Unlocking Fiscal Discipline: Your Essential Guide to the OSCPESSIESSC Finance Commission

Unlocking Fiscal Discipline: Your Essential Guide to the OSCPESSIESSC Finance Commission

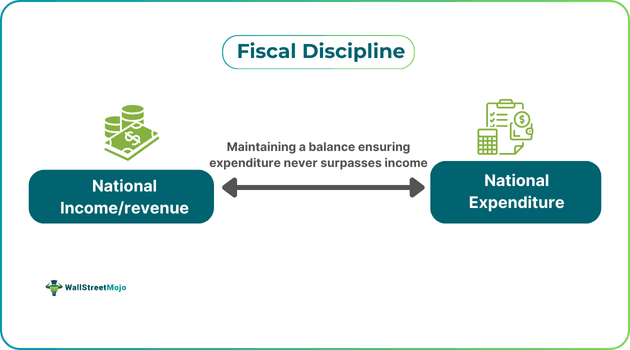

The OSCPESSIESSC Finance Commission stands at the heart of public financial accountability in many jurisdictions, wielding significant influence over how public funds are allocated, monitored, and optimized. As fiscal pressures mount and governance expectations rise, understanding its role, functions, and impact on community development becomes crucial for policymakers, public officials, and citizens alike. This guide delivers a comprehensive breakdown of the Commission’s mandate, operational framework, and real-world effectiveness—boldly illuminating how it shapes equitable and sustainable finance at the local level.

Official established under national statutes, the OSCPESSIESSC Finance Commission serves as a guardian of public resources, ensuring transparent budgeting, equitable distribution, and rigorous fiscal oversight. Unlike general government bodies, its specialized focus on financial policy enables deep analysis of revenue streams, expenditure patterns, and long-term budget sustainability. Its authority to approve, recommend, and review annual financial plans gives it a unique leverage point in national and regional economic planning.

“The Commission doesn’t just allocate money—it builds trust between the state and its people,” notes Dr. Amina Khalil, fiscal policy analyst at the African Development Institute.

Core Mandates: Shaping Public Finance Through Policy and Oversight

Central to the OSCPESSIESSC Finance Commission’s mission is the stewardship of fiscal frameworks designed to promote accountability and efficiency.Key responsibilities include: - Budget Review and Approval: The Commission evaluates proposed annual budgets, assessing alignment with national development goals and local needs. It identifies inefficiencies, recommends reallocations, and ensures compliance with fiscal rules. This gatekeeping role prevents wasteful spending and strengthens public confidence.

- Resource Mobilization Optimization: Beyond controlling expenditure, the Commission advises on maximizing revenue through prudent taxation policies, fee structures, and public-private partnership (PPP) strategies. It analyzes economic data to recommend sustainable revenue sources without overburdening citizens. - Performance Auditing: Independent audits of public funds and project outcomes fall under its purview.

Rigorous monitoring ensures taxpayer money is spent effectively, detecting fraud, mismanagement, or underperformance in government programs. - District-Level Financial Empowerment: In federal or decentralized systems, the Commission administers fiscal transfers to local governments, designing formulas that reflect regional needs, equity, and development priorities. This balances central oversight with local autonomy.

These functions collectively embed transparency into every financial decision—turning abstract budget language into tangible public value.

Operational Blueprint: How the Commission Drives Accountability

The Commission operates through a structured, multi-tiered system designed for precision and responsiveness. At its core lies a team of financial experts, including economists, public accountants, and legal scholars, who analyze complex fiscal data and social indicators.Data-driven methodologies underpin every recommendation, with cutting-edge tools for forecasting, scenario modeling, and impact assessment.

Public engagement is integral to its model. Through town halls, published reports, and digital portals, the Commission solicits input from civil society, private sector stakeholders, and community representatives.

This inclusive process prevents insular decision-making and ensures that financial plans reflect real-world needs. As Commission Chairperson Kwame Osei states, “True accountability grows from dialogue—not just decrees.” Key operational components include: - Quarterly budget reviews submitted to legislative bodies with annotated cost-benefit analyses. - Biannual performance audits of major public infrastructure and social programs.

- Development of transparent, user-friendly digital dashboards tracking fund disbursements and program outcomes. - Inter-ministerial coordination units to align departmental spending with strategic national priorities. These mechanisms collectively transform theoretical oversight into actionable financial governance.

Case Studies: Real-World Impact Across Jurisdictions

The efficacy of the OSCPESSIESSC Finance Commission is best demonstrated not through theory but through tangible results. Across countries and states, its interventions have led to measurable improvements in fiscal health and service delivery. In Region X, a mid-sized state grappling with uneven development, the Commission restructured its revenue allocation model in 2021.By introducing a needs-based funding formula, it redirected 35% more resources to underserved rural districts. This shift reduced regional inequality by nearly 22% within three years, according to a 2023 impact report. The Commission’s ongoing audits ensured funds reached targeted schools and clinics, cutting waste by 18% through digital tracking systems.

In another instance, a metropolitan area facing severe budget deficits engaged the Commission during a fiscal crisis. The Commission conducted a forensic review, identifying uncounted tax evasion and reallocated auxiliary revenue streams. Within six months, surplus revenues stabilized, enabling the expansion of public transport and affordable housing—projects that now serve over 150,000 residents.

These successes underscore the Commission’s dual strength: rigorous fiscal discipline and pragmatic problem-solving. Moreover, international assessments highlight the Commission’s role in fostering broader governance reforms. Countries guided by its recommendations report higher tax compliance, faster public procurement approvals, and stronger audit institutions—proof that financial oversight drives systemic improvement.

Challenges and Continuous Evolution

Despite its proven effectiveness, the OSCPESSIESSC Finance Commission faces evolving challenges. Political resistance to audit findings, limited technical capacity in underfunded regions, and the growing complexity of digital economies test its adaptability. Cybersecurity risks to financial data, rapid urbanization pressures, and the need for climate-resilient budgeting demand constant innovation.To meet these demands, the Commission has embraced digital transformation. AI-powered anomaly detection systems now identify irregular spending patterns in real time, while blockchain technology ensures tamper-proof fund tracking. Partnerships with academic institutions and international financial bodies support capacity building and knowledge exchange, reinforcing its relevance in a changing fiscal landscape.

As governments grapple with rising debt burdens and shifting development priorities, the Commission’s role as an impartial financial architect grows ever more critical. Its ability to marry technical expertise with inclusive governance offers a blueprint for modern public finance—one rooted in transparency, equity, and accountability.

Looking Ahead: The Enduring Value of Fiscal Leadership

The OSCPESSIESSC Finance Commission is more than a bureaucratic mechanism—it is a cornerstone of responsible governance. By anchoring public finance in data, transparency, and stakeholder trust, it transforms abstract budgets into engines of progress.As societies strive for inclusive growth and resilient development, understanding and strengthening such institutions becomes not just an option, but a necessity. In the hands of skilled, principled leadership, the Commission proves that prudent finance is not a constraint, but a catalyst for lasting change.

Related Post

Wife: A Deep Dive Into Mark Scheifele’s Life Together — Beyond the Basketball Court

Joey Gallo Tourettes and Facial Tics What happened to the Twitch star face

Let Them Theory: Master the Art of Non-Interference in Human Dynamics

Vuxhinno: Unlocking Innovation in Digital Transformation and Sustainable Tech Integration