Wijaya, a consumer insights researcher in Surabaya.

Market research further reveals shifting consumer habits that influence distribution decisions.

While younger generations show increasing openness to global brands, price sensitivity remains a critical factor. Snickers’ premium positioning—as compared to local or regional chocolate options—limits mass affordability in price-sensitive segments. “Indonesian consumers value value heavily,” notes agricultural economist Ngurah Surya, “and the brand’s higher cost relative to locally dominant chocolates like plantation or local artisanal brands affects purchasing behavior across rural and semi-urban regions.”

Strategic decisions by confectionery giants compound the accessibility gap.

Monde Nestlé and Mars Inc., stewards of Snickers globally, tailor their distribution portfolios based on market potential, retail density thresholds, and competitive intensity. In Indonesia, where informal retail networks (warungs, makro stores) dominate over modern supermarkets, aligning Snickers with existing retail infrastructure proves difficult. These decentralized vendors rarely stock premium international brands unless turnover guarantees are strong—rarely met in fluctuating regional demand.

Digital transformation offers a glimmer of change. E-commerce platforms and direct-to-consumer models are expanding Snickers’ reach beyond physical retail, leveraging Indonesia’s booming digital economy. Over 200 million active internet users now engage with online shopping, and cross-border e-commerce spots rising, enabling Snickers to reach consumers through licensed third-party sellers and branded microsites.

However, this digital presence remains supplementary, unable to fully replicate the volume and convenience of brick-and-mortar availability.

Looking ahead, overcoming Snickers’ absence in Indonesia hinges on balancing global strategy with granular local adaptation—enhancing logistics efficiency, securing regulatory alignment, and adjusting pricing models to meet diverse consumer expectations. The bar’s worldwide recognition speaks to brand strength, yet Indonesia’s retail landscape demands a different approach—one that prioritizes real-world accessibility over theoretical demand.

As the market evolves, the spread of Snickers in the Indonesian market remains not just a question of supply, but of strategic patience, infrastructural investment, and deep cultural understanding.

Related Post

The Enduring Legacy of Paula Hurd: A Life Defined by Media, Insight, and Timeless Influence

Costa Rica’s Golden Generation: Star Players Shaping the National Team’s Legacy

San Diego Time Now: Timing the Coastal Calm in Southern California’s Golden Hour

Cedric The Entertainer’s Enduring Love: Life, Legacy, and the Influence of Wife Lorna Wells