USAA Auto Loan Payoff: Your Guide to a Hassle-Free, Stress-Free Process

USAA Auto Loan Payoff: Your Guide to a Hassle-Free, Stress-Free Process

For military members and USAA customers, taking control of a vehicle’s outstanding loan isn’t just about saving money—it’s about reclaiming financial freedom with clarity and confidence. The USAA Auto Loan Payoff process, though often perceived as cumbersome, is designed to be seamless when approached with the right guidance. Whether refinancing early, preparing for a sale, or simply paying off a long-term obligation, understanding each step ensures a smooth transition without fees, surprises, or unnecessary delays.

With financial discipline and informed preparation, former servicemembers can complete payoff in record time, securing lasting peace of mind.

Early payoff of an auto loan delivers profound financial benefits, especially for those who value technology-driven finance and clear communication. With attractive interest rates often available through USAA, making extra payments compounds savings over time—sometimes amounting to thousands in avoided interest.

But navigating the system without direction can feel overwhelming. The key lies in understanding available options, timing, and the documentation required. USAA stands out by offering personalized support that demystifies the process, turning what many view as a chore into a straightforward milestone in post-military financial life.

Why Pay Off the Auto Loan Early?

Paying off a vehicle loan ahead of schedule isn’t merely about eliminating debt—it’s a strategic financial move.For military personnel, whose eligibility for competitive jobs and bonuses depends heavily on strong credit, every positive payment history strengthens the foundation. Extinguishing a loan early reduces or eliminates interest payments, freeing up monthly cash flow for emergencies, investments, or future milestones. - **Interest savings**: A typical auto loan carries an average interest rate between 4% and 10%, depending on credit and term.

Paying early cuts decades of compounding costs. - **Improved credit health**: Even a single early payoff can boost credit utilization ratios and signal responsible financial behavior, both critical for future loans and mortgages. - **Psychological payoff**: Closing a loan completes a major financial chapter, restoring confidence in long-term planning—a feeling especially empowering after years of service.

USAA routinely highlights that the earliest perks begin with proactive planning. Military members often automatically qualify for low-rate refinance programs when acknowledging a loan, making the transition smoother and faster than standard banking alternatives. This institutional advantage—rooted in decades of customer service focus—positions USAA as a trusted partner in timely repayment.

Step-by-Step: How to Pay Off Your Auto Loan via USAA

The USAA Auto Loan Payoff process is built on transparency and user-friendly tools.Begin by gathering essential documents: - Account statement - Proof of identity (military ID or USAA member ID) - Sales receipt (if vehicle is owned) - Banking info for direct payment Step 1: Review the Loan Balance and Terms Access your account online or through the USAA Mobile App to verify current outstanding balance, interest rate, and remaining term. USAA’s real-time dashboard enables easy snapshot review, revealing how much needs to be paid and how quickly the loan will be cleared. This visibility is critical—small discrepancies in payment amounts can extend payback timelines by months.

Step 2: Choose Your Payment Method USAA supports multiple payment pathways to suit your lifestyle: - E-Print approval: Instant digital authorization—secure, fast, and paperless.

- Auto-pay: Set up recurring payments to avoid missed deadlines and earn minor interest rate perks. - Mobile deposit with photo verification: Submit a selfie of the signed payment check and instantly process it. - One-time lump-sum payment via check, bank transfer, or linked financial institution.

Each method is fully supported by USAA’s team, even if paperless options feel unfamiliar. “We’ve designed this process to fit how servicemembers live—flexible, fast, and below the stress of military life,” notes a USAA financial advisor. “Whether you prefer digital or conventional, we guide you every step.”

Step 3: Execute the Payment and Confirm After selecting your method, submit the payment through your chosen channel.

Within minutes—especially with e-Print—your payment will appear in the loan portal. For added peace of mind, USAA automatically updates balances and logs each transaction with timestamps and references. Post-payment, check your statement; the loan will reflect “paid in full” status instantly.

Confirmation emails and SMS alerts ensure no gaps remain.

Bonus Strategies for Faster Payoff

While the core payoff involves settling the full balance, military members can amplify savings by combining smart tactics: - **Make bi-weekly payments** during the term: Spreading payments reduces interest over time and shortens payoff duration by one year. - **Negotiate early closure fees**: Some vehicles with loan payments include prepayment penalties; USAA staff routinely reviews accounts to waive or reduce such charges when possible. - **Refinance when rates drop**: If market conditions shift favorably, a rate-free refinance (through USAA or a new lender) can slash costs—especially beneficial when transitioning to a new vehicle or finalizing financial goals.These strategies, while optional, illustrate the flexibility inherent in USAA’s approach.

The auto loan is not a static obligation but a dynamic chapter that can evolve with your circumstances—right down to timing and structure.

Common Challenges—and How to Overcome Them

Despite clear instructions, delays sometimes occur. Equipment malfunctions in online systems, identity verification can falter with outdated IDs, or paper documents sent late may stall processing. To avoid these hiccups, USAA recommends: - Confirming all identity documents are current and match government-issued records.- Submitting original paperwork within 7–10 business days post-vehicle sale or loan termination. - Contacting USAA’s dedicated military support line at 1-800-433-3727 (Mon-Fri, 6 AM–10 PM ET) for immediate clarification on pending payments. “Military service demands adaptability—and the same mindset should guide financial tasks,” advises a senior USAA advisor.

“Anticipate the unexpected, stay proactive, and leverage our resources. We’re with you, not in front of a screen.”

Real-world examples reflect the process’s accessibility. Take Private First Class Elena Torres, a Navy veteran who chose the USAA Auto Loan Payoff program after selling her deployment vehicle.

“I used the mobile pay feature on payday,” she says. “One click, done—no stress, no paperwork creep. USAA didn’t just process the loan.

They saved me time I’d otherwise spend reconciling outdated banking logs.”

Final Thoughts: Owning Your Financial Freedom Starts Now

The USAA Auto Loan Payoff isn’t just a transaction—it’s a milestone in the transition from service to civilian life on your own terms. For every military member, controlling the final payment isn’t merely symbolic: it’s reclaiming financial autonomy, reinforcing the resilience that serves as the backbone of veterans’ strength. With clear guidelines, responsive support, and tools built for efficiency, USAA transforms a routine obligation into a confident step forward.Whether saving for the next chapter or simply closing a familiar debt, the process proves that clarity, guidance, and modern banking solutions combine to deliver peace of mind. Act now—every payment penned brings you closer to full financial freedom.

Related Post

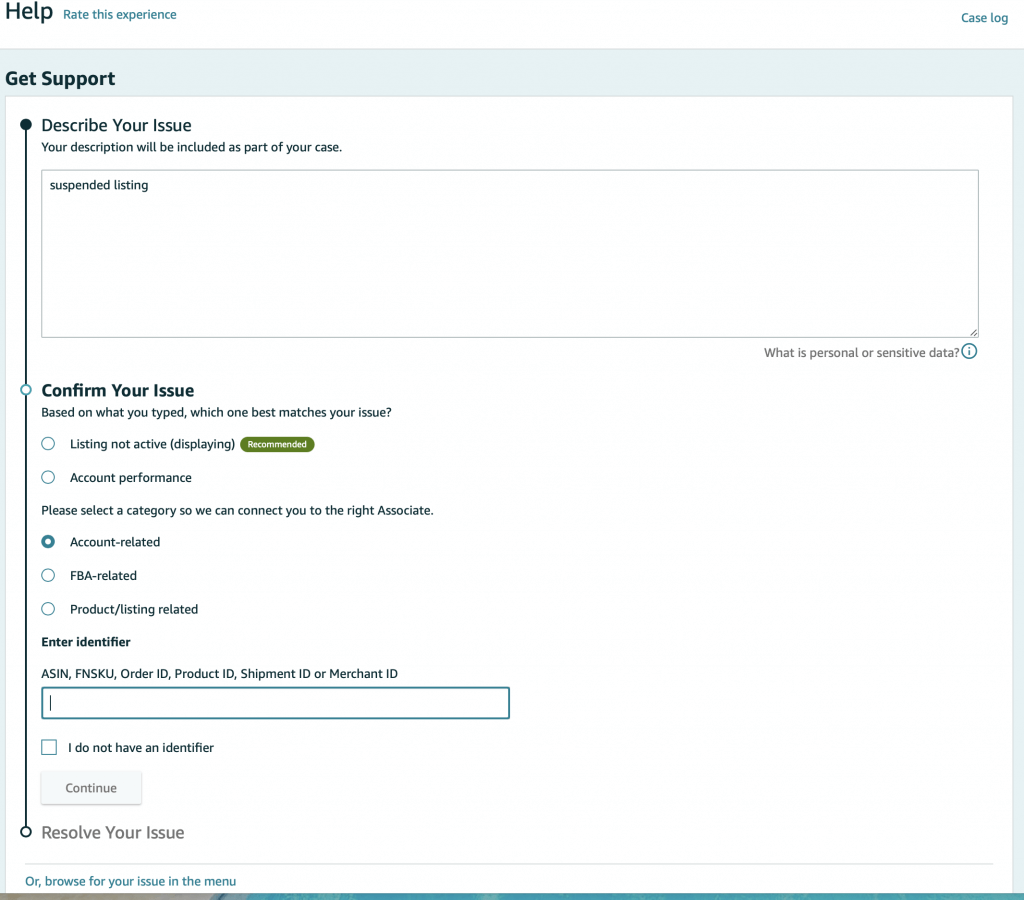

How to Contact Amazon Directly Using the Official Address & Contact Info: A Complete Guide

ExWWE Star Spotted Backstage At AEW Dynamite

What Is a Football Jamboree? The Thrill of Global Unity on the Field

Dead Man’s Chest: Unpacking the Iconic Cast That Redefined Pirates of the Caribbean