Top Billionaires In China: Who’s Shaping The Wealth Race?

Top Billionaires In China: Who’s Shaping The Wealth Race?

Behind China’s rapid economic transformation lies a cadre of billionaires whose fortunes reflect the nation’s dynamic shift toward innovation, state-linked industries, and global market integration. Their trajectories—from tech entrepreneurship to state-affiliated empire building—reveal a complex landscape where government policy, private ambition, and market forces converge. From the electric vehicle revolution to fintech breakthroughs and advanced manufacturing, these individuals are not only accumulating wealth but redefining China’s economic future.

This analysis examines the current top billionaires in China, their strategic domains, and the broader implications of their rising influence on both domestic development and global finance.

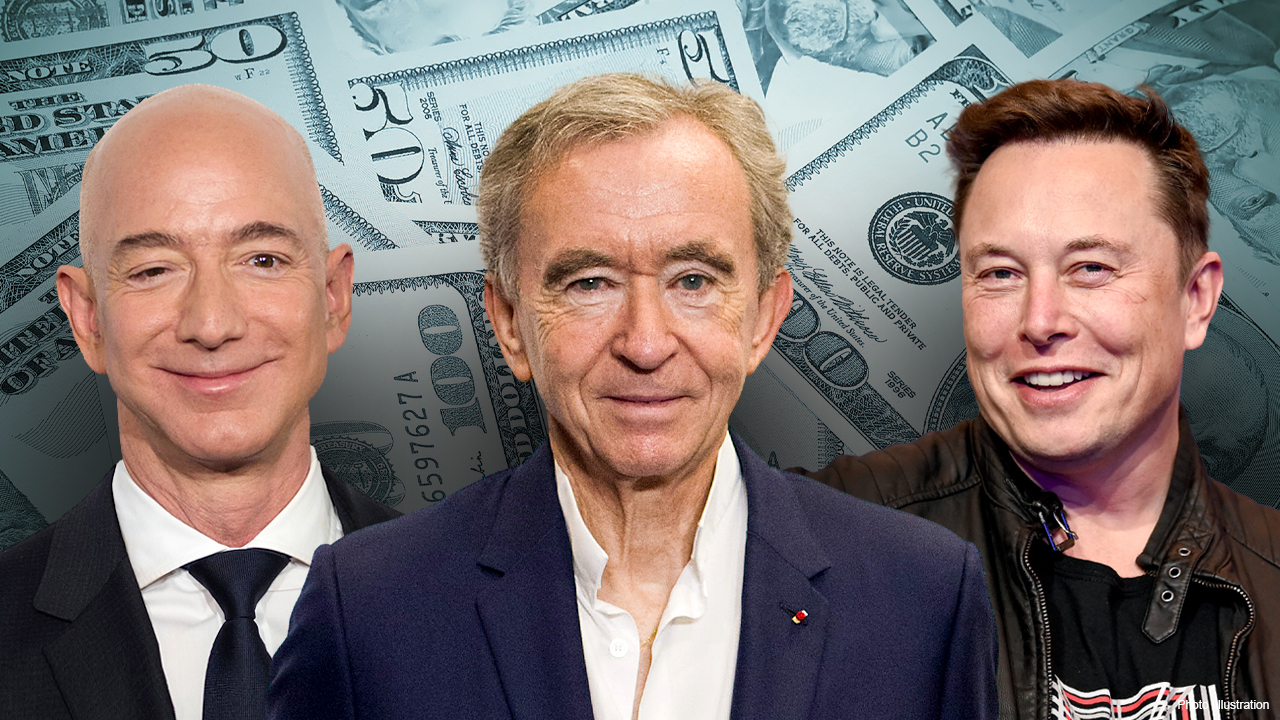

The Titans of Chinese Wealth: Top Earners in 2024

As of early 2024, China’s richest individuals rank among the world’s most powerful wealth creators, with their combined net worth exceeding $700 billion, according to Bloomberg billionaire rankings and market intelligence from macroeconomic reports. While wealth concentration remains fluid, several names consistently emerge in leadership positions, driven by strategic sector dominance: - **Jack Ma**, though no longer at the helm of Ant Group, retains immense influence through his legacy in fintech and continued investments.His net worth, still over $60 billion, underscores his enduring impact on China’s digital banking evolution. - **Pony Ma (Ma Huateng)**, CEO of Tencent Holdings, leads with a net worth near $80 billion, anchored in e-commerce, cloud computing, and gaming. Tencent’s ecosystem—encompassing WeChat, QQ, and strategic stakes in global tech firms—positions Ma as a central pillar of China’s digital economy.

- **Robin Li (Li Kawei)**, founder and CEO of Baidu, commands a $40 billion fortune built on AI-driven search and autonomous driving technologies. Li’s focus on artificial intelligence solidifies his role in China’s push toward high-tech self-sufficiency. - **Zhang Yiming**, sequencer of the ByteDance empire (parent to TikTok and Douyin), while no longer the active CEO, remains a high-impact figure with estimated wealth around $20 billion, reflecting the global scale of China’s tech exports.

- Emerging powerhouses include **Wang Gongquan** of netEase, a key player in game development and cloud services, and **Li Lu**, a prominent venture capitalist with deep government and private networks, illustrating how diverse paths fuel the billionaire class. These figures exemplify China’s dual engine of innovation and industrial integration, where technological prowess and market reach define wealth creation.

Sectoral Powerhouses: Tech, Finance, and Industrial Influence

The dominance of China’s billionaires spans transformative sectors, each leader leveraging unique advantages within national and global markets: - **Technology & Digital Platforms:** Chinese billionaires excel in digital infrastructure, where platforms like Tencent’s WeChat and ByteDance’s TikTok have achieved global cultural penetration.Jack Ma’s early vision for inclusive fintech via Ant Group redefined financial inclusion, despite regulatory headwinds. Robin Li’s Baidu drives China’s AI race with investments in autonomous vehicles and smart cloud services, aligning with national “Internet Plus” policies. - **E-commerce & Retail Innovation:** Beyond Ma, figures like Richard Liu (JD.com) have built robust logistics and retail ecosystems.

Liu’s focus on supply chain efficiency and smart warehousing reflects the sector’s evolution from pure transaction to integrated consumer experience, with cross-border trade amplifying wealth potential. - **Finance & Infrastructure Investment:** While less visible than tech moguls, billionaires such as Wang Jianlin (formerly China’s richest via real estate exploits) and executives in state-linked financial institutions shape capital flows. Their networks bridge public policy and private capital, enabling large-scale projects in renewables, infrastructure tech, and industrial upgrades.

- **Manufacturing & Emerging Innovation:** The rise of new industrial leaders—particularly in electric vehicles, semiconductors, and green tech—signals a strategic pivot. Legislated support for self-reliance in critical technologies has fueled capital influx into startup ecosystems, elevating entrepreneurs who blend private enterprise with national technological goals. This sectoral diversity underscores how China’s billionaires are not just wealth holders but architects of future industries, driven by both market demand and state-backed strategic objectives.

The Dual Forces Driving Wealth Accumulation

Wealth consolidation among Chinese billionaires is shaped by two interlocking dynamics: deep integration with state economic infrastructure and aggressive capital expansion into export-oriented, innovation-led sectors. - **State-Aligned Development:** Many top billionaires operate at the nexus of private enterprise and public policy. Government initiatives such as “Made in China 2025” and digital sovereignty projects have created fertile ground for state-linked tech and industrial champions.Strategic partnerships—often involving joint ventures, policy incentives, or access to state-backed financing—accelerate growth and shield key players from global volatility. - **Export-Led and Global Market Ambition:** China’s billionaires increasingly project influence beyond borders. Through investments in overseas markets, IPOs on global exchanges, and cross-border acquisitions, they secure competitive advantages.

Tencent’s cloud services in Europe and ByteDance’s TikTok data infrastructure exemplify this outward expansion, blending market reach with geopolitical awareness. - **Capital Reinvestment and Diversification:** The process of wealth accumulation is cyclical—reinvesting profits into emerging sectors such as AI, biotech, green energy, and fintech ensures sustained growth. This iterative model allows billionaires to pivot with the economic tide, maintaining leadership amid rapid technological change.

This dual strategy—anchored in policy alignment yet outward-facing—positions Chinese billionaires not merely as inheritors of wealth, but as active drivers of industrial transformation, reinforcing China’s role as a global innovation hub.

As China’s economy evolves toward high-tech leadership and self-reliance, these billionaires are more than financial leaders—they are linchpins in a national strategy balancing innovation, influence, and global competitiveness. Their fortunes, built on sectors ranging from digital platforms to advanced manufacturing, reflect a dynamic interplay of private ambition and state vision, making them central figures in the broader narrative of China’s ascent in the 21st-century wealth landscape.

Related Post

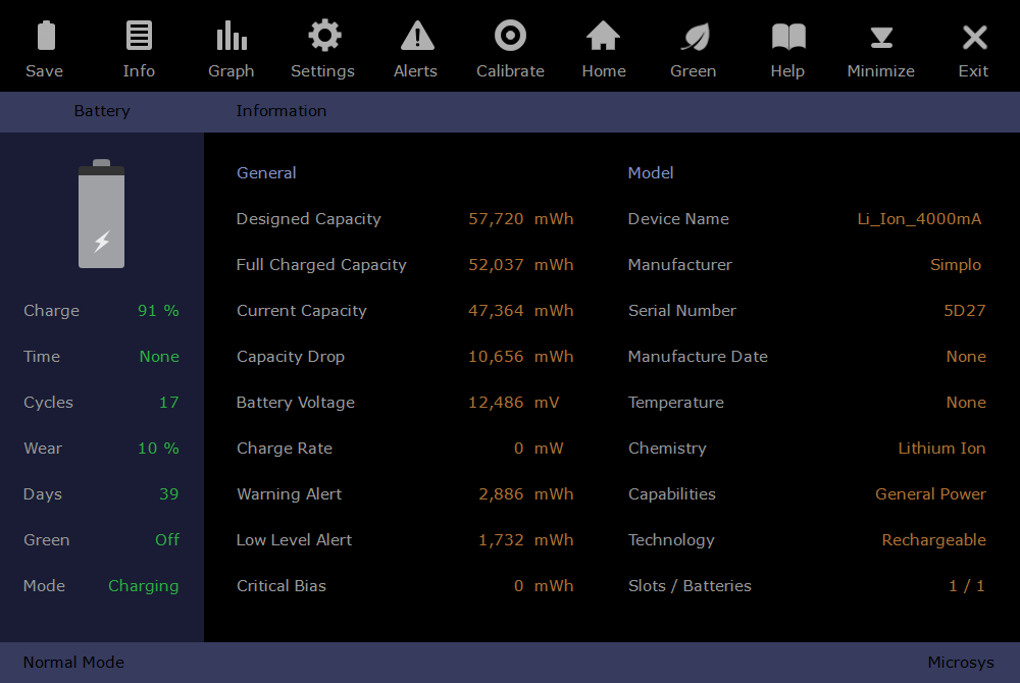

Mastering Greenify: The Ultimate Guide to App Hibernation for Smarter Battery Use

Unveiling the Phenomenon of Lilli Kay: A In-depth Analysis

Texas Hs Football Playoff Brackets Your Complete Guide: Navigate the March Madness of Texas High School Red State Glory

Score a Whopping 25% Off Full Synthetic Oil Change with Valvoline’s Limited-Time Coupon