The Invisible Engine of Borrowing: Decoding Loanable Funds Through Market Graphs

The Invisible Engine of Borrowing: Decoding Loanable Funds Through Market Graphs

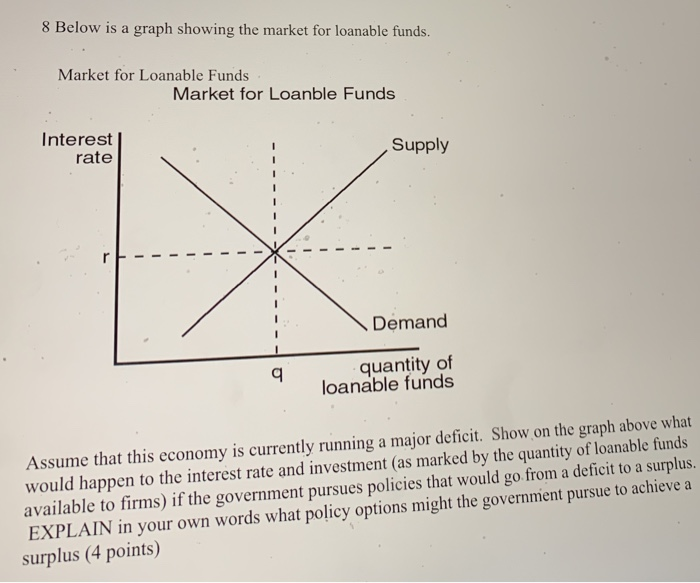

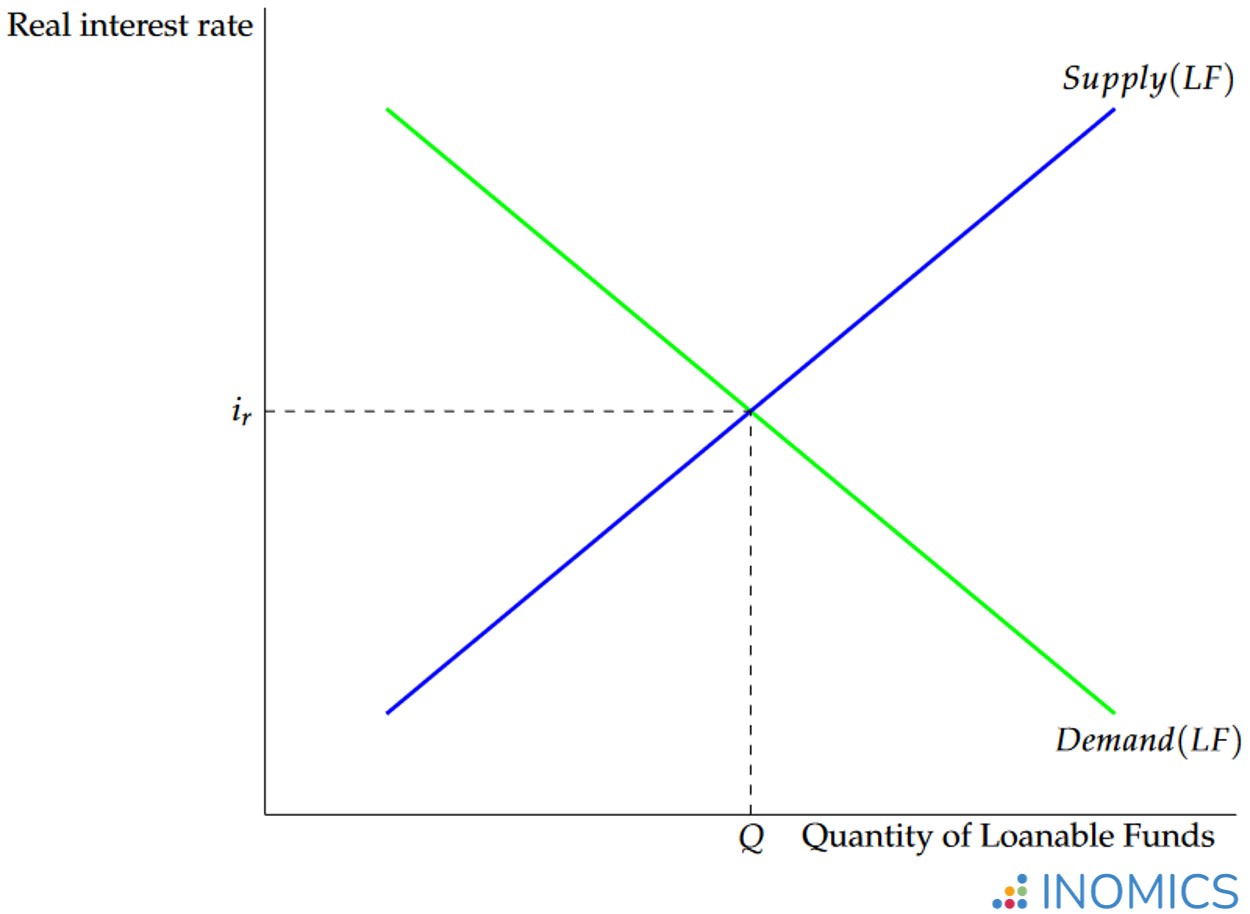

When millions of savers deposit idle cash and businesses seek capital, a silent economic machine drives the flow of loans—this is not magic, but the market for loanable funds, graphically illustrated by a foundational economic model. At its core lies the market for loanable funds, where total savings (supply of funds) interacts with total investment demand (demand for borrowing), determining interest rates through price—interest—like a balanced marketplace. The Market For Loanable Funds Graph reveals this dynamic with striking clarity, enabling economists, policymakers, and investors to visualize how shifting savings and investment reshape economic activity.

Understanding this graph is not just academic; it’s critical for grasping how interest rates are set and how financial markets influence growth, inflation, and policy outcomes.

The Mechanics Behind the Market for Loanable Funds

The market for loanable funds operates on a simple premise: where do borrowers seek money, and where do savers place it? Supply is driven primarily by households and firms depositing funds in banks and financial institutions, while demand emerges from businesses seeking capital to fund plant expansions, infrastructure projects, or innovation.These two forces collide at a price—namely, the interest rate—where quantity demanded equals quantity supplied. The Market For Loanable Funds Graph captures this intersection in two axes: the vertical axis measures total loanable funds at different interest rates, rising steeply as lenders become more willing to part with their savings at higher returns. The horizontal axis reflects the total volume of borrowing, increasing as firms pursue expansion and households finance homes or education.

Interest rates settle where these curves cross, setting the equilibrium rate that balances saving and investment desires. This graphical representation transforms abstract economic theory into a tangible, measurable framework. Economists use it to project how tax policy, demographic shifts, or global capital flows impact interest rates and economic output.

Supply: Where Do Savings Come From?

The supply curve of loanable funds illustrates how much capital becomes available for lending at various interest rates. Key contributors include household savings—often from income above consumption—and institutional deposits held by banks and credit unions. Over time, national saving rates reflect the portion of GDP not consumed but stored—government surpluses, corporate retained earnings, and foreign capital inflows.Notably, a rising national saving rate steepens the supply curve: more funds are poised to finance investment without additional saving pressure. For example, countries with high household savings, such as Germany or South Korea, often feature deep financial markets where robust saving feeds directly into available loans. “Savings are not just numbers on a balance sheet—they’re the silent engine powering future investment,”* says economist Dr.

Lisa Chen, specializing in monetary policy at the International Monetary Fund. *“The loanable funds graph makes this relationship visible and actionable.”* Demographic trends, retirement savings policies, and government budget discipline all shape the upward slope of this curve in meaningful ways.

Demand: The Engine of Investment

Demand for loanable funds originates from businesses seeking capital for productive purposes: manufacturing, technology deployment, construction, and research and development.Firms evaluate investment opportunity through the lens of expected return relative to interest costs—this determines how much borrowing they are willing to take at each rate. The demand curve slopes upward because higher interest rates increase borrowing costs, discouraging potentially profitable but marginally profitable projects. Conversely, in low-rate environments, even modest returns can justify investment, expanding demand sharply.

Businesses respond not just to nominal rates but to real rates—adjusted for inflation—making the Market For Loanable Funds Graph essential for forecasting investment under varied macroeconomic conditions. For instance, during the post-2008 low-rate era, historically cheap credit spurred corporate bond issuance and private equity activity, reshaping investment patterns globally. Interest Rate Equilibrium: The Balancing Point The intersection of supply and demand curves identifies the equilibrium interest rate, the market-clearing price at which loanable funds flow freely from savers to borrowers.

At this rate, every dollar of available savings funds exactly one dollar of investment demand—no excess supply stagnates the market, no shortage drains investment. Yet equilibrium is

Related Post

Rick Ness Gold Rush Bio Wiki Age Crew Neck Tattoo and Net Worth

Dallas Renters Association: The Essential Guide to Secure, Affordable Living in the Lone Star City

Hamilton County Booking Mugshots: The Face Behind Justice in Steel

Bus Simulator Indonesia: Unlock Easy Money Hacks That Turn Commute Time Into Cash