Who OwnsFacebook? The Complex Web Behind Meta’s Billion-Dollar Empire

Who OwnsFacebook? The Complex Web Behind Meta’s Billion-Dollar Empire

At first glance, Meta Platforms, Inc. — the parent company of what began as a social network named “Thefacebook” — appears as a digital titan shaped by visionary entrepreneurship, strategic acquisitions, and a board of influential stewards. Yet pinpointing exactly who owns the company reveals a landscape more intricate than a single ownership stake: it is a structuredefined by institutional shareholders, executive leadership, and a broader ecosystem of investors who collectively steer the direction of one of the world’s most powerful technology platforms.

This article unpacks the ownership architecture of what is now formally known as Meta, tracing its journey from college experiment to global digital infrastructure. Meta Platforms, Inc. is publicly traded on the New York Stock Exchange under the ticker META, with ownership dispersed across diverse institutional investors, individual shareholders, and key executives deeply embedded in its governance.

As of the latest available data, institutional investors hold over 80% of total shares, signifying that no single entity commands full control, but rather a coalition of major financial players governs the company’s strategic course.

Institutional Owners: The Silent Architects of Meta’s Direction

Institutional investors dominate Meta’s ownership landscape, reflecting the company’s scale and public market existence. These include massive asset managers and mutual funds with portfolios spanning thousands of public firms, but a few stand out for their significant holdings.- **Vanguard Group**: One of the largest shareholders, Vanguard holds approximately 7.2% of Meta’s shares. Vanguard, renowned for its low-cost index funds and passive investment philosophy, maintains broad exposure across the tech sector, with Meta representing a key growth name in social media and digital advertising. - **BlackRock**: As another heavy institutional holder, BlackRock owns roughly 6.8% of Meta’s shares.

BlackRock manages global investment funds with trillions in assets and leverages data-driven insights to influence shareholder engagement, often voting proxy proposals on corporate governance and ESG priorities. - **The Vanguard Group and BlackRock together account for nearly 14% of total outstanding shares**, illustrating how major index fund managers exert quiet but substantial influence over Meta’s trajectory. These firms do not control Meta directly but shape board dynamics and executive behavior through voting rights and collaborative engagement, particularly on long-term strategy, risk management, and shareholder returns.

Executive Leadership: Founders and Executives as Pillars of Control

Beyond institutional investors, Meta’s ownership structure is deeply intertwined with its founding team and senior leadership, whose stakes are reinforced through equity grants and stock options tied to performance. - **Mark Zuckerberg** stands at the epicenter as the largest individual shareholder, holding approximately 16.5% of shares through Parker Engineering, his family-owned holding company. His control extends far beyond market value: Zuckerberg retains super-voting shares that confer weighted voting rights, enabling him to maintain decisive influence over board compositions, major strategic shifts, and executive appointments—even as stock dilution from public offerings has diluted personal ownership percentages over time.- **Geoffrey A.lynn** (CEO) and other C-suite leaders hold meaningful equity packages, aligning their interests closely with long-term value creation. Executive compensation is heavily indexed to stock performance, reinforcing commitment to shareholder returns and innovation goals. - Board members, appointed through shareholder approval, include deep-industry veterans with decades of tech sector experience, further anchoring Meta’s governance with leadership that balances innovation and accountability.

This leadership framework ensures that while ownership is fragmented across public markets, strategic continuity is preserved through insider ownership and expertise.

Public Shareholders: The Broad Base of Supporting Investors

For retail investors, Meta’s ownership is accessible through publicly traded shares, with retail investors collectively holding about 45% of all outstanding shares—democratizing investment in one of the world’s most influential digital platforms. Millions of individual shareholders own stakes ranging from small portfolios to substantial holdings, often acquired through routine investing via brokerage platforms like Fidelity, Charles Schwab, or Interactive Brokers.Despite their decentralized presence, retail investors participate through proxy voting and engagement, particularly on matters like data privacy, algorithmic transparency, and corporate governance. While their individual influence is limited, collective activity shapes board oversight and public trust—key pillars in Meta’s long-term legitimacy.

Ownership Evolution: Fromkedastic Beginnings to Controlled Growth

Meta’s ownership story begins with its 2004 founding as “Thefacebook” by Mark Zuckerberg and fellow Harvard students.Initially a private venture backed by early investors including Peter Thiel’s Founders Fund (securing pivotal early capital), the company transitioned through multiple funding rounds before its iconic 2012 IPO. Since then, ownership has evolved through public market listings, secondary sales by founders, and institutional accumulation. Zuckerberg’s initial equity stake — around 28.5% at IPO — has steadily diluted due to brand-new share offerings and dilutive fundraising, now held through Parker Engineering, reducing direct public exposure but maintaining control via voting structures.

This trajectory underscores a broader trend: early creators ceding market ownership while retaining governance through structural design.

Who OwnsMeta Today? A Stakeholder Ecosystem Defining a Digital Era

The answer to “Who ownsFacebook?” is not a single figure but a layered ecosystem.Institutional investors hold the bulk through diversified funds, executives and founders maintain control via strategic ownership and governance mechanisms, and millions of retail shareholders form the foundation of public legitimacy. Ultimately, Meta’s ownership reflects the modern tech platform: a balance of dispersed capital, concentrated insider control, and engaged retail participation. This structure enables Meta to pursue ambitious innovation in virtual reality,人工智能, and the metaverse, while enduring scrutiny over privacy, competition, and societal impact.

Ownership, therefore, is not merely a financial detail—it is a mirror of Meta’s dual role as a private company accountable to a global public. Ownership determines not just who profits, but how the platform evolves—strategically, ethically, and technologically. As Meta continues to shape digital interaction, its ownership architecture remains central to understanding the forces driving one of the most consequential corporations of the 21st century.

in navigating the complex corridors of capital, control, and collective investment, Meta’s story illustrates the shifting dynamics of ownership in the digital age—where power lies not in singular ownership, but in networks of influence, shared risk, and visionary stewardship.

Related Post

Who Owns Facebook? Meet Mark Zuckerberg in the Lap of Digital Empire Control

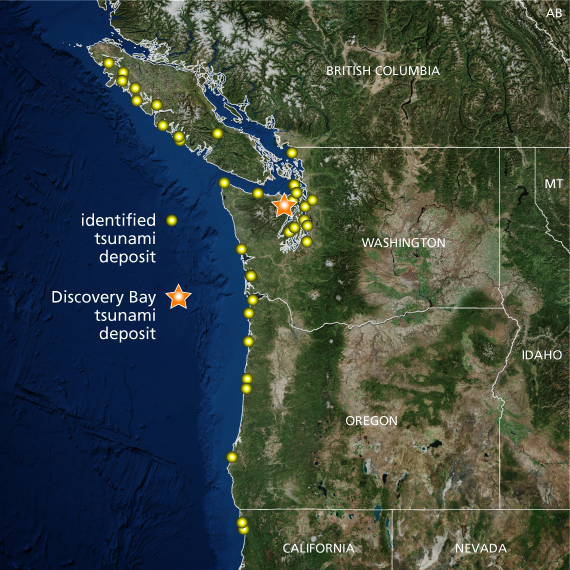

Stay Ahead: Tsunami Warning Today Live Map Tracks Real-Time Risk Before It Strikes

Baylee Martin: From Local Roots to National News Stage — The Rise of a Rising Anchor

Liz Sagal: A Comprehensive Guide To Her Life, Career, And Achievements (Pictures Of Her Work Included)