Unlock Financial Precision: Mastering Southwest Chase Login for Seamless Banking

Unlock Financial Precision: Mastering Southwest Chase Login for Seamless Banking

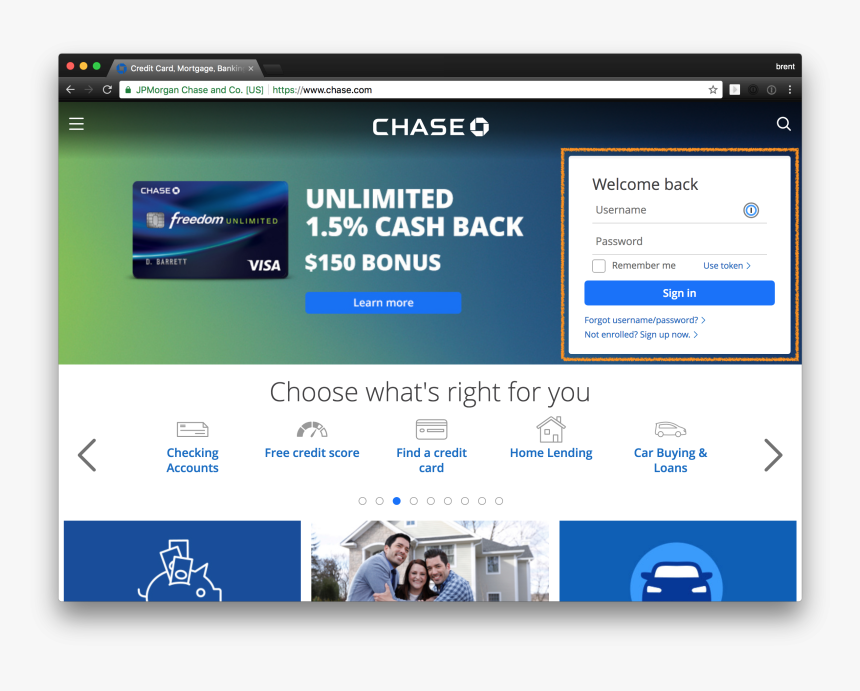

Secure access to your financial future begins with the simple yet powerful act of logging into Southwest Chase — a gateway that transcends routine sign-ins to become a hub of efficiency, security, and real-time insight. Whether managing daily transactions, tracking credit health, or securing your assets with advanced tools, the Southwest Chase Login experience sets the foundation for smarter, faster, and safer banking. The ease and reliability of logging into Southwest Chase define how users engage with their money.

Unlike fragmented banking experiences, the Chase platform integrates robust authentication protocols with intuitive navigation, ensuring that every login is both a security checkpoint and a launchpad for action. This dual purpose makes Southwest Chase Login not just a technical interface, but a strategic tool for financial empowerment.

At the core of the Southwest Chase login experience lies a layered architecture built on security, speed, and user-centric design.

The process begins with authentication through multi-factor verification — combining something you know (your password), something you have (a trusted device), and increasingly, something you are (biometric data like fingerprint or facial recognition). This multi-layered defense shields accounts from unauthorized access while maintaining fluidity for legitimate users.

Multi-Method Login: Balancing Security and Convenience Southwest Chase evolved its login system to accommodate diverse user preferences and threat levels. The standard username-password combination remains foundational, but modern access increasingly relies on advanced methods: - **Mobile Authentication**: Through the Southwest Chase mobile app, users access a one-tap login using biometrics or a secure one-time pass, eliminating the need to remember complex codes.- **Push Notifications**: Authorized logins prompt instant push alerts directly to registered devices, offering real-time confirmation and immediate dispute detection. - **Security Questions & Backup Codes**: Optional layers provide additional safeguards, especially during password resets or account recovery. - **Integration with Chase Identity Verification**: Leveraging behavioral analytics and AI, the system adapts authentication demands based on user activity, location, and device history.

“This is not just about logging in — it’s about logging in *smartly*,” says a SouthWest Bates banking security expert. “Our system evaluates risk in real time, ensuring protection without frustrating legitimate customers.”

Once authenticated, users are directed to a personalized dashboard that reflects their financial landscape in real time. Transaction summaries, account balances, and credit score snapshots update instantly, enabling proactive decision-making.

The interface prioritizes clarity: key actions like fund transfers, account alerts, and document uploads are seamlessly integrated into a responsive design optimized for mobile and desktop alike.

Beyond basic access, the Southwest Chase Login portal offers a suite of embedded financial tools designed to deepen engagement and control:

- Secure Fund Movement: Initiate wire transfers, bill payments, and fund transfers with end-to-end encryption and instant confirmation.

- Real-Time Alerts: Customizable notifications for transaction activity, low balances, or unusual logins keep users immediately informed.

- Budgeting & Insights: AI-powered analytics break down spending patterns and offer personalized tips to improve financial health.

- Account Recovery & Support: Instant password reset, live chat with customer service, and secure identity check minimize downtime during access issues.

For users requiring frequent or multi-device access, the Southwest Chase system supports secure sync across platforms without repeating verification steps unfairly. Single sign-on (SSO) features work seamlessly within Chase’s ecosystem, allowing access from bank-owned devices, partner financial apps (when permitted), and secure web portals—all protected by the same rigorous authentication framework.

Security Foundations: Built for Trust in a Digital Age Southwest Chase places cybersecurity at the heart of its login infrastructure.End-to-end encryption, token-based authentication, and regular audits by internal and third-party experts ensure that every login session remains private and tamper-resistant. The platform also participates in real-time fraud monitoring networks, enabling rapid response to suspicious behavior.

For small business owners, freelancers, and individual users alike, secure access via Southwest Chase Login transforms daily banking into a strategic asset. It removes the friction of cumbersome security measures and replaces it with intelligent, user-friendly tools that grow with financial needs. Whether checking a balance during a coffee break or arranging payroll with seconds to spare, the login process becomes invisible — yet indispensable.

And while login is a gateway, the true value lies in what it unlocks: timely access to cash flow data, credit management tools, and personalized financial advice—all woven into a login experience engineered for clarity and control.

This is banking reinvented: faster, safer, and fundamentally designed around the user, not the technology.

Related Post

Iwaiwa Z M2800: Review And Features

From Obscurity to Jacksonville’s Rising Star: Jdot Breezy’s Breakthrough Moment

Home of Olympus Mons Crossword Clue Can You Solve It Before Its Too Late