Usps Money Order: The Reliable, Secure Way to Send Money Across the U.S.

Usps Money Order: The Reliable, Secure Way to Send Money Across the U.S.

For millions relying on fast, trustworthy financial transactions, the U.S. Postal Service’s Money Order stands as a cornerstone of everyday money transfer—combining convenience, accessibility, and security in a single official tool. Unlike cash or personal checks, Money Orders offer a paper-backed, traceable alternative that bridges gaps in banking access and reduces fraud risks.

understood by millions but still underappreciated by many, the U.S.P.S. Money Order continues to serve as a vital financial instrument, especially in rural areas, for small businesses, and among those navigating financial inclusion challenges.

At its core, a U.S.P.S.

Money Order functions as a prepaid, payable-order form issued by the Post Office, designed to send or receive funds securely. Unlike cash, it requires no bank account, credit check, or immediate funds—making it accessible to anyone with a government-issued ID and a voucher purchase. Each order is uniquely numbered, tied directly to the buyer’s account, and traceable through postal tracking systems.

This combination of direct postal backing and built-in fraud protection sets Money Orders apart from informal payment methods.

Mechanics and How It Works: The Technology Behind U.S. Postal Money Orders

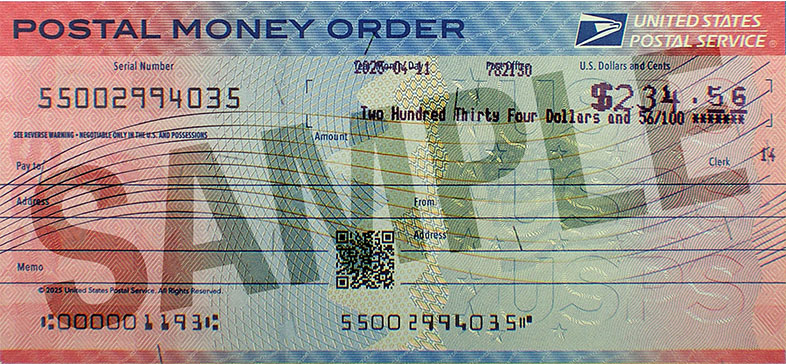

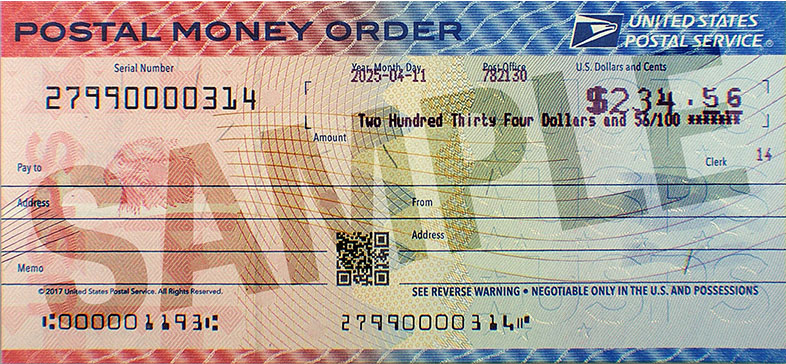

When purchasing a Money Order, customers select the amount in dollars and cents, pay via cash, credit, or debit at a Post Office location, complete a brief form with recipient details, sign the order, and receive a numbered receipt—either enclosed or separately. The number printed serves as both a unique identifier and a verification tool in case of disputes or lost items.As security expert and financial analyst Rachel Lopez notes, “The Money Order’s strength lies in its intermediation: it removes direct banking dependencies by centralizing risk and traceability through the postal network.” U.S.P.S. Money Orders clear within 1–3 business days depending on routing, and recipients use the serial number to claim funds quickly. Unlike checks, which require bank clearing and are vulnerable to endorsement fraud, Money Orders settle at the post office—often with minimal fees, especially for domestic transfers.

For businesses processing refunds, contract deposits, or selling goods, the clarity of a signed, postally verified instrument reduces liability and simplifies accounting.

Key features of the U.S.P.S. Money Order include strict issuance controls: only residents or holders of valid U.S.

address may buy them, and all validators are cross-referenced against Postal Service databases. The automatic “fail safely” mechanism ensures missing or mismatched serial numbers trigger immediate notifications, reducing wasteful re-intents. This system reflects decades of refinement in postal financial services.

Target Audiences: Who Benefits Most from Using a Money Order

The U.S.Postal Service’s Money Order serves a diverse user base, but particular strength lies in specific demographics and scenarios. For individuals without a checking account, especially in low-banking regions, Money Orders enable reliable receipt-processing payments for utilities, rent, or small loans. Small and medium enterprises rely on them for reliable cash rounding, government payments, and transaction documentation without requiring customer bank access.

User scenarios include:

- Rural populations: Where bank branches are sparse, Post Offices remain community banking anchors.

- Elderly and younger demographics: Less comfortable with digital transactions, they value the tangible, physical nature of money orders.

- Government agencies: Used for issuing refunds, permits, and stimulus payments—guaranteeing accountability and proof of delivery.

- Small retailers and service providers: Enabling customers to settle balance owed via a recognized, traceable method without requiring credit checks.

Fraud Prevention and Legal Safeguards

Fraud remains a persistent challenge in financial exchanges, but Money Orders offer robust protection. The address-checking system verifies buyer legitimacy, curbing unauthorized payments.Unlike electronic transfers susceptible to hacking or identity theft,

Related Post

How The Seven Sins Define Modern Blunders in Business and Life

Sid the Sloth’s Icy Odyssey: Unforgettable Ice Age Imagery and Surprising Facts About a Slow but Stout Adventure

Verizon Speed Test: Unlocking Ultra-Fast Connectivity in the Digital Age

How Much Do Marine Biologists Really Make? Salaries Across Science and the Ocean’s Frontier