The Macroeconomics Definition: The Engine That Powers National Economies

The Macroeconomics Definition: The Engine That Powers National Economies

At its core, macroeconomics is the branch of economics that examines the behavior, performance, and structure of economies as a whole—not individual markets or firms. Defined by the collective analysis of aggregated variables such as national income, inflation, unemployment, and overall output, macroeconomics seeks to understand how policies, global events, and institutional frameworks shape economic growth and stability. The formal macroeconomic definition centers on the study of systemic economic phenomena: how governments and central banks influence aggregate demand, manage fiscal and monetary tools, and respond to cycles of boom and recession.

Unlike microeconomics, which focuses on individual choices and market efficiency, macroeconomics grapples with nationwide patterns—from GDP growth rates to trade balances and public debt levels.

“Macroeconomics is the compass that guides nations through economic turbulence,” affirms economist Dr. Elena Mischke of the International Institute for Economic Studies.

“It reveals how decisions at the national level ripple through labor markets, financial systems, and global markets.” This holistic view allows policymakers to anticipate economic shifts and deploy targeted interventions—balancing inflation, employment, and productivity with a keen awareness of ripple effects.

Core Phillips Curve: The Trade-Off Between Inflation and Unemployment

One of the foundational concepts in macroeconomic theory is the Phillips Curve, which historically illustrated a short-term inverse relationship between inflation and unemployment. According to this classical link, as unemployment falls, wages rise and demand increases—potentially fueling inflation.Though modern critiques have nuanced this idea—especially given stagflation in the 1970s and changing global dynamics—the Phillips Curve remains a vital analytical tool for understanding short-run economic trade-offs.

Recent studies, including work by the OECD (2023), highlight that while the relationship may weaken in the long run, policymakers still monitor labor market tightness as an early signal of inflationary pressure. When joblessness drops below the “natural rate” (estimated between 4% and 5% in many advanced economies), wage growth typically accelerates—prompting central banks to raise interest rates to maintain price stability.

Fiscal Policy and Public Investment: Stimulus, Growth, and Debt Sustainability

Fiscal policy—government spending and taxation—forms a cornerstone of macroeconomic management. Governments use expansionary fiscal policy during downturns by increasing spending on infrastructure, education, or healthcare, or cutting taxes to boost disposable income and consumer demand. Conversely, contractionary measures slow overheating by raising taxes or reducing expenditure.Effective fiscal policy requires balancing immediate economic stimulus against long-term sustainability. The World Bank (2022) notes that well-targeted public investment—such as in renewable energy or digital infrastructure—boosts long-term productivity while mitigating inequality. However, persistent deficits risk raising public debt to unsustainable levels, potentially crowding out private investment and triggering higher borrowing costs.

Monetary Policy: Central Banks and Interest Rate Levers

While fiscal policy operates through government budgets, monetary policy is the domain of central banks, which regulate the money supply and interest rates to maintain economic stability. By adjusting repo rates, reserve requirements, or engaging in quantitative easing, central banks influence borrowing costs, investment, and spending. The U.S.Federal Reserve’s aggressive rate hikes in 2022–2023 exemplify how tighten monetary policy fights inflation by cooling demand. In contrast, during the 2008 financial crisis, near-zero rates and asset purchases aimed to reignite growth. As Chairman Jerome Powell observed, “Monetary policy is the central bank’s primary tool to shape near-term economic outcomes—but it works best in sync with sound fiscal frameworks.”

The Transmission Mechanism: How Policy Impacts Everyday Economies

The transmission mechanism describes how central bank decisions and government actions trickle down to households and firms.A rise in policy rates, for instance, increases mortgage payments and loan servicing costs, dampening consumption and housing investment. Simultaneously, lower public spending reduces government contracts, affecting suppliers and construction workers. Conversely, fiscal stimulus injects liquidity: a $1,000 infrastructure check boosts consumer confidence, drives retail sales, and supports employment in downstream sectors.

However, lag times complicate timing—alternative concepts like “real-time macroeconomic monitoring” aim to shorten the lag between policy enactment and economic response.

Global Interdependence: Cross-Borders in Macroeconomic Equilibrium

In an era of integrated supply chains and mobile capital, macroeconomic outcomes are increasingly shaped by global forces. Exchange rate fluctuations, trade flows, and foreign investment flows bind national economies.A surge in Chinese demand, for example, lifts export volumes in Southeast Asia and Latin America, while U.S. interest rate hikes often trigger capital outflows from emerging markets. The International Monetary Fund (2023 Global Financial Stability Report) stresses that “without international coordination, isolationist policies risk destabilizing growth and creating volatile spillovers.” Challenges like currency manipulation, debt distress in low-income nations, and synchronized recessions underscore the need for collaborative macroeconomic governance.

Macroeconomic Indicators: Measuring National Performance

Gross Domestic Product (GDP) remains the flagship metric, measuring total output. But experts emphasize complementary indicators: unemployment rate, inflation (CPI), consumer confidence, and the trade balance. The Conference Board’s widely cited confidence index offers leading signals of economic sentiment, while producer prices reveal inflationary pressures before they reach consumers.Policy makers also track structural metrics—labor force participation, productivity growth, and government debt-to-GDP ratios—to assess long-term health. Negative interest rates in Japan and Europe, for example, reflect deep struggles with deflation despite robust GDP figures, highlighting the limits of output-based assessments without deeper analysis.

The Limits of Predictability in Macroeconomic Forecasting

Even with robust models, forecasting macroeconomic trends remains challenging.Models rely on historical data and behavioral assumptions that shift rapidly—geopolitical shocks, technological disruption, and behavioral changes (like post-pandemic remote work) challenge predictive accuracy. The OECD warns, “Macroeconomic models must evolve beyond static equations to incorporate real-time data, AI-driven analytics, and behavioral economics.” Adaptive frameworks, stress testing, and scenario analysis now form integral parts of central bank toolkit, improving resilience against unexpected shocks.

The Macroeconomic Mandate: Stability, Growth, and Inclusion

At its essence, macroeconomics embodies a dual mandate: fostering sustained economic growth while ensuring broad-based stability and inclusion.This balancing act demands coordination across fiscal and monetary domains, sharp policy foresight, and responsiveness to evolving social and environmental challenges. As global uncertainties mount—from climate change to digital transformation—macroeconomic principles grow ever more vital. They equip nations not just to react, but to anticipate, adapt, and build economies resilient enough to deliver prosperity across generations.

In essence, macroeconomics is not merely an academic discipline—it is the living architecture of national economic health. Through its precise definitions, tools, and policy frameworks, it empowers decision-makers to shape economies capable of rising to complex, interconnected challenges. The definition endures: macroeconomics is the science of national economies in motion.

Related Post

What Is Macroeconomics? The Core Definition and Essential Concepts Shaping Global Economies

Revolutionizing Digital Journalism: How WWW Innewstodaynet Is Redefining News Delivery in the Modern Age

The Next Big Shift After Erome Register 8 Has Just Begun – What to Watch as a New Era of Digital Intimacy Unfolds

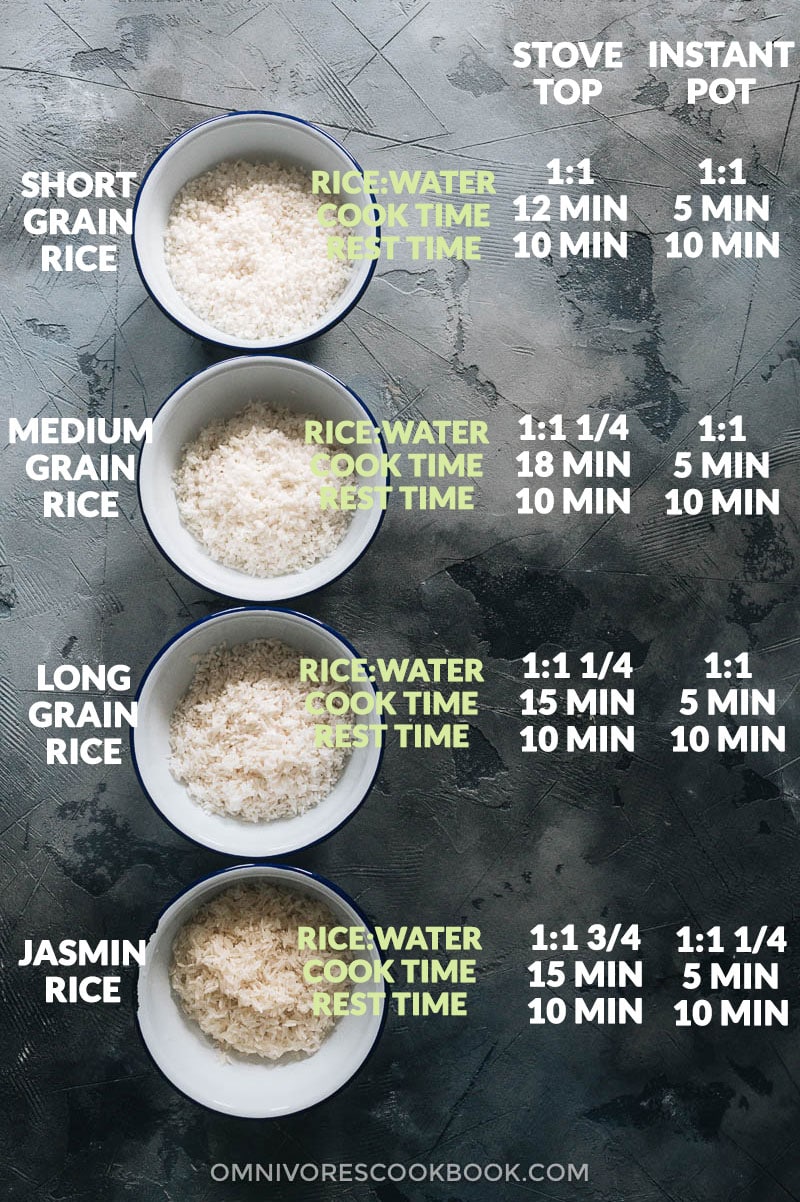

Mastering Perfect Rice: The Essential Guide to Rice to Water Ratio in Electric Rice Cookers