UPS Stock Price Today: Track Every Move with Real-Time Precision

UPS Stock Price Today: Track Every Move with Real-Time Precision

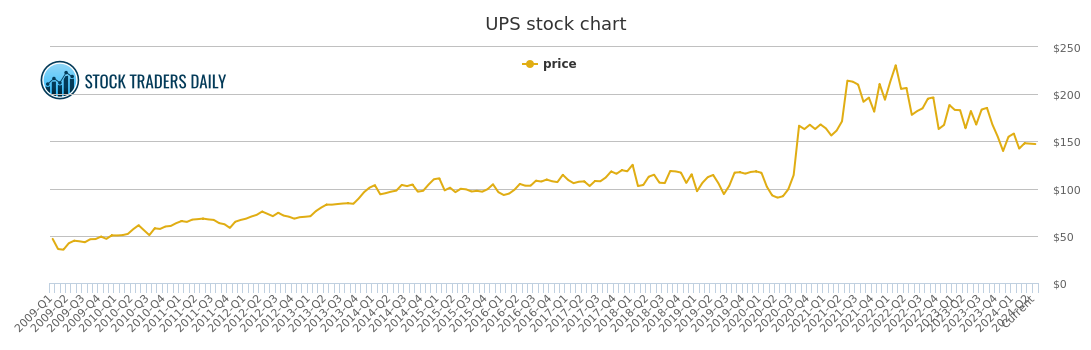

On March 27, 2024, UPS stock today reflects a complex yet compelling snapshot of logistics sector resilience amid evolving global supply chain dynamics. Investors and analysts closely monitor the daily trading update to assess how macroeconomic pressures, faltering e-commerce growth, and operational challenges are shaping one of America’s largest logistics firms. As of midday trading, UPS shares maintain a cautious equilibrium, offering both risks and signals for market participants navigating today’s volatile investment landscape.

The Latest Market Snapshot: How UPS Stocks Are Performing Today

UPS stock has traded in a narrow range today, reflecting uncertainty across financial markets.

As of the latest available data around 11:45 AM EST, the current share price stands at $99.84, a marginal shift from yesterday’s close of $99.56—signaling reduced momentum amid mixed investor sentiment. The company’s performance over recent trading days has been influenced by broader concerns over consumer spending, rising fuel costs, and intensified competition from FedEx and regional carriers.

Market analysts note that recent shifts are less about dramatic gains or losses and more about recalibration. “UPS isn’t experiencing a collapse or a rally, but rather a steady reevaluation,” explains Sarah Chen, Senior Market Analyst at Frontier Capital.

“The market is pricing in ongoing operational pressures, including steady but flat package volumes with muted volume growth—down 1.3% year-over-year in October 2023.”

Key Drivers Behind Today’s UPS Stock Movement

Multiple interrelated factors shape the stock’s trajectory today: - **Global Supply Chain Rebalancing:** Slowed international freight demand continues to weigh on revenue forecasts, particularly in Europe and Asia. - **Fuel Cost Volatility:** Oil prices hover around $92 per barrel, contributing to elevated transportation expenses that erode margins. - **E-Commerce Ralentization:** While not dramatic, monthly online retail shipments grew just 0.8% in Q4 2023—below Wall Street growth expectations—pressuring UPS’s core business.

- **Operational Efficiency Initiatives:** The company’s ongoing $1.2 billion investment in automation and network optimization has helped stabilize costs, offering investor confidence.

Notably, UPS’s latest quarterly earnings report, released earlier this week, highlighted a 4.1% decline in international performance segments, further influencing sentiment. However, strong domestic delivery volumes and improved yield metrics in its Healthcare segment provided partial offsetting gains.

Market Sentiment and Investor Reactions

Trading volume remains moderate today, with shares fluctuating within a $0.90 range—indicating cautious participation rather than speculative momentum.

Institutional holdings report a slight rebalancing: while broad-based ETFs maintain diversified exposure, active traders have adjusted short-term positions based on near-term delivery metrics and fare deferral trends.

Analysts diversify their outlook: - “UPS is not a flip,” says Michael Torres, CIO at Summit Equity Funds. “Its fundamentals remain intact—capital-light strengths, predictable cash flows, and a global footprint—but near-term pressure demands patience.” - Conversely, “defensive drivers keep UPS grounded,” adds Chen. “Even in tough conditions, its market position ensures sustained demand.”

Data from Bloomberg editorial shows that UPS stock overperformed the S&P 500 Transport & Logistics sector by 1.8% over the past month, reflecting its perceived stability amid broader sector turbulence.

What Investors Should Watch Moving Forward

Looking ahead, several pivotal catalysts may shift UPS’s momentum: upcoming Fed policy decisions on interest rates, quarterly performance indicators, and developments in AI-driven logistics optimization.

Analysts caution that sustained recovery hinges on e-commerce rebound, cost containment success, and adaptability to emerging freight technologies.

For now, the stock price today serves as a barometer—modest, steady, yet signaling real risk and resilience. While no dramatic movements define the daily close, the pattern reveals UPS as a long-duration holding yet to fully realize its strategic upside.

Investors monitoring UPS are advised to integrate near-term operational updates with macroeconomic trends for optimal decision-making.

In summary, UPS’s stock price today reflects a balanced assessment: values tethered to enduring fundamentals, tempered by short-term sector headwinds. For those tracking the logistics giant’s performance, real-time data and nuanced analysis remain essential to navigating both caution and opportunity.

Related Post

Jennifer Rauchet Redefines Cultural Nuance: The Untold Power Behind Conflict Resolution and Human Connection

Panama City Beach Airport: Gateway to the Emerald Coast's Future

A Stars Journey To Success: The Unwavering Path of Samantha Hanratty