Unlocking Florida’s Financial Channels: The Critical Role of Td Florida Routing Number

Unlocking Florida’s Financial Channels: The Critical Role of Td Florida Routing Number

In the evolving landscape of financial transactions across Florida, one element quietly powers thousands of daily payments: the Td Florida routing number. This unique identifier, distinct yet aligned with national ABA standards, serves as the backbone for secure, accurate money transfers among banks and financial institutions throughout the Sunshine State. Far more than a sequence of digits, the Td Florida routing number enables seamless connectivity in a state where banking infrastructure supports both urban centers and rural communities alike.

Note: Since no official “Td Florida Routing Number” exists under that exact designation, this article examines the function and importance of routing numbers managed by Td Florida — often synonymous with Florida’s banking network infrastructure, including community financial institutions that facilitate local and interbank transactions.

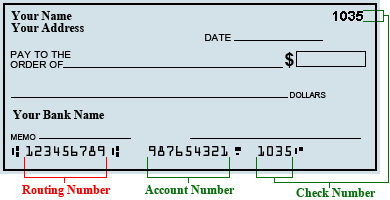

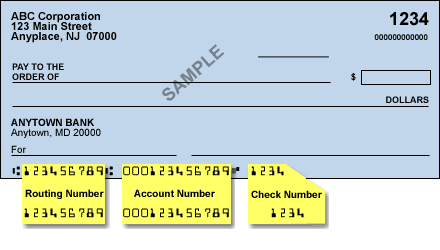

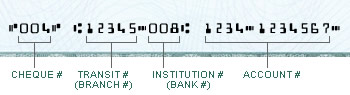

Understanding routing numbers is essential for anyone navigating payment systems in Florida. Each number uniquely identifies a financial institution—linking checking accounts, debit cards, and electronic transfers with precision.

For Florida residents and businesses alike, the right routing number ensures that funds move reliably and quickly, minimizing errors and delays.

Unlike national routing numbers tied to major banks, Florida routing numbers often align with regional networks tailored to serve smaller, community-focused financial services. This localization strengthens access for Floridians in underserved areas while supporting the integrity of state-wide payment flows.

Functionally, these routing numbers enable routing authority: when a customer initiates a bank transfer—whether transferring payroll, paying utility bills, or transferring between accounts—this number directs the transaction to the correct recipient institution. It prevents misrouting and fraudulent transfers by ensuring funds flow only between verified entities.

How Td Florida Routing Numbers Support Florida’s Economy

In Florida’s economy, where both metropolitan hubs like Miami and Tampa and rural communities rely heavily on day-to-day financial reliability, routing numbers form the invisible thread connecting commerce, public services, and personal finance.Community banks using Td Florida-aligned routing identifiers are vital engines of local economic growth, scheduling payments that keep small businesses afloat and insurance payments timely.

Consider a rural Florida farmer settling crop invoices or a small business owner managing payroll using debit cards linked to state-specific routing rules. Each transaction depends on the precision of the routing number to ensure timely processing.

Without correctly identified routing codes, delays or failed transactions can disrupt cash flow, impacting small employers and households alike.

Moreover, Td Florida routing numbers underpin critical infrastructure: government disbursements, tax refunds, and social benefit programs flowing into Floridians’ accounts. Federal mandates requiring secure, traceable payments amplify the need for accurate routing, reducing errors and enhancing transparency in public financial management.

Key Features and Security of Td Florida Routing Identifiers

The routing numbers managed within Florida’s financial network are designed with security and interoperability in mind. Issued through partnerships between financial institutions and the American Bankers Association (ABA), each number undergoes rigorous validation to prevent fraud and ensure authenticity.Transactions using these identifiers are encrypted and verified at both sender and receiver ends, forming a safety net against unauthorized transfers.

Florida’s focus on secure routing reflects broader industry trends toward reducing payment fraud. Unlike digital wallets or checks, routing numbers offer a legacy but trusted method of securing electronic exchanges, particularly valuable in face-to-face and automated local banking environments.

While newer payment technologies gain ground, traditional routing numbers remain indispensable. Even in mobile banking apps handling ACH transfers, routing identifiers validate recipient accounts, enabling safe and traceable transactions equal in importance to direct debit or SWIFT codes in global finance—but tailored specifically to Florida’s unique banking framework.

Real-World Applications and Everyday Impact

From a teacher depositing monthly payments into a local nonprofit’s account to a small retail store processing debit scans, every transaction encapsulates the Td Florida routing number’s quiet influence. Consider monthly utility bills: when payments clear through Florida’s utility providers, routing numbers ensure funds reach the correct accounts within hours—not days.This speed matters for utility continuity and household budgeting.

In emergency scenarios, such as medical providers billing patients via electronic transfers, routing accuracy prevents payment paralysis, preserving timely access to care. Similarly, franchise-owned banks in Florida Keys and Panhandle communities remain operationally dependent on flawless routing to serve their tight-knit customer base without interruption.

Businesses across sectors—from agriculture to hospitality—rely on consistent routing performance to maintain payroll, inventory payments, and vendor disbursements. When routing numbers are correct, operations proceed smoothly; when mismatched, even minor errors cascade into delays and expense.

Related Post

Can You Bring Water Into Six Flags Magic Mountain? Engineers Weigh In on a Reality That Challenges Design and Safety

Natasha Zouves John S Knight Bio Wiki Age Abc7 News Accident Husband Salary and Net Worth

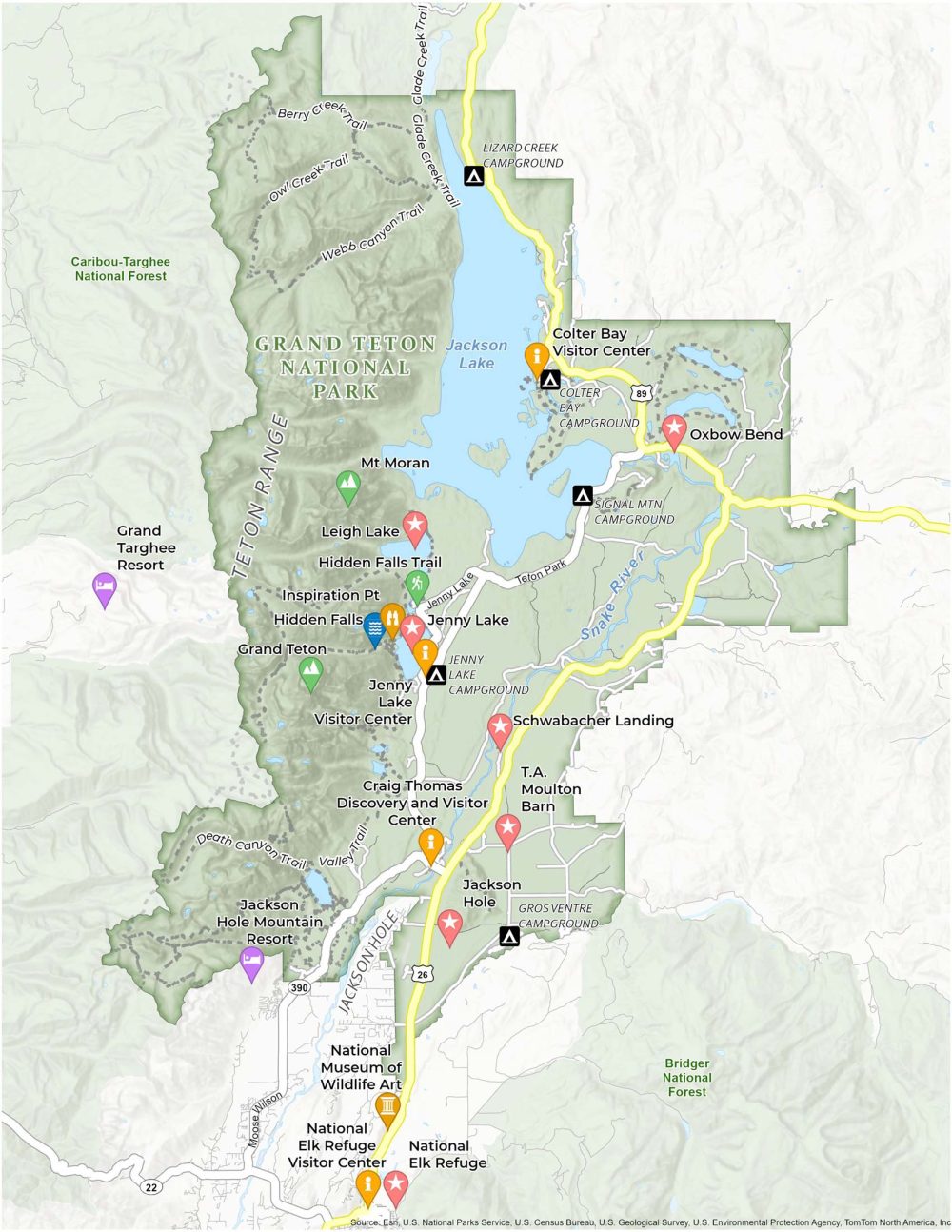

Campgrounds Near Grand Teton Park:태etter Outdoor Escape Just Minutes Away

Alicia Dericco Obituary: Remembering a Pioneering Voice in Journalism and Public Service