Unlock Instant Credit Access with Vsangelcard Claim Bill’s Unique “Tap into Credit” Feature

Unlock Instant Credit Access with Vsangelcard Claim Bill’s Unique “Tap into Credit” Feature

For users of the Vsangelcard Com Pay Bill platform, managing finances has never been simpler—thanks to a groundbreaking feature embedded directly into the system: the “Tap into Credit” function. This innovative capability transforms how cardholders interact with their credit balance, enabling seamless access to available funds without traditional borrowing hurdles. By redefining credit availability, Vsangelcard introduces a user-centric mechanism that empowers financial flexibility in real time.

At its core, the “Tap into Credit” feature operates as a dynamic credit-on-demand solution. Unlike conventional lines of credit that require hard application processes or credit checks, this function instantly taps into authorized credit—within pre-set limits—allowing users to “spend” available funds with a tap, pull, or digital authorization. As one Vsangelcard user remarked, “It’s like having a credit boost ready-to-use, no wait, no forms—just instant confidence in my spending power.”

How the “Tap into Credit” Mechanism Works

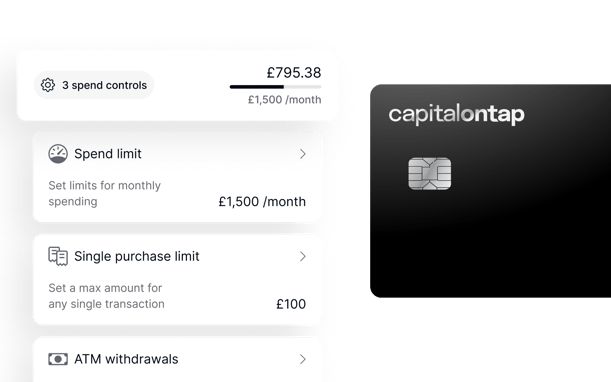

The feature leverages real-time data synchronization between transaction tracking, spending behavior, and available credit.When funds remain in a card account but are not fully utilized, the system automatically flags unused balances. With user consent, the platform activates the “Tap into Credit” function, transforming idle credit into actionable liquidity. Key components include: - **Intelligent Balance Scanning:** The system continuously monitors account activity and identifies underutilized credit lines.

This prevents waste and maximizes value. - **Instant Activation:** Once a user authorizes access, funds become available for immediate use—whether for digital payments, in-store purchases, or peer transfers—via mobile app or online portal. - **Dynamic Credit Limits:** Available credit dynamically adjusts based on recent spending patterns, ensuring personalized, adaptive financial support.

- **Seamless Integration:** Works alongside the existing Vsangelcard payment workflow, requiring no additional authentication steps once enabled. For frequent travelers, merchants, or daily spenders, this eliminates friction in financial operations. Instead of waiting for disbursements or navigating lengthy credit applications, users gain immediate access to funds when needed—turning financial oversight into strategic advantage.

Unlike traditional credit avenues that saddle users with debt or rigid repayment schedules, “Tap into Credit” functions more like a flexible credit bridge. Users tap only what they need, repaying through automated or manual deductions, minimizing financial strain. This responsible approach reflects Vsangelcard’s commitment to ethical fintech innovation.

Comparative Advantage: Why Vsangelcard Stands Out

While many fintech platforms offer credit access, Vsangelcard’s feature distinguishes itself through user control and transparency. Most competing systems require users to request and await approvals, often tied to credit scores or income verification. In contrast, the “Tap into Credit” feature resides entirely within the user interface—accessible one-tap, with clear visibility of available balance and exposure.“It’s not just about access—it’s about agency,” notes a compliance officer from Vsangelcard. “Users know exactly how much credit they’re engaging with and can withdraw at any time. This transparency builds trust and financial discipline.” Additionally, the system integrates with the platform’s robust security protocols.

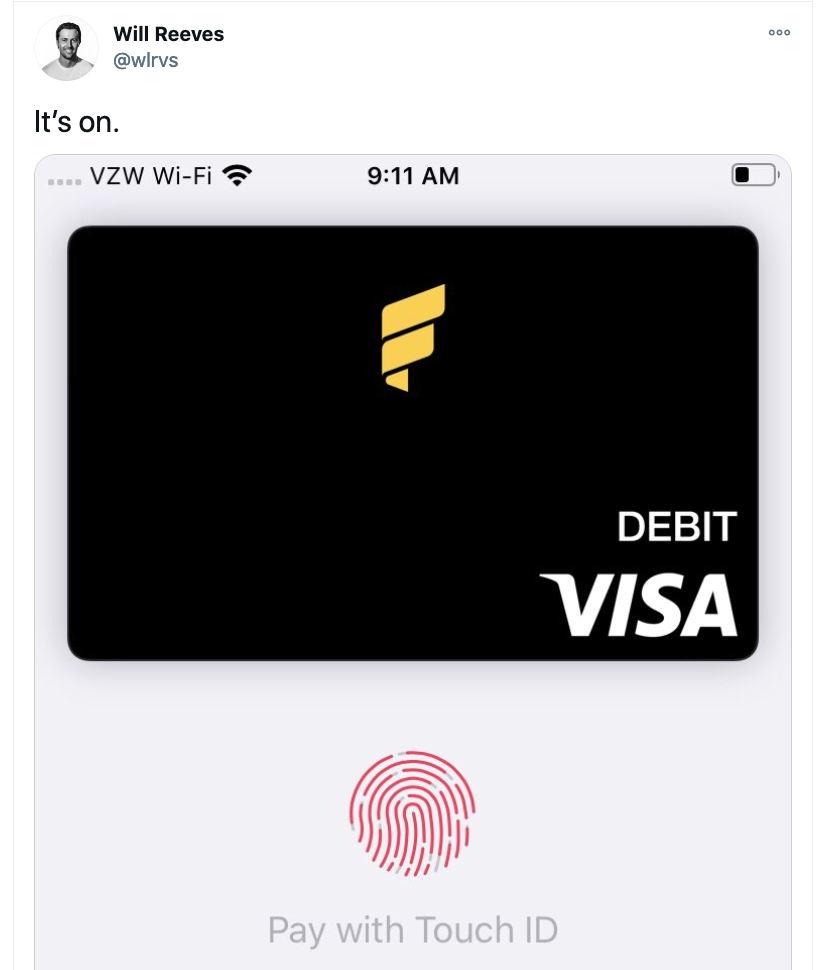

Biometric authentication, real-time fraud alerts, and encrypted transaction logs ensure that accessing credit remains secure and reliable. This balance of convenience and protection sets the feature apart in a crowded digital wallet landscape.

Use cases underscore its practicality: - **Small business owners** use the feature to rush orders during peak demand.

- **Commuters** tap for travel-related expenses without cash or debit delays. - **Event planners** secure last-minute venue deposits using unused credit. - **Everyday shoppers** capture limited-time offers with instant credit backing.

Every scenario reinforces how the “Tap into Credit” feature adapts to diverse financial needs—turning potential cash flow gaps into resolved opportunities.

Impact on Financial Behavior and Inclusion

Beyond convenience, the mechanism encourages responsible usage. Because access is tied directly to available balances, users are prompted to reflect on their spending: tapping enables mindful decisions rather than impulsive outlays.Over time, this fosters better financial habits, even among first-time credit users. Accessibility also broadens underbanked populations’ participation. With simplified KYC digital steps and real-time credit disbursement, more people gain structured credit access without legacy financial barriers.

“Our vision is a financial ecosystem where credit responds to need—not red tape,” says Vsangelcard’s fintech lead. “‘Tap into Credit’ embodies that philosophy. It’s not just a feature; it’s a shift toward empowerment.”

As mobile banking grows ever central, Vsangelcard’s innovation offers a blueprint: real-time, user-controlled credit access powered by smart technology.

The “Tap into Credit” function is not merely a tool—it’s a catalyst for smarter, faster, and more inclusive financial management. For cardholders, it means greater freedom, transparency, and control—right at their fingertips.

Related Post

Discovering Reba McEntire’s Family: The Truth Behind Whether She Has Grandkids

Tony Balkissoon Laura Jarrett Husband Bio Wiki Age Height Wedding Mother and Net Worth