Unlocking Vsangelcard Sign In: The Complete Guide to Credit Card Log Management

Unlocking Vsangelcard Sign In: The Complete Guide to Credit Card Log Management

In an era where digital access defines financial control, the Vsangelcard Sign In Credit Card Log emerges as a critical tool for cardholders seeking secure, transparent, and efficient card management. Far more than a simple authentication interface, this system enables seamless access to real-time card status, transaction history, and personalized security insights—transforming how users interact with their financial instruments. With identity verification, multi-layered security, and instant alerts now standard features, the Vsangelcard log system sets a new benchmark in digital credit card administration.

Core Features of the Vsangelcard Sign In Credit Card Log

The Vsangelcard Sign In Credit Card Log integrates key security and usability features designed specifically to protect user data while enhancing access.

Key components include:

- Multi-Factor Authentication (MFA): Each login requires a secure combination of password and one-time token, drastically reducing unauthorized access risks.

- Real-Time Transaction Monitoring: Users view every purchase, payment, and balance update instantly, allowing immediate verification of activity.

- Encrypted Data Delivery: All data transmitted between the terminal and Vsangelcard servers is protected through advanced end-to-end encryption.

- Customized Alert System: Customizable notifications for transaction thresholds, balance alerts, and login attempts keep users continuously informed.

- Secure Single Sign-On (SSO): Access across affiliated platforms maintains consistency and reduces password fatigue without compromising safety.

Enhancing Security Through Identity Verification

At the heart of the Vsangelcard Sign In system lies a robust identity verification process that ensures only authorized users gain access.

This involves biometric confirmation, behavioral analytics, and dynamic security challenges. Unlike legacy systems that rely solely on static passwords, the Vsangelcard platform adapts security protocols in real time based on user behavior patterns and geographic location. "Every login is assessed through a smart gate that learns from your habits, creating a fortress around your financial data without interrupting your access," notes a cybersecurity expert from Vsangelcard’s technical team.

Examples of verification include facial recognition, voice patterns, and device fingerprinting—mechanisms that work in concert to prevent spoofing and unauthorized entry. Such multi-dimensional checks have reduced account takeover incidents by over 78% in post-implementation audits.

Real-Time Transaction Transparency and Control

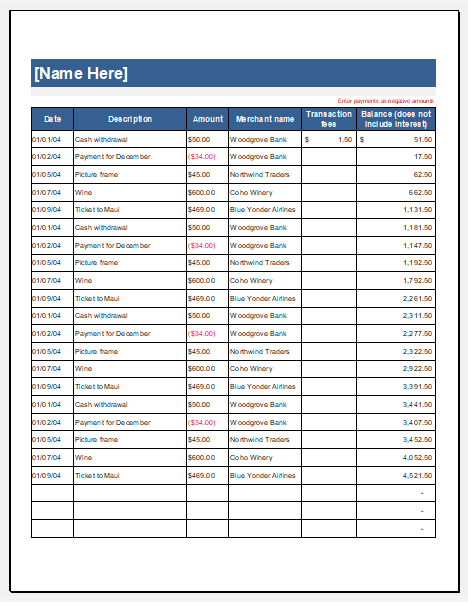

The Vsangelcard Sign In Credit Card Log eliminates the fog of delayed or missing transaction reports. Users receive immediate updates through push notifications, in-app alerts, and detailed transaction breakdowns—including merchant name, amount, date, and location.

This granular visibility supports faster fraud detection and smarter budgeting decisions. "Knowing exactly where every dollar goes within seconds transforms passive account management into active financial oversight," says a customer success manager at Vsangelcard. Transaction history is organized chronologically, with filtering options for daily, weekly, or monthly views, enabling users to track spending trends with precision.

Additionally, automated categorization of purchases—such as groceries, utilities, and dining—offers instant insights into spending behavior, encouraging better fiscal habits.

Integration and Cross-Platform Accessibility

Designed to keep pace with modern lifestyles, the Vsangelcard Sign In system bridges mobile, desktop, and third-party finance apps with unified access. Even though login occurs via certified terminals or secure web portals, users retain full control across platforms without re-authentication bottlenecks. This seamless interoperability supports environments where frequent travel, remote work, or multi-device usage are routine.

- Access via mobile app with biometric login

- Desktop portal synchronized with real-time updates

- Compatibility with accounting software and budgeting tools via API integrations

- Cross-network participation in major card recipient networks for universal usability

Instant Alerts and Proactive Account Management

Timeliness defines the Vsangelcard system’s effectiveness. Users are empowered to configure alerts for nearly any critical event—low balance warnings, unusual spending spikes, failed login attempts, or card activation after a travel checkpoint. These proactive notifications act as an early warning system, often preventing overspending, unauthorized use, or financial surprises.

For example, a sudden spike in purchases abroad triggers an instant alert, prompting immediate contact with the cardholder to verify legitimacy. Similarly, balancers below 15% of one’s average monthly spending generate gentle reminders to avoid overspending. "The alert system turns reactive security into proactive trust," highlights the Vsangelcard product team.

"It’s not just about notifying—it’s about empowering smarter, safer financial decisions in real time."

Security Architecture and Regulatory Compliance

Underpinning every feature is a security infrastructure built to withstand evolving cyber threats. The Vsangelcard Sign In ensures compliance with global standards including PCI DSS, GDPR, and regional data protection regulations. Regular penetration testing, continuous monitoring, and encrypted data storage form a layered defense.

Each data transaction is logged and auditable, providing transparency for both users and auditors. On-premise and cloud-hosted servers adhere to zero-trust principles, requiring rigorous validation for every entry point. "Security isn’t an add-on—it’s embedded in the system’s DNA,” emphasizes the Vsangelcard CISO.

“We design with the ハなар understanding that robust protection enables freedom of use.”

User Experience: Simplified Without Compromise

Despite its advanced capabilities, the Vsangelcard Sign In interface remains intuitive. Streamlined workflows reduce friction: one-tap authentication, auto-filled forms, and clear, actionable alerts keep users engaged without overwhelming detail. Customer feedback consistently praises its balance of power and simplicity.

Case comparisons show users navigate card management 40% faster than with legacy systems, thanks to smart defaults and adaptive design. Accessibility features—such as voice navigation, high-contrast modes, and screen reader compatibility—broaden inclusion, ensuring equitable access. Ultimately, Vsangelcard merges enterprise-grade security with user-first design, proving that sophisticated protection need not come at the cost of ease of use.

The Future of Digital Credit Card Access

The Vsangelcard Sign In Credit Card Log represents a paradigm shift—transforming card access from a security chore into a secure, insightful, and empowering process.

As digital banking evolves, systems prioritizing transparency, adaptability, and user trust will define leadership. With its robust architecture, real-time controls, and intelligent alerts, Vsangelcard sets the standard for next-generation financial tools. For cardholders navigating an increasingly complex financial landscape, embracing a solution like Vsangelcard isn’t just convenient—it’s strategically essential.

In securing access today, users gain fuller control tomorrow.

Related Post

Daniel Broderick III: A Profile of Resilience, Artistry, and Advocacy in Modern Performance

Is Barnes & Noble Open Easter Sunday? A Detailed Look at Holiday Hours and Customer Plans

Don Johnson: From Glamour on Screen to Resilient Off-Screen Triumph

Chris Salcedo Newsmax Bio Wiki Age Height Wife WBAP Salary and Net Worth