The Silent Guardians of Financial Integrity: Uncovering the Power of Auditing & Assurance Services

The Silent Guardians of Financial Integrity: Uncovering the Power of Auditing & Assurance Services

In an era defined by financial complexity and heightened risk, auditing and other assurance services serve as the bedrock of trust across global markets. These critical practices provide independent verification of financial statements, internal controls, and operational integrity—offering stakeholders confidence in the accuracy and reliability of business information. As dictated by evolving regulatory demands and the need for transparency, the principles guiding auditing have grown more sophisticated, integrating frameworks that extend beyond basic compliance into the realm of proactive risk mitigation.

This article explores the core principles of auditing and assurance services, their expanding role in modern governance, and the tangible impact they deliver across industries.

Core Principles Governing Auditing Practices

At the foundation of all auditing lies a rigorous adherence to established principles that ensure objectivity, professional skepticism, and methodical execution. These principles are not merely procedural—they shape the credibility and integrity of the audit process itself.- **Integrity and Objectivity**: Auditors must remain impartial, resisting any influence that could compromise their impartial judgment. The International Standards on Auditing (ISAs) emphasize that independence—both in fact and appearance—is non-negotiable. “The hallmark of credible assurance is the auditor’s unshakable independence,” asserts the International Federation of Accountants (IFAC).

- **Professional Competence and Due Care**: Professionalism demands continuous skill development and meticulous attention to detail. Auditors are expected to maintain technical proficiency and apply sound professional judgment in assessing risks and designing audit procedures. - **Confidentiality and Data Security**: With sensitive information forming the core of audit engagements, protecting client data is paramount.

Assurance professionals must safeguard data throughout the audit lifecycle, aligning with cyber risk management standards. - **Adherence to Generally Accepted Auditing Standards (GAAS) / International Standards on Auditing (ISA)**: These comprehensive frameworks govern audit design, execution, and reporting. They ensure consistency, transparency, and reliability, enabling stakeholders to compare results across entities and sectors.

These principles form a robust foundation, ensuring audits serve not only as compliance checklists but as rigorous evaluations that reinforce organizational accountability.

The Evolving Scope of Assurance Services

Assurance services have expanded far beyond traditional financial statement audits, now encompassing a broad range of capabilities designed to address modern business risks. While financial audits remain central, ISO/ISA standards now support assurance on internal controls, sustainability reporting, cybersecurity governance, and operational effectiveness.- **Financial Audits as a Cornerstone**: The core remains the independent verification of financial records, ensuring accuracy and compliance with accounting standards. This builds investor confidence and supports fair market valuation. - **Internal Control Assessments**: Auditors evaluate the design and effectiveness of controls over financial reporting, fraud prevention, and operational efficiency.

This supports compliance with frameworks like COSO and ISO 37001. - **Sustainability and ESG Reporting**: With global focus on environmental, social, and governance (ESG) metrics, assurance providers validate sustainability disclosures, enhancing credibility amid growing stakeholder demand for transparency. - **IT and Cybersecurity Assurance**: As digital transformation accelerates, assurance extends to evaluating IT controls, data integrity, and cyber resilience—critical in an environment where breaches threaten operational stability and reputational trust.

This expanded scope reflects audit’s transformation into a strategic function, contributing not just to compliance but to long-term organizational resilience.

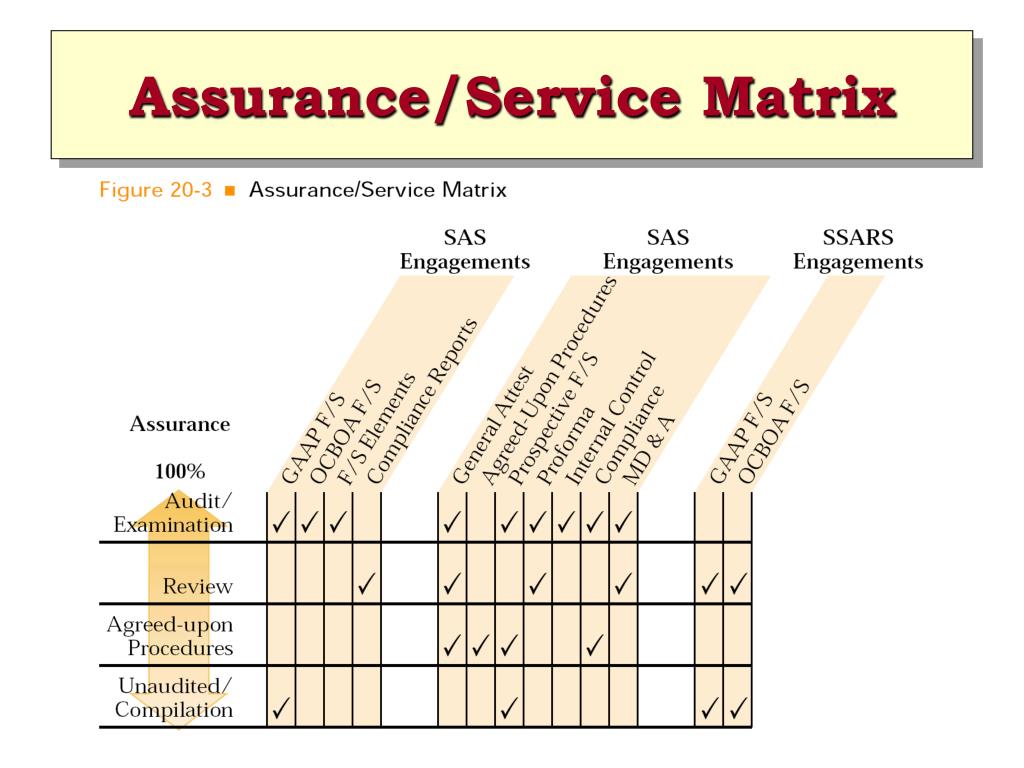

Key Assurance Engagement Types and Their Impact

Auditing and assurance services manifest in diverse forms, each tailored to meet specific stakeholder needs and risk environments. Understanding these modalities reveals their practical value across industries.- **Type I & II Financial Audits**: Type I confirms whether financial statements present fairly under applicable standards, while Type II evaluates the reliability of internal controls supporting those statements. Together, they deliver both point-in-time assurance and ongoing control evaluation. - **Operational Audits**: These assess efficiency, effectiveness, and cost-effectiveness of business processes, uncovering waste, duplication, or process breakdowns—helping organizations optimize performance.

- **Compliance and Regulatory Assurance**: Audits focused on adherence to laws, regulations, and internal policies, crucial in heavily regulated domains like banking, healthcare, and public sector operations. - **IT System and Data Integrity Assurance**: Evaluating data governance, system controls, and software reliability, this modern assurance service addresses vulnerabilities in digital infrastructure and ensures trust in electronic records. Organizations leveraging these engagements report tangible benefits—from reduced fraud occurrence to improved decision-making grounded in trustworthy data.

Challenges Shaping Modern Auditing Practices

The path of auditing is not without complexity. Rapid technological change, regulatory volatility, and escalating cyber threats challenge traditional models, demanding adaptation and innovation. - **Digital Transformation and Emerging Technologies**: AI, blockchain, and advanced data analytics are reshaping audit workflows, enabling real-time insights and predictive analytics.Yet these tools require auditors to maintain technical fluency while managing algorithmic bias and data privacy risks. - **Regulatory Fragmentation Across Jurisdictions**: Multinational enterprises face divergent compliance requirements, complicating audit planning and reporting. Global harmonization efforts play a critical role, though local nuances persist.

- **Cybersecurity Threats and Data Validity**: The rise of deepfakes, data manipulation, and ransomware endangers audit evidence integrity. Assurance professionals must adopt layered security protocols and blockchain-based verification to maintain trust. - **Skills Gap and Talent Shortages**: A shortage of qualified auditors—especially those versed in ESG, cybersecurity, and advanced analytics—threatens service delivery and quality assurance.

Addressing these challenges demands proactive investment in training, technology, and collaborative frameworks between regulators, firms, and professional bodies.

The Future of Assurance: Integrating Trust Across All Operations

Looking ahead, the role of auditing and assurance services is poised to deepen, evolving from reactive verification to proactive risk stewardship. The convergence of AI-driven analytics with human judgment promises greater precision and foresight, enabling auditors to detect anomalies before they escalate.Increased emphasis on integrated reporting—where financial, environmental, and social performance are assessed together—expands assurance into holistic value creation evaluation. Moreover, regulatory trends are shifting toward real-time assurance models, supported by continuous monitoring tools and automated controls validation. This transition supports dynamic risk management, allowing organizations to respond swiftly to emerging threats.

Ultimately, auditing and assurance services are the silent guardians of financial integrity, embedding accountability and transparency into the fabric of business. As the global economy grows more interconnected and complex, their principled, adaptive evolution remains indispensable—not just for compliance, but for sustaining trust in an age of uncertainty.

In essence, these services are not merely technical exercises—they are vital enablers of credibility, resilience, and long-term value across every sector.

Organizations that embrace robust assurance frameworks position themselves not only to survive but to thrive in an era where trust is the most valuable asset.

Related Post

Unveiled: The Complicated Connection Between Guy Fieri and Donald Trump Examined

All The Small Things That Sparked Blink 182’s “All the Small Things” — The Hit Behind the Song That Defined a Generation

If Tomorrow Never Comes: The Haunting Legacy of Ronan’s Role in Cinematic Mortality

Jared Leto’s Twisted Mirror: Reimagining American Psycho for a Modern Dark Age