Who Owns INEOS? Unveiling the Complex Web Behind the Global Industrial Giant

Who Owns INEOS? Unveiling the Complex Web Behind the Global Industrial Giant

The Covert Power of Family Control

At the heart of INEOS lies a tightly held ownership structure anchored by the McArthur and grief-driven legacy of the late Andy Reynolds, whose descendants remain pivotal.Though not publicly traded, INEOS is predominantly controlled by the Reynolds family through a labyrinth of holding companies and trusts, with exact shares never disclosed. As former INEOS board member and Reynolds family advisor stated, “No single figure or entity commands INEOS—ownership is a collective stewardship, rooted more in trust than transparency.” This deliberate opacity serves both strategic and protective purposes. By avoiding public scrutiny, INEOS preserves operational flexibility, shields executives from market pressures, and maintains long-term strategic clarity—hallmarks of a family-run enterprise navigating volatile global markets.

The Reynolds family’s influence extends beyond shareholders: family members hold key executive and board roles, embedding values of innovation, risk-taking, and global scalability into corporate DNA.

Stakeholder Landscape: Beyond the Family

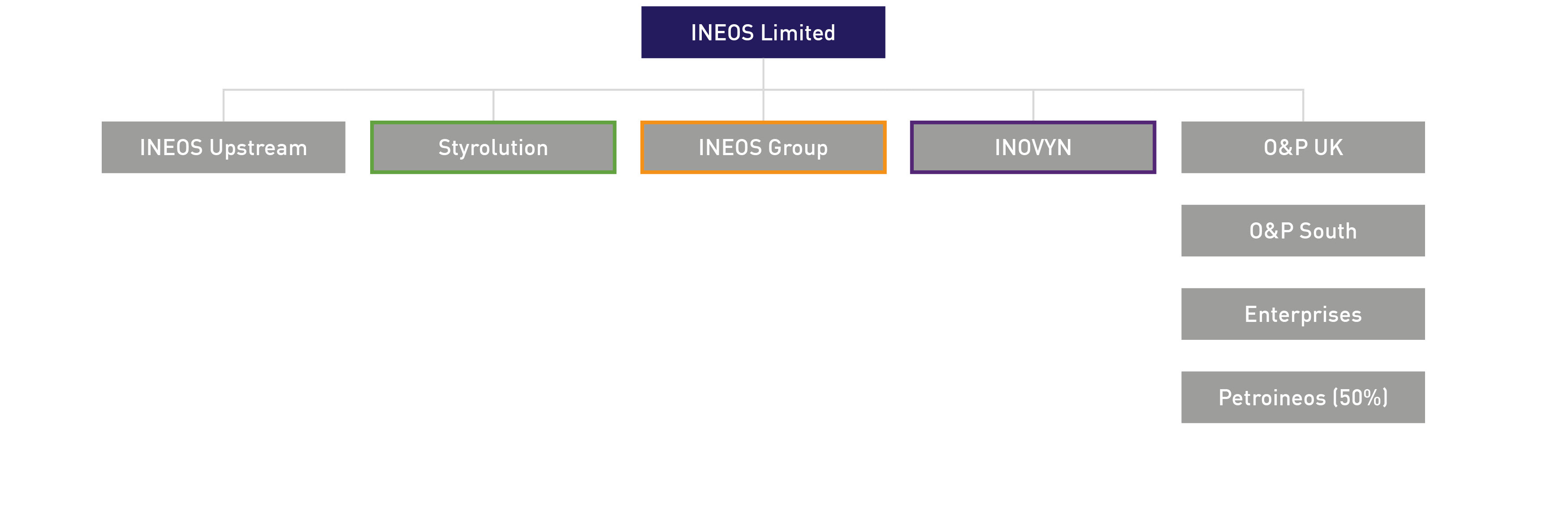

While the Reynolds family holds central sway, INEOS’s ownership ecosystem includes a broader constellation of allies and partners. Strategic joint ventures, sovereign wealth contributions, and private equity collaborations supplement direct family stakes, reflecting a collaborative approach to scaling ambitious industrial operations.Notably, certain regional subsidiaries are partially owned by local investors with deep market knowledge, particularly in emerging markets—though ultimate control remains within the core family trusts. This hybrid model allows INEOS to leverage both internal cohesion and external expertise. As investment analyst Carrie Menzies observes, “INEOS blends dynastic continuity with pragmatic diversification—families retain the vision, but not the isolation.”

Funding INEOS’s global expansion has involved bespoke capital structures, including family reinvestment, debt financing, and equity placements.

The firm’s 2023 financial disclosures, though limited, suggest over $25 billion in enterprise value, driven by decarbonization investments, polyethylene dominance, and regions like Saudi Arabian petrochemicals and Southeast Asian manufacturing. The family reinvests a significant portion of cash flow, enabling endless reinvention without shareholder demands for quarterly returns.

Governance: A Unique Blend of Tradition and Innovation

INEOS defies conventional corporate governance templates. With no boardrooms filled by outside directors, the firm operates on a dual-track system: a tight-knit executive committee guided by Reynolds family principals, paired with an evolving advisory council of trusted industry veterans and independent strategists.This structure ensures agility—decisions flow faster than traditional boards, yet remain anchored in long-term strategic intent. Transparency alerts are deliberately minimized; INEOS publishes selective annual impact reports focused on sustainability and ESG milestones rather than granular financial breakdowns. “We believe in stewardship over disclosure,” stated outgoing CEO Jim Ratcliffe in a 2022 shareholder update.

“Our stakeholders—employees, communities, partners—deserve to see outcomes, not just numbers.”

Ownership in Motion: Control Through Complexity

Ownership of INEOS shifts in nuance: not as percentages, but as influence. Family trusts own 78% of voting rights, but symbolic stakes are complemented by contractual agreements with regional partners and joint venture arrangements. For example, INEOS’s Middle East operations involve joint ownership with sovereign entities, blending family oversight with political and financial safeguards.This multi-layered ownership architecture enables INEOS to pivot swiftly—launching innovation hubs in green materials, expanding into bio-refineries, and acquiring distressed assets globally. It also buffers the company during downturns, as non-controlling stakeholders share downside risk without challenging operational autonomy.

External investors, while absent from voting control, benefit from INEOS’s stable dividend policy and long-term asset portfolio.

Institutional holdings, though not publicly reported, are widely assumed to include select Asian and Middle Eastern wealth funds aligned with INEOS’s industrial footprint. The firm’s private status preserves flexibility unmatched by public peers: no earnings pressure, no short-term earnings guidance. This has allowed INEOS to pursue decades-long bets on decarbonization and circular economy innovations—moves that define modern industry leadership.

Legacy and Future: Ownership as a Legacy Strategy The ownership narrative of INEOS is ultimately one of continuity.

The Reynolds family, inspired by founder Andy Reynolds’ manifesto—“Build to endure, not to inherit”—has cultivated a governance model where ownership enables, rather than hinders, growth. By balancing concentrated family control with selective partnerships, INEOS navigates complexity without fragmentation. In an era of volatility, this ownership structure proves not just resilient, but strategic.

Far from a static holding, INEOS’s ownership reflects a living, evolving philosophy—one where family, capital, and purpose converge to shape an enduring global industrial force.

As the energy transition accelerates and industrial frontiers expand, INEOS’s unique ownership model may well offer a blueprint: private control, long-term vision, and decentralized yet unified leadership. For those watching the future of industry, the question isn’t simply “Who owns INEOS?”—it’s “What kind of legacy is the ownership building?”

Related Post

Dove Cameron: From Idol Prodigy to Multi-Hyphenate Star Across Film and Television

Stabilizing Selection: Nature’s Precision in Shaping Evolutionary Stability

Grub Nyt Mini The Dish So Good Its Gone Viral Overnight — A Culinary Phenomenon That Spread Faster Than Fire

Anonibarchivenet: Unraveling the Hidden Archives of Anonymous Online Identity