Unlock Your Financial Potential with the Chase App: Smart Banking, Real Insights and Unmatched Convenience

Unlock Your Financial Potential with the Chase App: Smart Banking, Real Insights and Unmatched Convenience

In an era defined by digital transformation, personal finance tools like the Chase App are redefining how millions manage, track, and grow their money. By combining intuitive design with powerful financial features, Chase has positioned its mobile platform as a comprehensive solution for both everyday banking and long-term financial planning. Users gain not just access to accounts, but a full suite of tools that foster smarter decisions—whether budgeting for groceries, saving for a vacation, or investing in the future.

The Chase App delivers real-time transparency like never before. Every transaction, from a $5 coffee purchase to a $2,000 wire transfer, appears instantly, allowing users to monitor spending patterns and identify savings opportunities on the fly. With category tagging and customizable alerts, tracking finances has never been easier—no more sifting through stacks of statements or missing late payments.

Real-Time Tracking and Automated Insights at Your Fingertips

Central to the app’s effectiveness is its robust real-time tracking system. Every financial movement is logged and categorized automatically, offering users immediate visibility into their cash flow. The dashboard serves as a financial command center, displaying balance, recent deposits, and due dates with a single glance.Beyond basic monitoring, the Chase App leverages transaction data to generate smart insights: - Automated spending summaries break down expenses by category—food, transportation, utilities, and entertainment—enabling targeted budget adjustments. - Weekly and monthly trend reports highlight recurring costs and emerging patterns, helping users stay ahead of overspending. - The “Quick Views” feature offers a flash snapshot of account health, crucial during busy workdays or while planning weekend expenses.

These tools transform passive checking into active financial management—empowering users not just to know where their money goes, but to shape where it goes.

Secure, Seamless Banking: From Deposits to Transfers in Seconds

At its core, the Chase App excels in delivering both speed and security. Biometric authentication—such as fingerprint and facial recognition—ensures that access remains strictly controlled, protecting users against unauthorized access.Encryption protocols and multi-layered fraud detection systems further secure every interaction, providing peace of mind in every digital transfer. Transactions are designed for speed without compromise: - Deposits take seconds via mobile deposit technology, eliminating the need to visit a branch. - Peer-to-peer transfers and bill payments settle in minutes, often instantly.

- Credit card payments integrate securely, with instant confirmation and favorable routing alerts. The app also supports contactless debit and contactless account features, streamlining everyday purchases—whether at a café or across the globe. This fusion of convenience and protection reflects Chase’s commitment to a frictionless, safe banking experience.

Master Your Finances with Intelligent Budgeting and Goal Setting

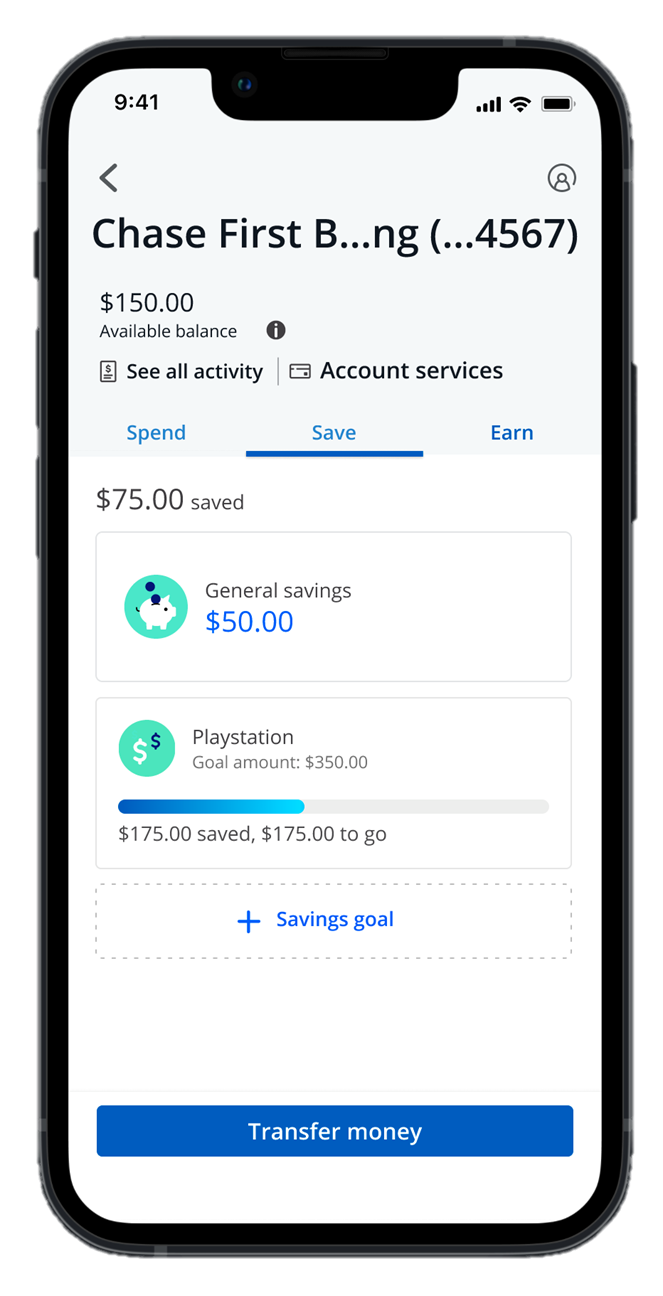

What sets the Chase App apart is its proactive approach to financial planning. Users are no longer limited to passive account balance checks; they actively shape their financial futures through structured budgeting and goal tracking tools. Budgeting within the app is dynamic and adaptive.Users set custom monthly limits across spending categories, receiving real-time push notifications when thresholds are approached or exceeded. This adaptive feedback helps prevent impulse buys and stay aligned with long-term objectives. Financial goals—whether saving for a down payment, paying off student loans, or funding a family vacation—transform abstract aspirations into measurable targets.

The app tracks progress visually, highlights achievements, and offers gentle nudges when momentum lags. For used car purchases, college savings, or home renovations, Chase enables users to allocate dedicated funds, monitor progress, and adjust plans as life circumstances evolve. One Pauley, Four Key Features Transforming Budgeting - Customize categories to mirror personal spending habits, ensuring reports reflect what truly matters.

- Access weekly and monthly spend analytics with drill-down detail, identifying underutilized budgets or hidden waste. - Receive real-time alerts when balances dip below set thresholds, preventing overdrafts and late fees. - Visual progress bars and milestone markers provide motivation, turning financial planning into an engaging, forward-looking journey.

These features allow users to move beyond budgeting as a chore and toward a proactive strategy—reducing stress and building lasting financial resilience.

Seamless Integration with Chase Ecosystem: More Than a Banking App

The Chase App thrives not in isolation, but as part of a broader financial ecosystem. Its deep integration with Chase’s suite of services—including credit cards, investment platforms, and digital loans—creates a unified experience where banking, investing, and credit management converge.Owning a Chase credit card unlocks exclusive app benefits: - Real-time fraud alerts with instant reporting capabilities - Spending insights tagged to specific card uses - Special offers and rewards analysis directly within the app - Automatic balances tracked across multiple cards, eliminating manual entry The app also connects effortlessly with Chase’s investment tools, allowing users to transition from tracking daily spending to building long-term wealth with minimal friction. Whether reviewing portfolio performance or reallocating assets, Chase users experience continuity across financial life stages. Moreover, guest access and shared banking features—such as joint accounts and secure employer-linked payroll deposits—expand utility without compromising security.

This interconnected model fosters deeper engagement and loyalty, reinforcing Chase’s position as a financial partner, not just a service. Biometric Security: Redefining Trust in Digital Banking In an age of rising cyber threats, the Chase App leads with next-generation security rooted in biometric authentication. Users authenticate transactions using fingerprint verification or facial recognition through Apple Face ID or Android’s biometric sensors—eliminating passwords and reducing identity theft risks.

The app’s layered security architecture extends beyond initial login: - All transfers and sensitive requests require one-time passcodes sent to registered devices. - Deep packet encryption safeguards data in transit and at rest. - Behavioral analytics monitor for unusual activity, triggering immediate alerts or temporary access blocks.

- Regular security updates and transparent breach communication maintain ongoing trust. These measures ensure that users enjoy rapid access balanced with uncompromising protection—an essential balance in cultivating long-term confidence. Additionally, Chase offers a “Report Lost” feature with instant card freezing and account reconnection options, minimizing disruption during physical security incidents.

This blend of cutting-edge tech and human-centered security practices positions the Chase App as a benchmark in digital banking safety. Support, Accessibility, and Inclusivity: Beyond Transactions While advanced features dominate attention, the Chase App excels in delivering accessible, user-first support. In-app help centers provide step-by-step guides, and a 24/7 live chat connects users to financial advisors during critical moments.

Accessibility features—such as screen reader compatibility, high-contrast mode, and voice navigation—ensure usability across diverse demographics. The intuitive interface guides new users seamlessly while delivering depth for seasoned reflectors. Time-saving tools further enhance utility: - Auto-fill payment details based on past behavior - Customizable notification preferences tailored to daily routines - Quick-access widgets for favorite functions like pay cards or check deposit This harmony of accessibility and sophistication makes the Chase App not just powerful, but universally usable—bridging gaps between generations and tech savviness.

In sum, the Chase App stands as a paradigm of modern banking—merging real-time insight, intelligent automation, and ironclad security into one seamless platform. It empowers users to track every dollar with precision, plan boldly through linked goals, and act confidently amid evolving financial landscapes. More than a transaction tool, it’s a financial companion built to grow with its users.

As digital banking evolves, Chase proves that convenience, clarity, and care can coexist—delivering value that transcends apps and lives in lasting financial well-being.

Related Post

Get Your Chase Appointment in Minutes with Same-Day Access

Honoring Generations: The Story Behind Cuddie Funeral Home Obituaries