Streamline Your Payments: Smart, Simple Ways to Pay Your Lowes Credit Card Bill

Streamline Your Payments: Smart, Simple Ways to Pay Your Lowes Credit Card Bill

Managing credit card payments, especially for a major retailer like Lowes, doesn’t have to be a cumbersome chore. With rising consumer demand for convenience, FinTech innovations and smart financial tools now make settling your Lowes credit card bill faster, secure, and stress-free than ever. Whether through mobile apps, automated billing, or direct payment integrations, multiple effective methods exist to ensure on-time payments and maintain a healthy financial workflow.

Paying your Lowes credit card bill efficiently begins with understanding the ecosystem of available options—tailored for busy homeowners who value time and control. Beyond the standard minimum due due by monthly deadlines, modern payment solutions eliminate guesswork and reduce late fees. The key is to choose a method that aligns with your preferences, security needs, and financial habits.

Mastering Mobile and Digital Payments: The Fastest Path to Payment Efficiency

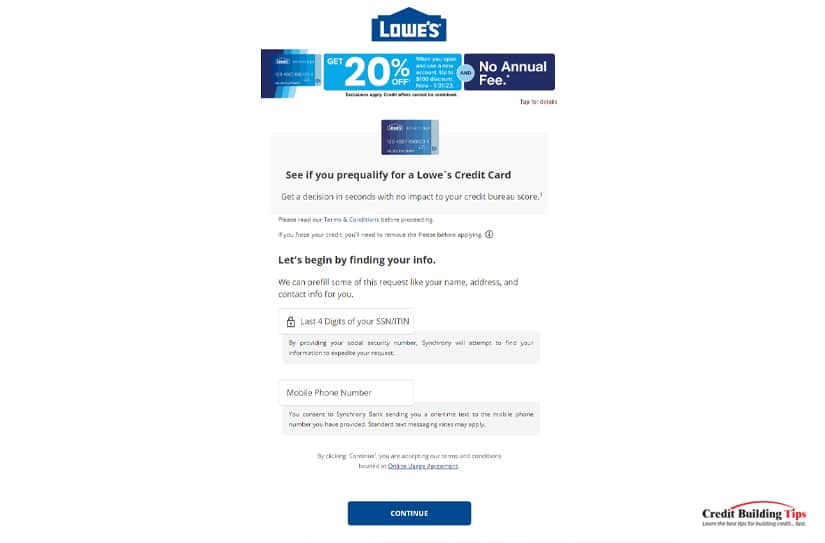

Lowes supports seamless digital transactions through its user-friendly website and smartphone app, allowing cardholders to settle balances with just a few clicks.By linking your Lowes credit card directly within the app—after completing a secure verification—payments are processed instantly, often in real time. The system cross-references account details instantly, minimizing errors and ensuring accuracy. The app’s interface prioritizes simplicity: users select “Pay Bill,” confirm their card, enter payment amount, and confirm.

With push notifications reminding you of upcoming due dates, late fees become a thing of the past. This digital-first approach is ideal for those juggling home improvement projects and tight schedules—every interaction is designed to save time without sacrificing security.

Security remains paramount: Lowes employs industry-standard encryption and multi-factor authentication to protect your financial data.

Because convenience must never come at the expense of safety, digital payments were engineered with robust fraud detection algorithms. If a transaction appears suspicious, alerts are triggered instantly, ensuring your account remains protected.

Leverage Recurring Payments for Hassle-Free Budgeting

For homeowners committed to timely Credit Card payments, setting up automatic monthly payments is a game changer. Through Lowes’ portal or mobile banking integrations, users can configure auto-pay for their credit card bill—ensuring payments clear on schedule without manual intervention.This prevents missed deadlines, accumulating late charges, and potential impacts on your credit score. Automatic payments offer several tangible benefits:

- **Consistency:** No more forgetfulness—payments execute automatically each billing cycle.

- **Predictability:** Fixed dates allow tighter financial planning, especially for recurring home renovation expenses.

- **Fee savings:** Eliminate costly late fees and interest buildup from delayed payments.

While auto-pay requires upfront setup, the long-term reliability and financial discipline it delivers make it indispensable for steady, stress-free management of credit obligations.Upload Payment Documents or Schedule Payments via Third-Party Platforms

For those preferring manual processing or managing multiple accounts across retailers, Lowes offers flexible alternatives.Users can generate official payment authorizations—aviable through the credit card account dashboard—and submit them via physical mail or electronic upload. These documents authorize payment without requiring app access, catering to tech-averse or privacy-conscious customers. Additionally, Many financial institutions integrate with platforms like Apple Pay, PayPal, or Venmo, enabling third-party payment routing directly through your Lowes billing portal.

Linking your credit card through verified fintech partners expands payment flexibility, letting you draw from preferred digital wallets while retaining full control. This interoperability transforms payment options from limited to limitless.

Homeowners who incorporate such third-party integrations gain dual advantages: enhanced convenience and diversified transaction security.

Whether via digital wallets, payment aggregators

Related Post

Decoding PBU in Football: Meaning, Real-World Examples, and Game-Changing Impact

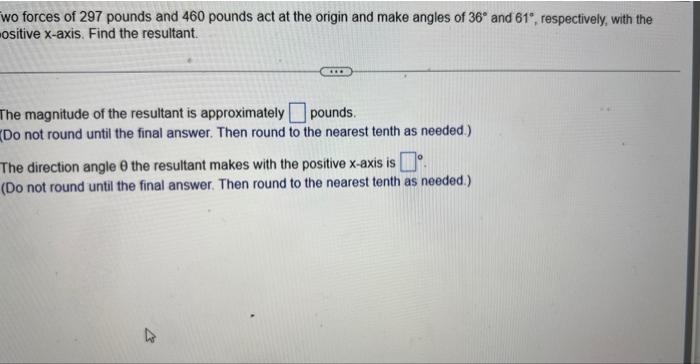

Kevin Hart’s Transformation: From “Weight of the World” to a Bold Reinvention at 297 Pounds

Grow A Collection Codes: The Unconventional Path to Financial Freedom and Enduring Happiness

Lawrencia Palmer: Architect of a Forgotten Civil Rights Era