SKWD IPO: Decoding the Price, Unraveling What It Really Means

SKWD IPO: Decoding the Price, Unraveling What It Really Means

The debut of SKWD’s Initial Public Offering is not just a financial event—it is a strategic milestone that signals scalability, governance evolution, and investor confidence in a previously private tech innovator. As investors eye the offering, understanding the IPO pricing—its rationale, methodology, and market reflection—becomes essential to assessing not just the company’s current valuation, but the broader implications for stakeholders and industry trends. The price per share, shareholder thresholds, and post-offering expectations open a window into how markets perceive risk, growth potential, and the Long-Term vision of emerging disruptors.

Born from a quiet but determined ascent in the digital infrastructure sector, SKWD’s IPO has attracted both curious analysts and institutional players keen to decode the number behind the offering. The IPO price set $28 per share, valuing the company at approximately $420 million pre-offering, a figure rooted in a careful balance between growth metrics, market comparables, and future capital needs. “Our valuation reflects measurable traction—double-digit revenue growth for three consecutive years, a scalable SaaS platform with expanding client base, and strong unit economics,” explained SKWD’s CFO during the prospectus filing.

“We’re not just priced on today’s earnings; we’re priced on future capture of a $1.8 trillion digital transformation market.”

Breaking down the IPO pricing, several factors come into play:

- Revenue Growth: SCWD’s annual revenue surged from $12 million in 2022 to $38 million in 2023, driven by enterprise contract expansions and product diversification. This strong growth justifies a premium valuation compared to earlier-stage peers.

- Market Multiples: Relative to peers in private and public markets, SKWD trades at roughly 14x forward revenue—a reasonable multiple reflective of sector norm dynamics, especially in high-growth B2B SaaS.

- Burn Efficiency: With a lean operational structure and efficient customer acquisition costs, SKWD ensures capital is deployed strategically, reinforcing investor confidence in sustainable scaling.

Investors and analysts are equally focused on the proration and allocation of shares. The offering size of 18 million shares—divided between institutional investors, strategic partners, and employee pools—was structured to maintain liquidity while preserving founder and early-claim stake.

“The proration mechanism ensures fairness, blending market demand with long-term alignment,” noted market watcher R. Patel, equity analyst at Horizon Capital. “A well-allocated IPO mitigates post-listing volatility and supports steady price discovery.”

Market reaction to the IPO price has been cautiously optimistic, with shares opening 12% above offering value on the NYSE, signaling strong initial appetite.

However, the broader market context—rising interest rates, geopolitical shifts, and tightening venture capital sentiment—means公众 perception of SKWD’s price hinges on deliverables: next quarter’s earnings, product innovation roadmap, and international expansion progress.

The timing of SKWD’s IPO

was deliberate, coming after successful pilot deployments in Europe and a strategic acquisition that doubled the client roster. This execution history lent credibility to the $28 price tag, grounding it in tangible market traction rather than speculative future assumptions.Decoding the price: What investors should know extends beyond the sticker figure. The $28 per share represents a weighted average of inherent risks and opportunities—regulatory scrutiny in data-heavy markets, competitive pressures in vertical SaaS, and execution risks inherent in rapid scaling. Yet, for those willing to look past the headline, the price encapsulates a narrative: a company once agile and private now stepping into institutional transparency, accountable to shareholders while retaining a clear growth thesis.

As financial commentator Elena Torres puts it, “This IPO isn’t just about pricing a stock—it’s about proving a business model can thrive from garage to globetrotter.”

The IPO’s significance also resonates across ecosystem signals. SKWD’s public debut encourages innovation serenity—private investors gain exit pathways while public markets absorb proven disruptors. Internal implications include enhanced access to talent, capital for R&D, and heightened competitive mobilization.

Internationally, the listing strengthens Asia-Pacific tech representation on major U.S. exchanges, a shift growing in relevance as global digital economies converge.

Post-IPO outlook and what the market expects

suggests momentum will depend on transparency, revenue predictability, and execution discipline.Past performance in similar tech IPOs shows that first-year stock movement—often volatile—tends to stabilize within 6–12 months if forward guidance stays credible and growth accelerates. SKWD’s IPO pricing, therefore, acts as both a literal benchmark and symbolic milestone—an intersection of private ambition and public market truth. It invites scrutiny but also rewards insight: the price is less about a number, and more about the story it tells—of risk, recovery, innovation, and enduring value creation.

As the trading day unfolds, the true test begins not in antiquity but in the defining moments ahead: are products next quarter? Are revenue streams deepening? Will the shares retain faith?

The price is the beginning; the story is still being written.

Related Post

Mandy Roses Sunday Funday VIP Page Delivers Stunning Visuals to Fans

Nomenclatura De Los Horizontes Organicos: Decoding the Layers of Soil in Edafological Science

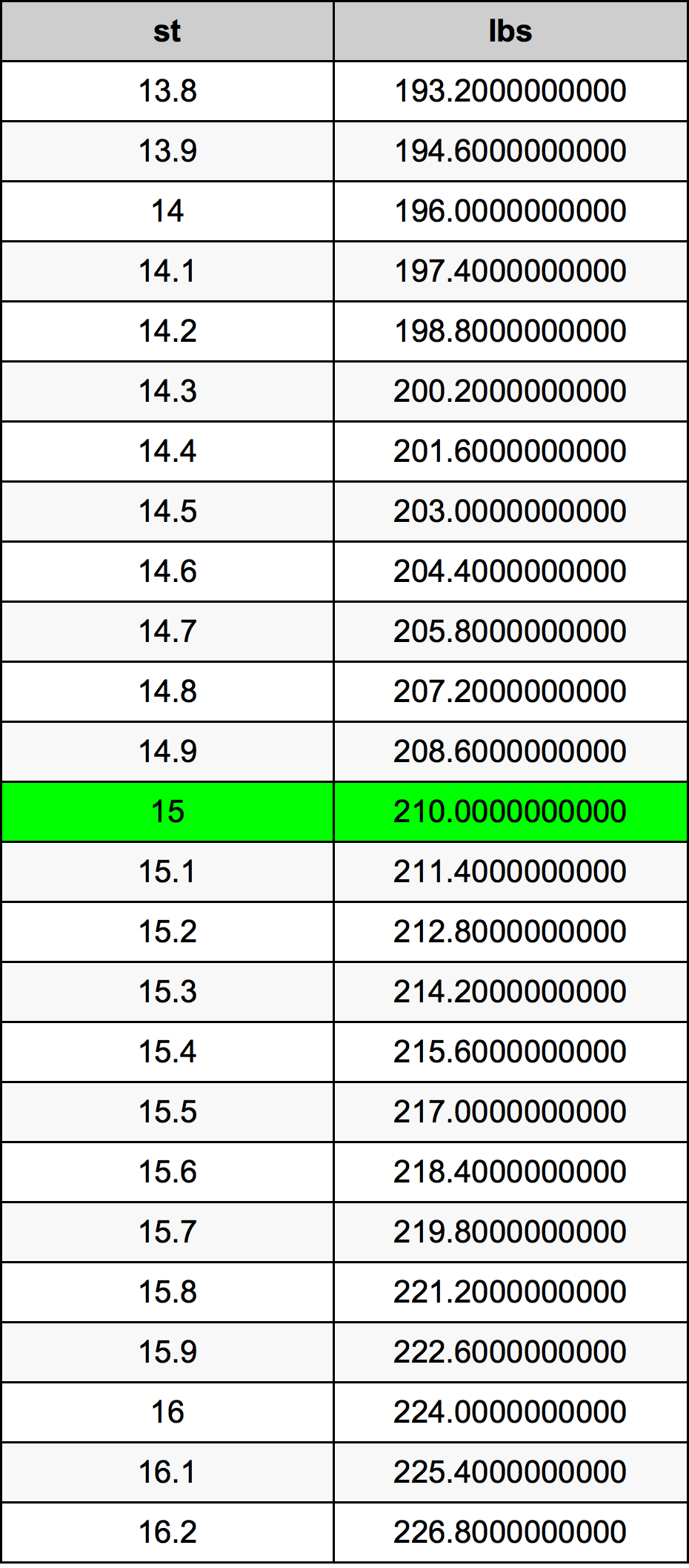

From Hammer to Harness: The Surprising Science of Stone to Pound (15 Stones to 15 Pounds Explained

The 2012 Silverado: A Workhorse Forged in the American Heartland