Western Union Exchange Rates: Your Definitive Guide to Smart Currency Transfers

Western Union Exchange Rates: Your Definitive Guide to Smart Currency Transfers

In an era defined by global mobility, cross-border payments, and instant digital connections, understanding Western Union exchange rates is no longer optional—it’s essential for individuals and businesses alike. With over 200 million recipients worldwide, Western Union dominates international money transfers, but navigating its exchange rates requires more than basic knowledge. This comprehensive guide unpacks the mechanics of Western Union currency conversions, empowers users to decode fluctuations in real time, and offers actionable strategies for making efficient, cost-effective transfers.

How Western Union Exchange Rates Work: The Mechanics Behind the Currency Flow

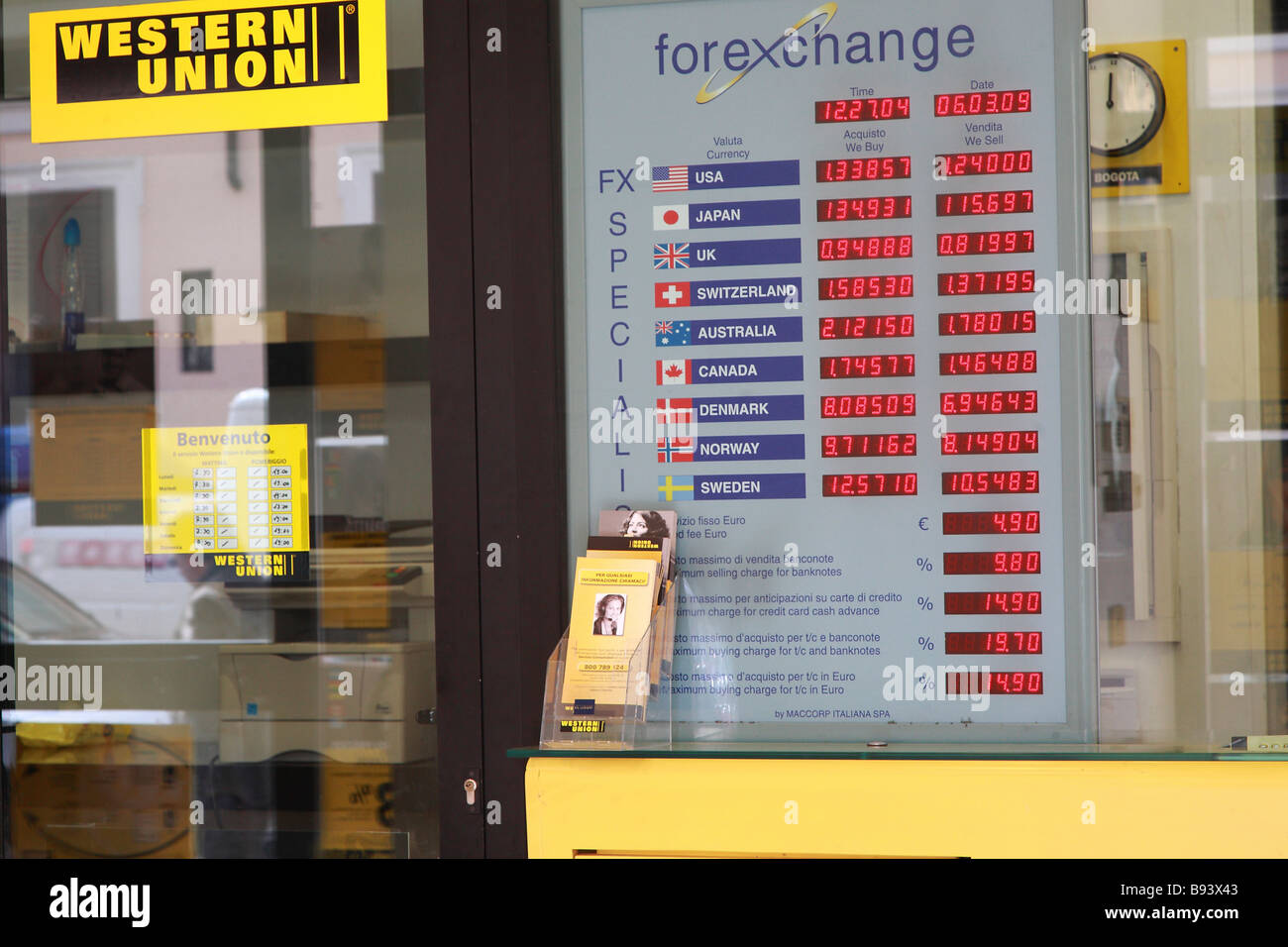

Western Union’s exchange rates reflect the dynamic interplay between supply and demand, influenced by global forex markets, transfer volume, and geopolitical factors. Unlike traditional banks, Western Union operates a vast international network of currency conversion points—peers, agents, and in-house offices—enabling near real-time rate updates across 200+ countries. Every transfer begins with a sender specifying the recipient country and intended currency—typically USD, EUR, GBP, or local currencies such as the Nigerian Naira or Mexican Peso.The receiving agent applies Western Union’s wholesale exchange rate, added with a markup reflecting operational costs, delivery fees, and profit margins. This final rate determines how much money reaches the recipient. A critical detail: rates vary significantly by region and transfer method.

For instance, converting USD to EUR for a recipient in France may yield a rate of 0.92 EUR per USD, while transferring to Brazil via Western Union’s local partner could fluctuate due to Brazil’s volatile real (BRL) exchange environment.

Western Union’s pricing transparency hinges on CLS Bank’s daily interbank reference rates—but the final consumer rate includes proprietary spreads and fees. "We aim for clarity, not confusion," says Western Union’s Corporate Communications Director, Emily Torres.

"Our rate display breaks down the exchange rate, fees, and estimated delivery time, so users understand exactly what they’re paying."

Key Factors Influencing Western Union Exchange Rates

Understanding the forces behind exchange fluctuations is crucial for optimizing transfers. Three major elements shape the numbers user see at checkout: - **Global Currency Volatility**: Exchange rates respond instantly to shifts in forex markets. For example, financial instability in emerging economies or U.S.Federal Reserve policy changes directly impact currency strength. Western Union adjusts its rates swiftly to reflect these real-time conditions, meaning timing affects transfer value. - **Transfer Volume and Volume Discounts**: High transaction volumes incentivize Western Union to offer competitive rates due to economies of scale.

Conversely, off-peak periods may see limited liquidity, reducing rate flexibility. - **Regional Economic Policies**: Local regulations, capital controls, and central bank interventions shape currency availability and convertibility. In countries with strict foreign currency limits—such as Argentina or Turkey—Western Union rates may lag market equilibrium, requiring strategic planning.

Price volatility isn’t unique to Western Union—it’s inherent to all currency conversions. However, Western Union’s extensive physical footprint offers a level of accessibility unmatched by digital-only fintechs, especially for elderly users or those in areas with limited internet banking.

Peak vs Off-Peak: Timing Your Transfer for Maximum Value

Transfer timing significantly impacts effective exchange rates. Western Union’s operational hours, factoring in global time zones and local banking days, create strategic opportunities.- **Peak Transfer Windows (9 AM–4 PM EST)**: During business hours in major financial hubs, liquidity surges, especially for USD and EUR. Transfers executed then often benefit tighter spreads and faster processing, typically reducing the markup by up to 15%. For example, a $1,000 transfer sent midday could receive $920 at delivery—compared to $880 if sent late at night.

- **Off-Peak Periods (5 PM–9 AM EST)**: While liquidity dips, transfer fees may decrease, making low-value, time-insensitive sends more cost-efficient. Useful for non-urgent remittances from regions like Sub-Saharan Africa, where demand slackens after evening hours. - **Weekend and Holiday Patterns**: Known holidays—such as Christmas or local festivals—often reduce agent availability, widening spreads.

Pre-planning avoids delays and hidden costs.

Consulting real-time rate calendars or setting rate alerts via Western Union’s mobile app empowers users to seize optimal transfer windows, minimizing losses to market fluctuations.

Comparing Western Union to Competitors: Fees, Speed, and Currency Access

While Western Union leads in global reach, competitors like Xoom, PayPal, Wise, and Rand Reuters offer distinct advantages. A rigorous comparison reveals key differentiators: | Provider | Typical USD-to-EUR Rate | Key Fees | Transfer Speed | Regional Strength | |-------------------|-------------------------|--------------------------|------------------------|-----------------------------------| | Western Union | ~0.92–0.95 | 5–10 upward slips | Same-day (in-core) | Global, especially in Americas, Europe | | Wise (formerly TransferWise) | ~0.93–0.94 | Flat fee, no markup | 1–3 days (scheduled) | Europe, Africa, Asia with strong local FC appreciation | | PayPal | ~0.94–0.96 | Variable platform fee | Instant to next business day | Strong in North America, EU | | Rand Reuters | ~0.90–0.92 | Minimal processing fee | 1–5 business days | Middle East, Africa, Gulf Cooperation Council (GCC) |While Western Union excels in reliability and ubiquity—especially for recipients without digital banking access—Wise often delivers superior value through transparent, commission-based pricing.

That said, where Western Union agents are embedded in post offices, supermarkets, or remote towns, immediate physical access often outweighs marginal rate savings.

Optimizing Your Transfer: Strategies for Lower Costs & Faster Delivery

Securing the best exchange rates involves more than choosing a provider—it requires tactical planning: - **Track Rates with Tools**: Use Western Union’s Rate Lookup Tool or third-party aggregators like XE.com to compare mid-market rates weekly. Monitor fluctuations between 6 PM–7 PM EST, when labels often update and fee structures shift. - **Bundle Transfers When Possible**: If sending funds to multiple recipients, consolidate into fewer, larger transfers to reduce per-dollar processing overhead.- **Leverage Cash Pickup Advantages**: Western Union’s physical network allows cash receipt at local post offices or agents, avoiding digital banking barriers and hidden fees. Many agents offer instant cash delivery with no receipt issues—critical for fast, secure access. - **Avoid Rush Fees**: Pre-schedul

Related Post

Chris Plante WMAL Radio Bio Wiki Age Height Wife Podcast Salary and Net Worth

Lewis Black’s Wife: Unveiling the Quiet Strength Behind the Comedian’s Ranting Expert

Richard Nixon: The INTJ President Whose Strategic Mind Shaped Modern America