The Trustee Model of Representation: Redefining Fiduciary Duty in Trust Law

The Trustee Model of Representation: Redefining Fiduciary Duty in Trust Law

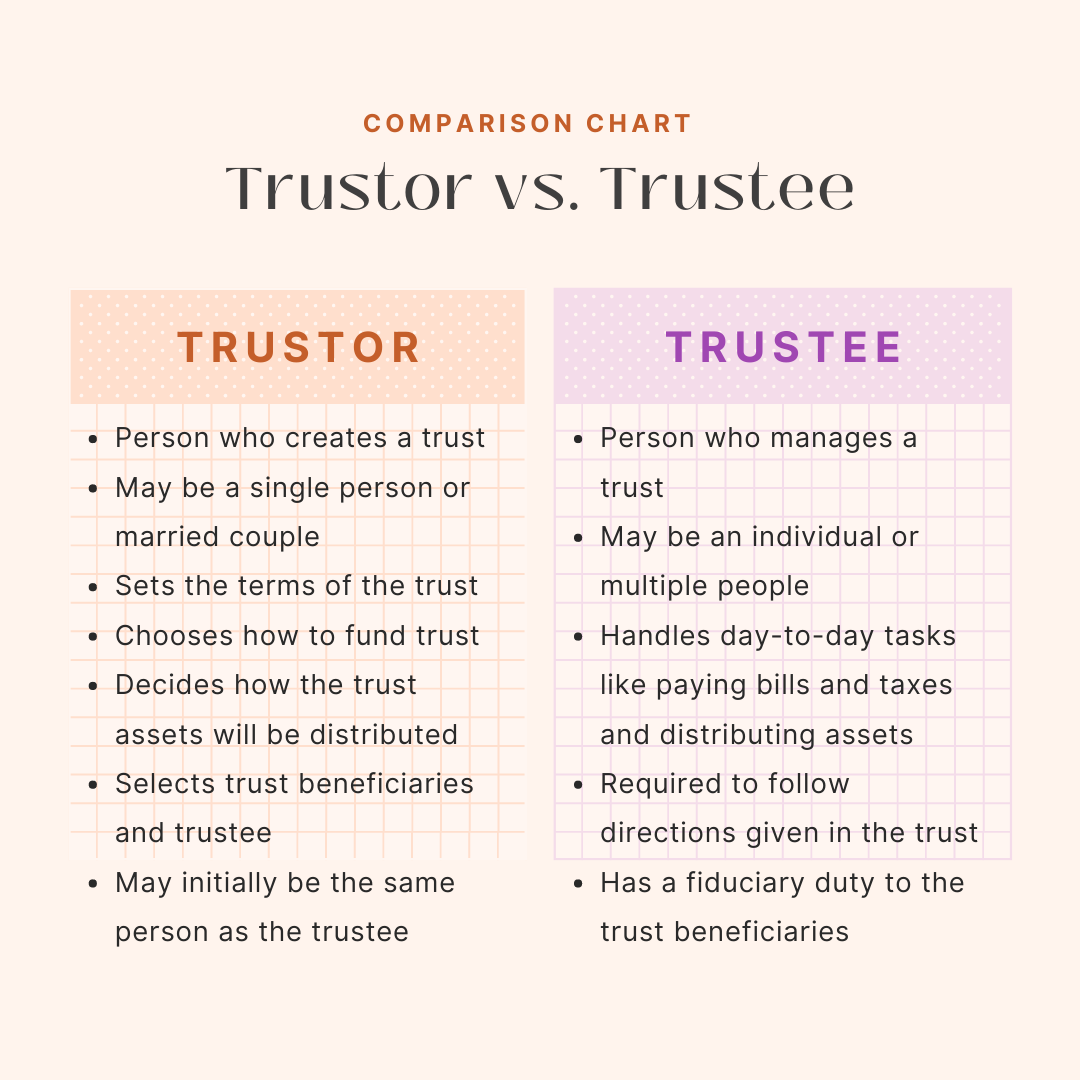

In an evolving legal landscape where accountability and transparency are paramount, the Trustee Model of Representation stands as a cornerstone of modern fiduciary governance. It redefines how trustees act not merely as executors of legal instructions, but as vested representatives owed to beneficiaries, bound by a higher standard of loyalty, care, and informed judgment. Unlike agent-based models, this framework positions the trustee as a surrogate decision-maker entrusted with both legal authority and moral responsibility, reshaping expectations across family, charitable, and commercial trust structures.

At its core, the Trustee Model of Representation establishes a fiduciary hierarchy grounded in representative fiduciary duty—a construct that transcends traditional agent-principal relationships. Trustees are not passive custodians; they act as stewards entrusted to manage assets and rights on behalf of beneficiaries with diligence, impartiality, and informed discretion. As consistently noted by legal scholar Professor Paul C.

Rozell, “The trustee does not simply follow orders—today, they embody the beneficiary’s interest within a legal framework that demands both accountability and proactive judgment.”

This shift from mechanical compliance to representative fidelity transforms core duties. Trustees must balance legal obligations with ethical foresight, making decisions that serve beneficiary needs both currently and in the long term. Key principles include:

- Fiduciary Loyalty: Trustees must avoid conflicts of interest and prioritize beneficiary welfare above personal or third-party gain.

- Prudent Administration: Acting with care equivalent to that of a prudent person, trustees exercise discretion informed by market knowledge, beneficial property context, and evolving risks.

- Transparent Communication: Regular, detailed reporting fosters trust and enables informed beneficiary engagement, reinforcing accountability.

- Impartiality in Distribution: Trustees must fairly allocate benefits among beneficiaries, applying neutral criteria even amid divergent interests.

The model’s influence extends across diverse trust forms—from testamentary trusts in estate planning to charitable trusts serving public good, and commercial trusts managing complex fiduciary portfolios.

In family trusts, the trustee model often replaces adversarial inheritance disputes with collaborative stewardship, guided by the trustee’s duty to represent all beneficiaries as a unified collective. Medical trusts for minors exemplify this well: trustees act not on precise legal directives alone, but on the holistic well-being of the beneficiary under evolving circumstances.

Real-world application demands trustees navigate legal statutes and personal judgment with equal precision.

For example, a trustee overseeing a legacy farm must weigh short-term income needs against long-term sustainability, potentially investing in eco-friendly infrastructure even without explicit beneficiary mandate—because prudent administration obliges foresight. Similarly, in charity trusts, trustees balance donor intent with current community needs, adapting mandates to reflect societal change while preserving core charitable purpose.

A defining feature of the Trustee Model is its embedded expectation of active informedness.

Trustees are expected to stay abreast of economic trends, legal precedents, and risk landscapes—transforming passive oversight into evolved fiduciary expertise. This demands ongoing education and transparency, ensuring decisions remain defensible under scrutiny. As jurist Helen M.

Grant emphasizes, “True trustee representation means translating legal rights into meaningful outcomes, not merely executing instructions.”

Critical to this model is the principle of equitable benefit distribution. Trustees must navigate complex formulas—whether determining fixed rent vs. proportional shares among siblings or dispersing income in line with evolving family circumstances.

Thoughtful application ensures fairness persists across generations, preventing arbitrary or short-sighted decisions. In commercial trusts, this translates to prudent investment strategies aligned with fiduciary prudence, balancing growth with risk mitigation under board and beneficiary oversight.

The impact of the Trustee Model of Representation reaches beyond legal compliance—it cultivates a culture of accountability that strengthens trust institutions overall.

By positioning trustees as conscious representatives rather than silent agents, beneficiaries gain reliable stewardship, estate plans achieve enduring stability, and charitable missions remain responsive and relevant.

Ultimately, the Trustee Model of Representation redefines representation as a dynamic fiduciary act: one rooted in loyalty, tempered by wisdom, and anchored in the beneficiary’s best interest. As legal practice evolves, this model endures not as a rigid framework, but as a living doctrine guiding trustees to uphold the highest standards of representation in a world where trust is both fragile and indispensable.

Rooted in both tradition and modern necessity, the trustee’s role has matured beyond guard

Related Post

Emoni Rivers Boyd Girl who slapped mum found dead shot 16 times

Gogosh Patch V90: The Definitive PES 2021 Master League Upgrade That Redefines Club Management

How to Change WeTV Subtitles on Your TV: A Simple, Step-by-Step Guide

Hingham Ferry Schedule: Your Key to Timely Travel on the Water