Stock Definition: A Simple Guide to Understanding Stocks and Their Role in Modern Finance

Stock Definition: A Simple Guide to Understanding Stocks and Their Role in Modern Finance

Stocks represent ownership in a company—and in today’s dynamic financial landscape, they serve as a cornerstone of investment portfolios, wealth building, and market participation. Understanding what stocks are, how they function, and why they matter is essential for anyone seeking financial independence or long-term growth. Far from being just pieces of paper or abstract numbers, stocks are tangible shares that grant holders partial claim over a company’s assets, earnings, and future potential.

At its core, a stock is a financial instrument that signifies proportional ownership in a privately or publicly traded corporation. When individuals or institutions purchase stocks, they buy a slice of that business—lingering as shareholders amid corporate decisions, dividend payouts, and market fluctuations. “Stocks provide real economic exposure,” notes financial analyst Sarah Chen.

“They’re not just numbers; they represent stakes in companies driving innovation, growth, and employment.” The mechanics of ownership through stocks are straightforward: each share issuance is recorded in a company’s capital structure. Early investors absorb initial risk, often acquiring shares during launch stages, while later-round investors participate as enterprise scales. Investors track ownership via share price movements, dividends, voting rights, and capital gains—all reflecting a company’s performance and broader economic conditions.

The Different Types of Stocks

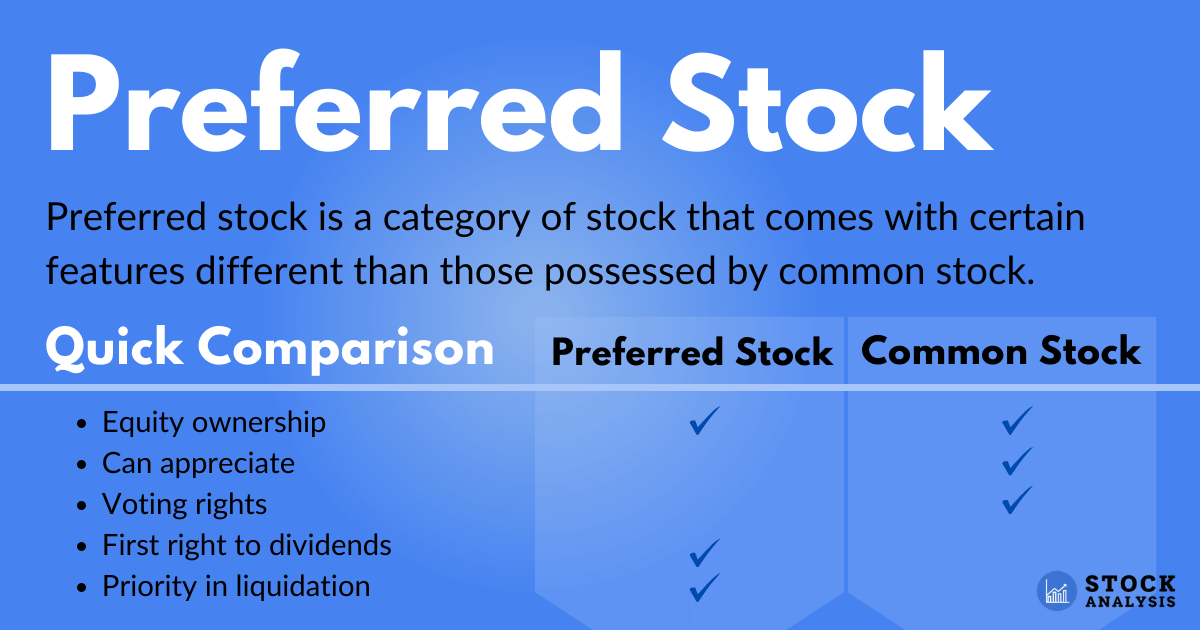

Not all stocks are created equal. Investors encounter several variations, each with unique characteristics and risk-return profiles: - **Common Stock:** The most prevalent form, granting shareholders voting rights and eligibility for dividends (though not guaranteed). Holders may benefit from appreciation and corporate governance influence.- **Preferred Stock:** Offers fixed dividends and priority in asset distribution during liquidation, but limited or no voting power. Ideal for income-focused investors seeking stability. - **Growth Stocks:** Represented by companies prioritizing reinvestment over dividends, featuring volatile but high appreciation potential.

- **Value Stocks:** Traded below their intrinsic or book value, viewed as undervalued by analysts—often stable with dividend yields. - **Index Stocks:** Track major benchmarks like the S&P 500, offering diversified exposure with low transaction costs. Diversification across these types allows investors to balance risk and return, adapting strategies to market cycles and personal financial goals.

How Stock Prices Move: Market Forces and Valuation Drivers

Stock prices are determined by the interplay of supply and demand in global markets. “Prices reflect all publicly available information—earnings reports, interest rates, geopolitical events, and investor sentiment,” explains economist Jamesを作業. “A company’s news, sector trends, or macroeconomic shifts directly influence its market value.” Key factors shaping stock performance include: - **Corporate Earnings:** Quarterly results reveal profitability and growth; strong income fuels share price appreciation.- **Dividends:** Regular payouts signal financial health and attract steady-income investors. - **Market Sentiment:** Psychological trends, media coverage, and behavioral finance dynamics can trigger rapid price swings. - **Macroeconomic Conditions:** Interest rates, inflation, and economic growth impact investor risk appetite.

- **Sector Performance:** Cyclical industries like tech and energy respond strongly to economic cycles and technological change. Dividends themselves serve as both income and valuation signals—sustained payouts often reflect stable cash flow, while cuts may trigger sell-offs and margin calls.

Investing in Stocks: Strategies and Risk Management

Success in stock investing hinges on informed decision-making and disciplined risk management.Three foundational strategies guide investors: - **Long-Term Buy and Hold:** Foundational to wealth accumulation, this approach capitalizes on market growth and compound returns while minimizing transaction costs and short-term volatility. - **Dividend Investing:** Focuses on established companies with consistent payouts, generating passive income alongside capital preservation. - **Growth Investing:** Targets emerging firms with high revenue or earnings expansion, accepting price volatility for outsized returns.

Risk mitigation is equally vital: - Diversification across sectors and geographies reduces single-company exposure. - Setting stop-loss orders limits downside. - Regular portfolio reviews adapt to evolving market dynamics and personal goals.

- Maintaining emergency cash reserves prevents forced selling during downturns. As financier Warren Buffett famously advised, “Stock markets are designed to transfer money from the impulsive to the patient”—a principle that remains central for disciplined investors.

Why Stocks Matter in the Global Economy

Beyond personal portfolios, stocks fuel economic expansion by enabling firms to raise capital for innovation, expansion, and job creation.Publicly traded companies fund research, infrastructure, and entrepreneurship—driving productivity and global competitiveness. For individuals, stocks offer a pathway to financial autonomy: “Equity ownership equates to ownership stake in the future,” notes financial literacy expert Lisa Thompson. “It’s not just wealth—it’s participation in enterprise and progress.” Stocks also serve as barometers of economic confidence.

Rising indices signal investor optimism; declining markets often reflect uncertainty. Yet volatility underscores the importance of realistic expectations and long-term focus.

Getting Started: From Research to Execution

Embarking on stock investment requires preparation.Begin with foundational research: examine company fundamentals via balance sheets, income statements, and management oversight. Tools like financial ratios (P/E, EPS, ROE) quantify performance relative to peers and historical norms. Choose a regulated brokerage with low fees and robust research resources—platforms range from interactive networks to AI-driven advisory tools.

Platforms like Vanguard, Fidelity, and interactive Brokers attract both beginners and pros. Start small. Experienced investors stress consistency over timing.

Dollar-cost averaging—investing fixed amounts regularly—reduces market entry risk and smooths portfolio growth. Conclusion Understanding stocks is not merely about numbers or market noise—it’s about engaging with the engines of the global economy. From defining ownership and navigating price dynamics to implementing smart strategies and managing risk, stocks offer a structured, powerful means to build wealth and shape financial futures.

With informed entry, disciplined execution, and patience, anyone can harness the power of stocks—not just as investments, but as instruments of empowerment.

Related Post

97.5 Kg in Pounds: The Critical Weight That Reshapes Health, Performance, and Daily Life

John Bolz: A Remarkable Life Defined by Service, Resilience, and Quiet Influence

Osmosis Unlocked: How Nature’s Quiet Membrane Mechanism Powers Life, Medicine, and Industry

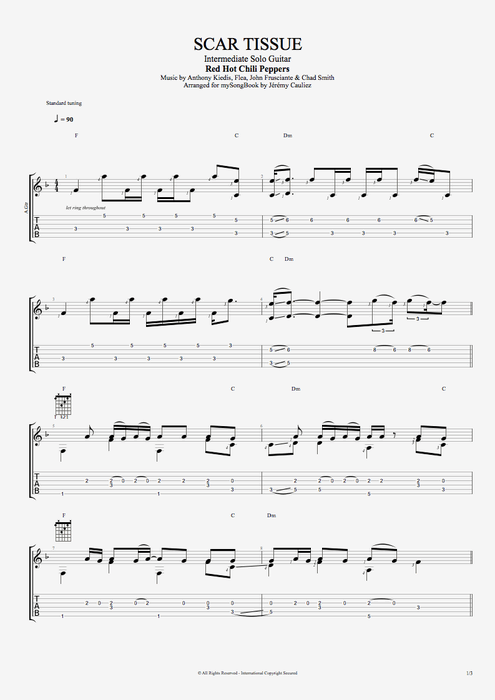

Red Hot Chili Peppers’ “Scar Tissue”: A Raw Sonic Gauge of Pain, Power, and Countercultural Fire