The Geometric Average: The Powerful Metric That Transforms Growing Systems

The Geometric Average: The Powerful Metric That Transforms Growing Systems

In finance, technology, ecology, and investment strategy, the geometric average emerges not as a routine calculation, but as a critical lens through which growth dynamics reveal their true trajectory. Unlike the arithmetic average, which assumes linearity, the geometric average respects the compounding forces inherent in exponential growth—making it indispensable for analyzing investment returns, population trends, and product performance. By factoring in volatility and growth rate consistency, it delivers a more accurate, realistic measure of long-term success.

Why the Geometric Average Matters Beyond Simple Numbers

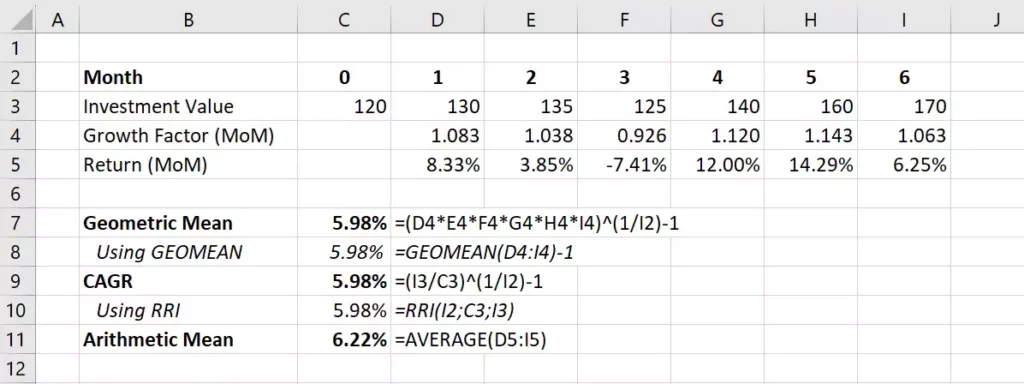

When growth is sequential—such as annual returns on an investment or year-over-year expansion of a startup—the geometric average provides clarity where arithmetic averages falter.

It effectively computes the constant rate of growth that would produce the final value from the initial over a given period, accounting for compounding’s compounding effect. For investors, analysts, and policymakers, this metric is not just mathematical rigor—it’s decision-making precision.

Consider a two-year investment: instead of averaging crude returns, the geometric average isolates the true compound annual growth rate (CAGR). If returns were 10% and 90% over two years, the arithmetic average is 50%, but the geometric average—calculated as √(1.10 × 1.90) ≈ 42.5%—reveals that the actual long-term performance was significantly lower due to volatility.

This distinction underscores why industry leaders insist on geometric averages when evaluating performance.

Mathematical Foundation: The Formula That Captures Compounding

Defined formally, the geometric average of n positive data points \( x_1, x_2, \dots, x_n \) is given by: \[ \text{GA} = \left( x_1 \times x_2 \times \cdots \times x_n \right)^{1/n} \] This formula multiplies all values and takes the nth root, emphasizing the multiplicative rather than additive nature of growth. It reflects how early underperformance or late surprises disproportionately shape outcomes—a nuance invisible to arithmetic averaging. For sequential data linked by multiplication, such as revenue in consecutive years or whale population trajectories, this measure offers a mathematically sound compass.

Applications Across Industries: From Finance to Ecology

The geometric average is not confined to a single domain—it is a cross-disciplinary imperative.

Below are key applications where its precision reshapes strategy and insight:

- Finance and Investment Analysis: Portfolio managers rely on geometric returns to assess real-world performance. Unlike arithmetic averages, which overstate long-term gains, the geometric average faithfully reflects the impact of volatility. For example, a fund delivering 20% in one year, -10% the next, produces a geometric return of √(1.20 × 0.90) ≈ 30.4% compounded over two years—far less than the often misleading 50% arithmetic average.

- Long-Term Growth Modeling: Demographers use geometric averages to project population growth, capturing compounding fertility rates and migration flows.

This methodology avoids the inflation of rapid early growth obscuring deceleration or reversal.

- Marketing and Product Lifecycle: Companies track user acquisition or revenue growth with geometric averages to identify sustainable scaling patterns. A product that doubles sales in year one but drops 40% in year two illuminates hidden risks invisible to simple averages.

- Biology and Environmental Science: Researchers apply the geometric mean when analyzing species population trends, where growth rates compound across generations. It ensures ecological forecasts honor the realities of exponential expansion and decline.

How Geometric Averages Prevent Misleading Interpretations

Perhaps the most compelling argument for the geometric average lies in its role as a corrective against common cognitive biases.

The arithmetic average tends to exaggerate growth by treating each year’s return as fungible, ignoring stacking effects. This leads to flawed expectations—think of investors chasing “25% returns” while the true long-term trend environmentalizes far weaker. By anchoring to compounding, the geometric average forces analysts to confront reality: growth compounds, setbacks endure, and consistency prevails.

Consider this real-world example: suppose a startup’s quarterly revenue grows year-over-year by 25%, 15%, -20%, and 30%.

Arithmetic averaging yields 17.5%, suggesting steady momentum. Yet the geometric average—calculated as √[1.25 × 1.15 × 0.80 × 1.30]^(1/4) ≈ 21.3%—reveals a more resilient base, though with critical volatility. This insight guides strategic resource allocation far more effectively than oversimplified metrics.

Practical Execution: Implementing the Geometric Average in Real-World Analysis

Using the geometric average requires care—especially with zero or negative values, which invalidate the nth root.

Best practices include:

1. Ensure all data points are strictly positive; negative values or zeros require alternative metrics like arithmetic averages or log-transformed analysis.

2. Use accurate, timestamped data—precision in input drives reliability in output, particularly in fast-moving markets.

3. Leverage software tools: Excel’s `GPS` function, Python’s `math.goldenen_ratio` (custom implementation), or R packages automate calculations, minimizing human error in complex datasets.

4. Pair geometric returns with benchmarks—comparing to market averages or industry standards contextualizes performance across time and competitive landscapes.

The Unseen Pulse of Sustainable Growth

The geometric average is more than a statistical tool—it’s a philosophy of measured growth. In a world obsessed with rapid gains and viral success, it reminds us that compounding rewards patience, consistency, and realism. Whether assessing financial portfolios, tracking ecological shifts, or scaling businesses, professionals who master this metric harness a deeper understanding of performance, avoiding the pitfalls of overestimation and fantasy.

As data becomes ever more central to decision-making, the geometric average stands not as a minor detail, but as a cornerstone of intelligent, forward-looking analysis.

In sum, the geometric average transcends mere calculation: it’s an analytical lens that reveals the true trajectory of growth, grounded in the physics of compounding and the rigor of mathematics. Its power lies not in sophistication, but in simplicity—offering clarity where complexity obscures, and insight where averages mislead.

Related Post

Powering Smart Decisions: The Geometric Average Formula in Data Analysis

Unlocking Snow Rider Github Io: Revolutionizing Autonomous Navigation with Open-Source Innovation

Vergilius: The Poet Who Forged Rome’s Eternal Soul

Unveiling Caitlyn Clark's Transgender Journey: Discoveries And Insights from a Trailblazing Athlete