State Farm Login Access Your Account Securely — Protect, Access, and Trust

State Farm Login Access Your Account Securely — Protect, Access, and Trust

In an era where digital security determines personal and financial safety, securing access to your State Farm account is not just a convenience—it’s a necessity. With millions of customers relying on State Farm for insurance, auto, home, and financial protection, maintaining a secure login process ensures uninterrupted access to critical services while safeguarding sensitive personal data. State Farm’s approach to account access combines user-friendly design with robust security measures, empowering members to stay protected, informed, and in control—every click, every login a step toward peace of mind.

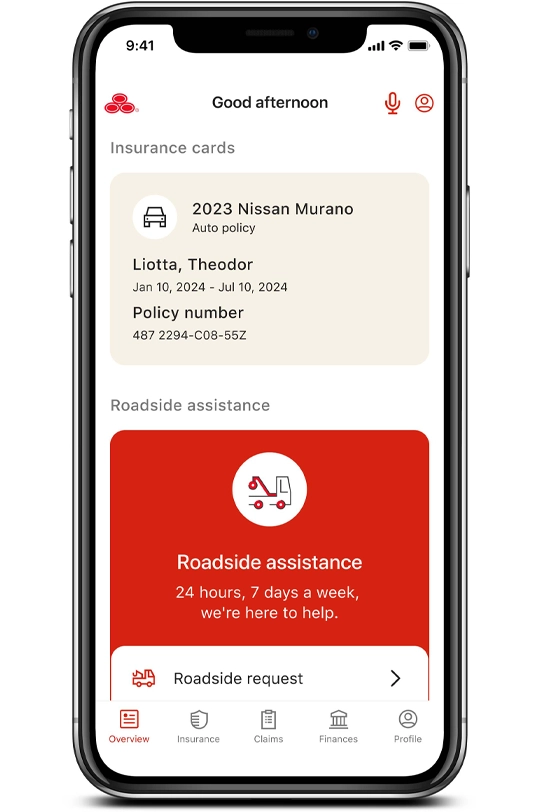

Accessing your State Farm account securely begins with understanding the core principles of digital identity protection. At its heart, secure login is about balancing accessibility and defense against cyber threats. For State Farm customers, that means using trusted tools like their official mobile app, website, or secure portals—all engineered to shield account information through advanced encryption and authentication protocols.

To begin securely, State Farm requires customers to authenticate through verified channels. Typically, this involves entering a unique login ID paired with a strong password—chosen to meet industry-grade complexity standards. Beyond basic credentials, the platform continuously enhances security with features such as multi-factor authentication (MFA), which adds a critical second layer of protection.

As former customer service representative Laura Chen notes, “MFA isn’t just an extra step—it’s a proven shield. Most logins that later raise suspicion simulate a breach, and MFA catches those threats before they grow.” State Farm’s login interface is intentionally streamlined to minimize risk while maximizing usability. The mobile app, available on iOS and Android, features biometric authentication options—including fingerprint and facial recognition—allowing fast, secure access without memorizing complex passphrases.

On desktop, the login page uses end-to-end encryption and secure HTTPS protocols to prevent data interception, even during transmission. Every transaction and access attempt passes through real-time fraud detection systems designed to flag unusual activity instantly.

The Multi-Layered Security Framework of State Farm Account Access

State Farm’s secure login ecosystem rests on three foundational pillars: authentication, encryption, and continuous monitoring.**Authentication: More Than Just a Password** The first line of defense is identity verification. State Farm mandates strong credentials—minimum eight characters, combining letters, numbers, and symbols—but encourages customers to adopt passphrases for added resilience. Multi-factor authentication elevates this security: after entering the password, users receive a one-time code via SMS, app notification, or biometric input.

This dual-layer approach dramatically reduces unauthorized access risks, especially in light of rising account takeover attempts across industries. **Encryption: Guarding Data in Transit and at Rest** Data protection begins the moment a user opens the State Farm app or accesses the website. All communications layer encryption—using industry-standard TLS 1.3 protocols—to prevent eavesdropping during login sessions.

Even data stored in State Farm’s servers is encrypted at rest, meaning personal details like policy numbers, claim histories, and payment information remain inaccessible to unauthorized parties. State Farm explicitly states, “We treat your data as inviolable—security isn’t an afterthought, it’s embedded in every line of code.” **Real-Time Risk Monitoring** Beyond login verification, State Farm employs intelligent analytics to detect suspicious behavior. If a login attempt originates from an unfamiliar device or location—say, a login spanning two time zones within an hour—triggered alerts are issued immediately.

Customers receive instant notifications, enabling prompt action if their account has been compromised. This proactive monitoring reflects State Farm’s commitment to evolving alongside emerging threats. Practical Steps for Secure Account Management Expanding on technical safeguards, practical habits reinforce login security among State Farm members: - **Strong Password Practices**: Create complex, unique passwords for each account.

Avoid reusing passwords across platforms—use a reputable password manager to track them securely. - **Enable Two-Factor Authentication (2FA)**: State Farm provides easy setup in both app and web settings. This simple step cuts unauthorized access risks by up to 99%, according to cybersecurity experts.

- **Avoid Public Wi-Fi for Login**: Public networks lack sufficient encryption. If using such connections, always confirm secured, password-protected Wi-Fi, and consider a virtual private network (VPN) for added layers of defense. - **Monitor Account Activity Regularly**: Log in weekly to review recent transactions and access logs.

State Farm’s mobile app lets users track activity easily, flagging any anomalies immediately. - **Respond Swiftly to Alerts**: Enable push notifications and configure security settings to receive real-time updates about login attempts, fostering swift response to potential breaches. The Role of the State Farm Mobile Application in Secure Access The State Farm mobile app stands out as a cornerstone of secure, modern account access.

Designed with privacy in mind, it integrates advanced security features seamlessly into daily use. Biometric login options, such as Face ID and Touch ID, deliver both convenience and stronger authentication than static passwords alone. The app also stores sensitive data locally using device encryption, meaning personal information never transmits across unsecured networks without explicit consent.

Behind the scenes, the app uses secure session management, automatically logging users out after periods of inactivity and encrypting cached data to prevent physical device compromises from exposing accounts. When State Farm updates its platform—whether to patch vulnerabilities or improve performance—users benefit from transparent communication and rapid deployment of enhanced security measures. Industry Recognition and Customer Trust State Farm’s approach to secure login access doesn’t rely solely on internal development.

The company actively pursues certifications from leading security organizations, reinforcing its credibility. Its adherence to standards such as PCI DSS for payment security, GDPR-compliant data handling, and ongoing engagement with cybersecurity audits signals a commitment to transparency and excellence. Customer feedback consistently reflects assurance in security performance.

“It’s rare to find a service that balances ease of use with rigorous protection,” notes one user from Austin, Texas. “Logging in feels quick, but I know my data’s protected by top-tier encryption and vigilant monitoring.” Navigating Identity Verification and Account Recovery Should a login issue arise—whether forgotten credentials or suspicious activity—State Farm provides clear, secure pathways for verification and recovery. The official login portal includes identity-verified recovery options, including SAFT codes sent via SMS or authenticator apps, preventing impersonation.

Unlike many services, State Farm’s process avoids unnecessary data scraping, prioritizing privacy during verification. For members facing unauthorized access, State Farm guides users through immediate steps: freezing accounts, resetting passwords through trusted channels, and enabling enhanced monitoring to detect post-recovery threats. This structured support underscores the company’s dedication to customer empowerment.

Looking Ahead: The Future of Secure Access at State Farm As cyber threats grow more sophisticated, State Farm continues investing in innovation to strengthen login security. Emerging technologies—such as behavioral analytics that detect subtle deviations in user habits and machine learning models predicting phishing risks—are increasingly integrated. These tools go beyond static passwords, adapting dynamically to protect accounts in real time.

State Farm also emphasizes ongoing education, helping members understand risks and best practices through in-app tips, email alerts, and dedicated cybersecurity resources. This holistic strategy—combining cutting-edge technology with continuous user engagement—positions the company not just as an insurer, but as a trusted guardian of digital well-being. In a digital landscape where identity is increasingly under siege, securing access to your State Farm account represents far more than a routine login.

It is a commitment to resilience, responsibility, and relentless protection. Through layered authentication, robust encryption, and vigilant monitoring, State Farm ensures members can trust their personal data—and their peace of mind—every time they log in, seamlessly and securely. Familiarizing yourself with the State Farm login process and embracing its full suite of security features transforms account access from a daily task into a strong defense against cyber risks.

It’s not just about logging on—it’s about logging on confidently.

Related Post

Rbxassetid Converter: Unlocking Value from Digital Assets with Precision and Speed

Mastering Unit Test Answers in Common Core Geometry A: The Key to Student Mastery

From Couch to Clutch: How Stephen Smith’s Weed Gif Moment Defined a Generational Shift in Sports Commentary