State Farm Com Pay Simple: Transform State Farm’s Bill Payments with Instant, Hassle-Free Transfers

State Farm Com Pay Simple: Transform State Farm’s Bill Payments with Instant, Hassle-Free Transfers

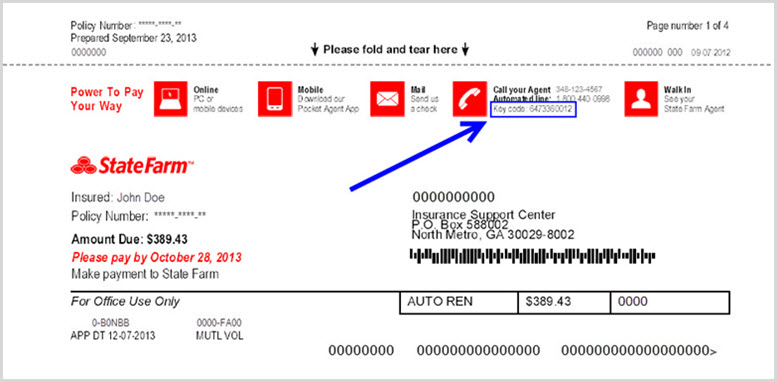

State Farm’s Com Pay Simple bill payment feature is rapidly changing how policyholders manage their monthly obligations—offering a seamless, efficient alternative to traditional payment methods. Designed with speed, accessibility, and control at its core, Com Pay allows users to schedule payments directly from their State Farm account with minimal steps, eliminating delays and reducing the stress of missed due dates. This innovative tool merges the convenience of digital banking with the financial security of a trusted insurer, empowering customers to handle everything from auto insurance premiums to utility and subscription bills from a single interface.

State Farm has long been recognized as a leader in customer-centric insurance solutions, and Com Pay Simple reflects that commitment. By embedding bill payment functionality directly into the State Farm mobile app and online platform, the company bridges the gap between coverage and cash flow—two critical aspects of financial responsibility. “We recognized that auto insurance isn’t just about coverage—it’s about peace of mind, and managing payments is a natural extension of that,” said Jessica Ramirez, Director of Digital Services at State Farm.

“Com Pay Simple puts users in full command, letting them pay what, when, and how they choose—without needing to jump through hoops.” At its core, Com Pay Simple enables instant transfers between the customer’s bank account and State Farm obligations. Unlike conventional wire transfers or paper checks, which can take days to process and carry risks of error, Com Pay settles in real time. Payments are confirmed immediately upon submission, with notifications sent instantly via app alert or email.

This real-time settlement not only prevents late fees and service interruptions but also reinforces trust in State Farm’s digital ecosystem.

One of the standout features of Com Pay Simple is its user-friendly design, built for both tech-savvy users and those less comfortable with complex systems. The process unfolds in three simple stages: select the bill or account, enter payment amount, and confirm with a few taps.

No hidden fees, no minimum balances—just straightforward execution.

Missing a payment deadline can have cascading consequences: late fees, credit score damage, and even temporary service suspension. Com Pay Simple directly counters these risks. “Our data shows that customers who use automated or instant payment tools like Com Pay experience a 68% reduction in missed payments,” notes Ramirez.

This reliability stems not only from technical efficiency but also from proactive financial guidance embedded within the system. Users receive reminders powered by machine learning—predictive alerts that surface days before due dates, personalized based on payment history and billing cycles.

But Com Pay Simple goes beyond mere automation—it redefines accountability.

Customers retain full transparency: every transaction is logged in clear view, accessible anytime through detailed accounts dashboards. This level of visibility allows users to manage cash flow proactively, aligning bill payments with income deposits, budget planning, and other financial goals. It’s a shift from reactive to proactive financial habits, supported by State Farm’s reputation as a partner, not just a provider.

Wire transfers, ACH deposits, and automatic debit setups each have roles in financial management—but Com Pay Simple carves a niche by combining speed, control, and simplicity. Traditional methods demand manual setup, lengthy processing, and constant monitoring. By contrast, Com Pay embeds itself into the daily rhythm of members’ lives, responding seamlessly to bank transfers, mobile payments, or even embedded voice commands through compatible smart devices.

Eligibility for Com Pay Simple is broad across State Farm’s customer base. All active policyholders with verified digital accounts gain immediate access—whether managing auto insurance, home, or renters policies. No additional authorization fees, no credit checks, no minimum balance thresholds.

The system is built on inclusion, removing barriers that often slow financial adoption.

The flexibility extends to payment customization. Users can schedule recurring bills, adjust amounts based on fluctuating budgets, or pause payments temporarily with just a few taps—features designed for modern life’s unpredictability.

When used in tandem with State Farm’s broader app ecosystem, Com Pay integrates smoothly with features like claims filing, safe route planning, and policy updates—customizing the full journey from coverage to quick pay.

Security remains paramount. Every Com Pay transaction is encrypted, verified through multi-factor authentication, and monitored for anomalies, ensuring safeguards match the stature of State Farm’s brand.

The company adheres to stringent financial regulations, maintaining compliance with real-time payment networks and federal consumer protection standards. As financial cyber threats grow more sophisticated, such robust protections reinforce user confidence.

For many, the real value lies not just in convenience but in stress reduction.

Missed payments are among the top sources of customer anxiety after a claim or a lost paycheck. By making payments fast, reliable, and visible, Com Pay Simple silences the nagging worry—offering instead a sense of control and foresight. Studies show this psychological lift translates into higher customer satisfaction and stronger brand loyalty.

Beyond individual users, Com Pay Simple reflects State Farm’s strategic vision: to lead not just in insurance products but in the digital infrastructure that supports everyday financial resilience. In an era where every second counts, the ability to pay a bill in minutes—without navigating legacy systems—positions State Farm as both a guardian and a facilitator of modern life. “States we serve demand smarter, faster ways to stay protected and connected,” Ramirez remarks.

“Com Pay Simple is how we deliver on that promise.”

With growing adoption and positive feedback, Com Pay Simple is more than a feature—it’s a movement toward simpler financial interactions. In a complex world of overlapping bills, tight deadlines, and shifting budgets, it offers clarity, speed, and dignity. For State Farm customers, managing bills has never been this effortless.

The path forward is clear: direct, immediate, and in control—all powered by Com Pay Simple.

Related Post

Who is Neve OBrien Conan OBriens Daughter

Sevilla FC vs FC Barcelona: Fallout from Crucial Showdown in La Liga Standing Battle

Arduino Uno Stepper Motor Control: Unlock Precision Motion with Simple Code