Semi Annual Rhythms: The Semi-Yearly Pulse That Shapes Global Markets and Strategic Planning

Semi Annual Rhythms: The Semi-Yearly Pulse That Shapes Global Markets and Strategic Planning

In an era of relentless acceleration, the semi-annual rhythm—rooted in the biannual cadence of financial reporting, strategic reviews, and institutional recalibration—remains a critical heartbeat for corporations, investors, and policymakers. Spanning six-month intervals across the calendar, these structured pauses offer far more than routine check-ins: they serve as decisive turning points where performance is measured, strategies adjusted, and long-term visions tested against near-term realities. This article explores the multifaceted role of the semi-annual cycle, examining its influence on corporate governance, investment behavior, economic forecasting, and organizational adaptability—while revealing how its controlled disruptions fuel resilience and innovation.

At the core of the semi-annual cycle lies financial reporting, a cornerstone that binds public companies, private firms, and regulatory bodies in a shared rhythm. Every lower-case “semiannual” review mandates the publication of half-yearly financial statements, encompassing income, balance sheets, and cash flow analyses. These reports are not mere transparency tools; they are performance snapshots that shape market sentiment, investor confidence, and analyst reputations.

As financial analyst Dr. Elena Marquez observes, “Semi-annual reports are market litmus tests—where decisions are made, reputations built or broken, and expectations recalibrated.” The timing of these disclosures, typically late June and December, aligns with fiscal year-ends, enabling stakeholders to assess progress against benchmarks with precision. Behind transparent reporting lies a deeper function: strategic recalibration.

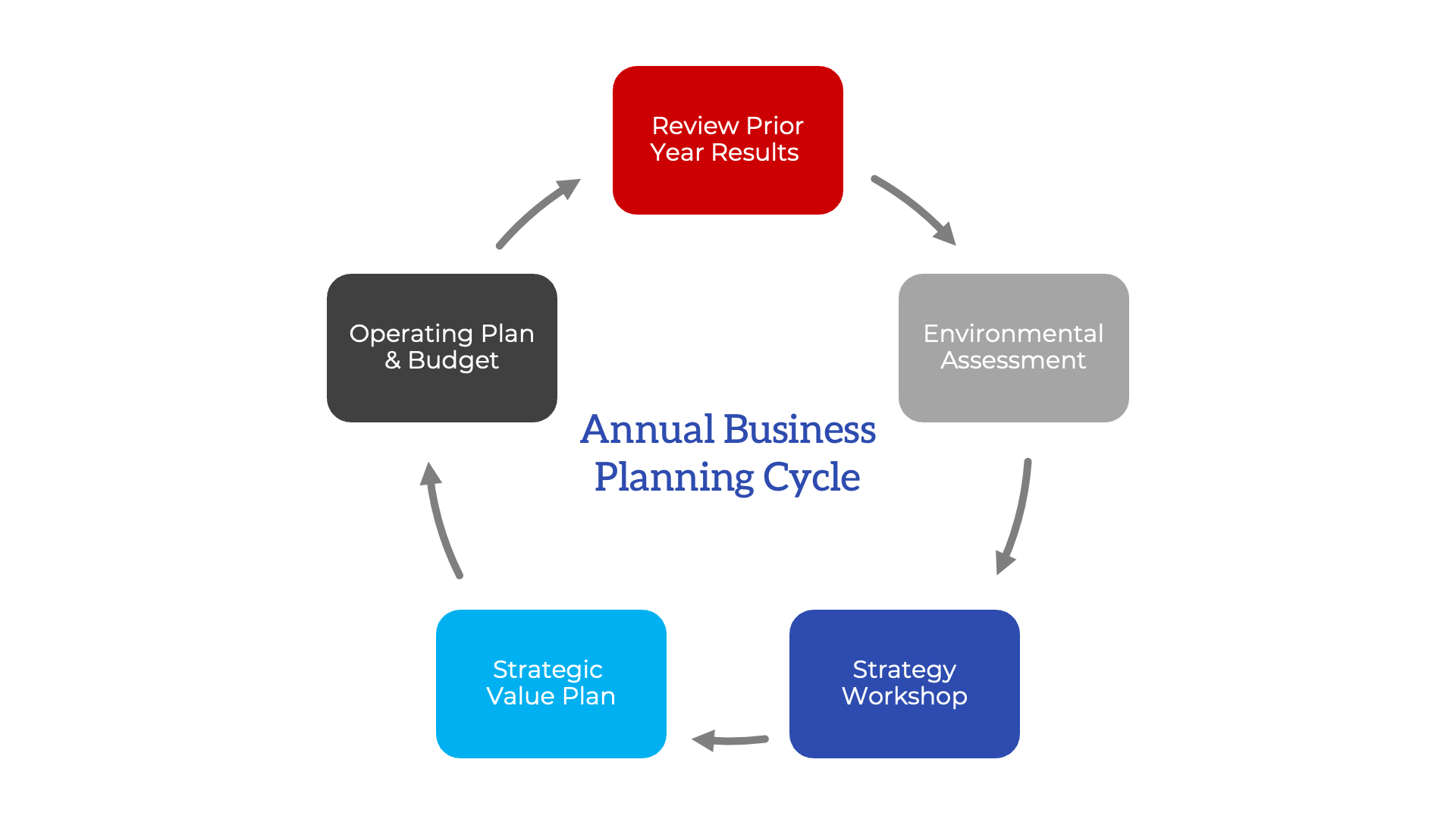

Mid-year reviews—often embedded within semi-annual planning windows—act as diagnostic checkpoints where leadership evaluates operational efficiency, market penetration, and risk exposure. This introspection enables agile shifts in business models, product roadmaps, and resource allocation. Companies use this window to answer hard questions: Did we meet quarterly targets?

How responsive are we to macroeconomic shocks? What customer needs demand urgent innovation? The semi-annual pause, therefore, becomes a diagnostic catalyst rather than passive reflection.

Institutional investors, from mutual funds to sovereign wealth entities, leverage the semi-annual cycle to reassess portfolio allocations and exert governance pressure. These firms conduct rigorous due diligence, comparing actual performance against internal benchmarks and peer groups. Governance committees convene to scrutinize executive performance, executive compensation, and ESG commitments—factors increasingly tied to long-term value creation.

Publ sponsored investor reports and attend annual meetings with care, investors amplify accountability, ensuring management remains aligned with shareholder interests. As venture capital leader James Carter notes, “The semi-annual window is when boards source clarity, challenge assumptions, and reorient strategy—before the next chapter begins.”

The phenomenon extends beyond finance into economic forecasting and policy formulation. Governments and central banks use semi-annual reviews to gauge GDP growth, inflation trends, labor market dynamics, and trade balances.

These data points inform monetary tightening or easing decisions, stimulus measures, and regulatory adjustments. For instance, Federal Reserve officials often reference mid-year economic reports to fine-tune interest rate paths, balancing inflation control with economic momentum. Similarly, global trade organizations analyze semi-annual supply chain resilience metrics to anticipate disruptions and coordinate cross-border responses.

This temporal alignment ensures policy interventions are timely, not reactive.

Organizational learning thrives within the semi-annual cycle’s structured interruptions. Mid-year performance sprints and year-end retrospectives foster culture of continuous improvement.

Teams assess project deliverables, identify skill gaps, and recalibrate workflows. Toyota’s well-documented “kaizen” philosophy epitomizes this: monthly review cycles, though not strictly semi-annual, reinforce a rhythm where progress is measured, feedback cascades, and refinement unfolds. Learestartups like Stripe institutionalize rapid iteration, using biannual reviews to pivot product directions in real time.

Within such environments, the semi-annual cycle becomes less about compliance and more about cultural reinforcement—driving accountability and innovation in equal measure.

Despite its disciplined framework, the semi-annual rhythm faces subtle but growing pressures. The acceleration demanded by digital transformation, volatile markets, and investor expectations risks compressing the cycle into reactive mode rather than reflective pause.

Some experts warn of “report fatigue,” where excessive disclosure dilutes impact, and strategic depth suffers amid urgent reporting cycles. Others caution that the spread of quarterly reporting may erode the semi-annual event’s unique role as a deep-dive inflection point. Still, many institution-builders argue that well-managed semi-annual reviews—grounded in quality over quantity—mediate this risk by preserving focused, purposeful evaluation.

Examples of clinical semi-annual effectiveness abound. In healthcare, pharmaceutical firms open mid-year reviews of clinical trial milestones, adjusting R&D pipelines based on emerging data. In technology, cloud service providers leverage CHapt annual (but biannual-timed) product assessments to accelerate feature rollouts aligned with customer demand.

Even traditional industries, from manufacturing to logistics, have adopted modular semi-annual audits to enhance operational agility. These use cases underscore a consistent pattern: firms that treat semi-annual checkpoints as strategic inflection points—not administrative hurdles—are better positioned to adapt and grow.

Looking ahead, the future of the semi-annual rhythm hinges on intent and innovation.

As artificial intelligence accelerates data ingestion and real-time analytics become standard, the quality of semi-annual evaluations will increasingly depend on insight depth, not volume. Organizations that embed predictive analytics, stakeholder inclusivity, and adaptive governance into their biannual cycles will unlock exponential advantages. The semi-annual rhythm, far from obsolete, evolves—its six-month cadence becoming a strategic lever for foresight, resilience, and sustainable growth.

In an age of constant change, the semi-annual rhythm stands as a testament to the power of disciplined reflection. More than a reporting checklist, it is a mechanism for clarity, course correction, and collective momentum. By honoring this biannual pulse, institutions and leaders do not merely track time—they shape it.

Related Post

What Is Semi Annual? Decoding the Rhythms of Half-Yearly Finance and Operations

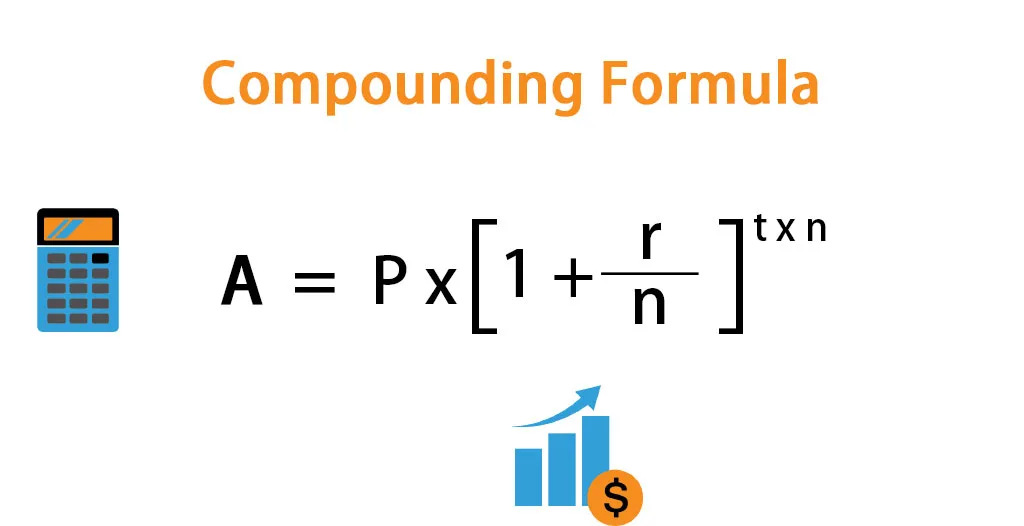

Unlocking Financial Growth: The Semi-Annual Compounding Formula Explained