Unlock Seamless Access: Mastering the Fnbo Credit Card Login Experience

Unlock Seamless Access: Mastering the Fnbo Credit Card Login Experience

Navigating online financial management begins with secure, effortless access—and the Fnbo Credit Card Login platform delivers just that. As digital banking evolves, users demand speed, security, and simplicity, especially when managing premium credit card accounts. Fnbo’s login system stands at the intersection of convenience and protection, combining biometric authentication with real-time fraud detection to deliver a reliable entry point for card members.

Whether renewing credit, checking balances, or accessing rewards, mastering this digital gateway empowers users to take control of their financial lives with confidence and clarity.

The Architecture of Secure Access: How Fnbo Login Works

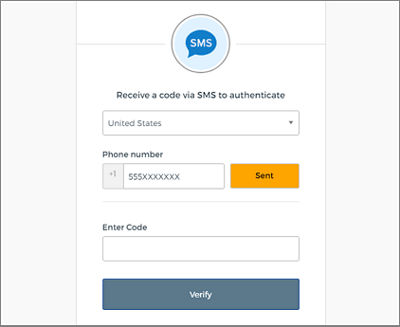

At the core of Fnbo Credit Card Login lies a multi-layered security framework designed to protect sensitive financial data while ensuring frictionless user experience. The process begins with a secure web interface hosted on Fnbo’s encrypted servers, accessible via desktop browsers or mobile applications dedicated to the platform.Users initiate their session by entering their registration number—often found on physical cards or emailed confirmations—and a PIN generated through tokenization, a standard security practice that replaces actual card details with unique codes. Beyond the initial credentials, Fnbo employs adaptive authentication protocols that assess behavioral patterns, device recognition, and geographic location. This means that a login attempt from a new location or unrecognized device may trigger step-up verification, such as a one-time password (OTP) delivered via SMS or authenticator apps.

“Our system balances safety with usability,” explains a Fnbo digital security officer. “No one wants to jump through endless hoops, but no one wants a breach either.” The platform also supports biometric logins, including fingerprint and facial recognition on supported devices, reducing reliance on memorized passwords. This integration aligns with modern standards of identity verification, making authentication both faster and more secure than traditional methods.

Once authenticated, the Fnbo dashboard presents a personalized interface designed for rapid interaction. Users instantly view credit limits, upcoming payments, reward points, and transaction history. From here, common actions—redeeming rewards, requesting a cardtop-up, or reporting a lost card—are accessible through intuitive links, minimizing navigation time.

This design philosophy reflects a deeper commitment to user empowerment: easy access to financial tools isn’t just a convenience—it’s a strategic advantage.

Key Features Driving User Engagement and Trust

Fnbo’s login experience is distinguished by several core features that elevate both functionality and security: - **Single Sign-On Integration**: Users can link Fnbo to affiliated services—such as travel booking platforms or e-commerce partners—enabling synchronized account access without repeated logins. This interoperability enhances workflow efficiency for frequent card users. - **Real-Time Balance Alerts**: The system continuously monitors spending patterns, delivering instant push notifications for unusual activity or threshold-based transactions, such as reaching 90% credit utilization.- **Customizable Notification Settings**: Users tailor alerts for payment due dates, balance updates, or security breaches via SMS, email, or in-app banners—ensuring they stay fully informed. - **Secure Password Management**: The platform recommends strong, unique passwords and stores credentials encrypted in Fnbo’s vault, reducing vulnerability to phishing or brute-force attacks. - **24/7 Support Integration**: In the rare event of login issues, embedded live chat and AI chatbots provide immediate technical assistance, minimizing downtime.

"What excites us most is how we blend robust security with user-centric design," notes a senior product manager at Fnbo. "Our logout flow is no longer just a step—it’s a safeguarded transition that protects the user’s entire digital journey."

Real-World Use Cases: From Beginners to Finance Pros

Ứnant design makes Fnbo Credit Card Login effective across diverse user profiles. For first-time cardholders, the clean interface and guided prompts reduce onboarding friction.First-time logins are quickly standardized: enter the Fnbo registration code, receive OTP, and gain instant access. Students managing travel cards benefit from quick access to currency conversion tools and trip insurance details—all within seconds of logging in. For business users, the platform’s bulk account management features simplify fleet expense tracking and approval workflows.

Many users leverage the login portal to initiate bulk reimbursements or generate corporate spending reports without leaving the app. For high-volume cardholders—such as freelancers or entrepreneurs—real-time balance and transaction data enable agile financial decisions. Questional use flows include: - Renewing credit limits with secure approval workflows - Applying for premium card upgrades - Disputing incorrect charges via seamless in-app dispute portals - Syncing the credit card with digital wallets like Apple Pay or Samsung Pay Each action is safeguarded by layered encryption, session timeouts, and biweekly security audits conducted by third-party experts.

These varied applications underscore a central truth: Fnbo’s login system isn’t merely a gateway—it’s a financial command center, enabling users to act decisively in a fast-moving digital economy. The seamless continuity between identity verification and action empowers confidence, turning routine transactions into strategic milestones.

The Road Ahead: Enhancing Security and Accessibility

As cyber threats continue to evolve, Fnbo invests heavily in advanced authentication technologies, including behavioral analytics that learn typical user patterns over time. These predictive systems detect anomalies—such as sudden large purchases or abrupt geographic shifts—before risks materialize.“We’re moving toward proactive security,” says the digital officer, “where login systems don’t just verify identity but anticipate threats in real time.” Accessibility remains a core focus, with Fnbo refining voice-guided navigation and compatibility with assistive technologies to support users with visual or motor impairments. This commitment ensures that secure access is inclusive, breaking down barriers that once limited effective financial engagement. The Fnbo Credit Card Login experience exemplifies how modern finance can marry rigor and simplicity—protecting users without compromising convenience.

In an era where digital ease defines competitive advantage, Fnbo continues to set benchmarks, proving that trust and usability are not opposing goals but synergistic pillars of digital banking excellence.

Related Post

Secure Access: Navigating the Fnbo Credit Card Login Process

Fnbo Credit Card Login Your Ultimate Guide: Secure, Simple, and Securely Access Your Finances

Analyzing the Public Persona: Unpacking the Significant Other of Ed Skrein Narrative

Shackles Breaking: How the Viral Meme Exposed Systemic Resistance and Sparked Cultural Shifts