SC Operating Brazil: Decoding CNPJ and Unveiling Company Dynamics in Brazil’s Economic Engine

SC Operating Brazil: Decoding CNPJ and Unveiling Company Dynamics in Brazil’s Economic Engine

In the bustling corridors of Brazil’s economy, where industrial expansion converges with digital transformation, understanding the backbone of corporate activity is essential. SC Operating Brazil stands as a pivotal player in this landscape, operating under the standardized identity of CPF/CNPJ — Brazil’s unique federal tax identification number — to drive efficiency, compliance, and strategic growth. With each registered entity reflecting millions in transactions and strategic influence, the CNPJ serves not just as a legal formality but as a critical lens through which Brazil’s corporate ecosystem reveals itself.

This article maps the terrain of SC Operating Brazil: analyzing its CNPJ profile, operational footprint, and the broader implications of its corporate structure in Brazil’s dynamic market.

What Is a CNPJ and Why It Matters in Brazil’s Business Fabric

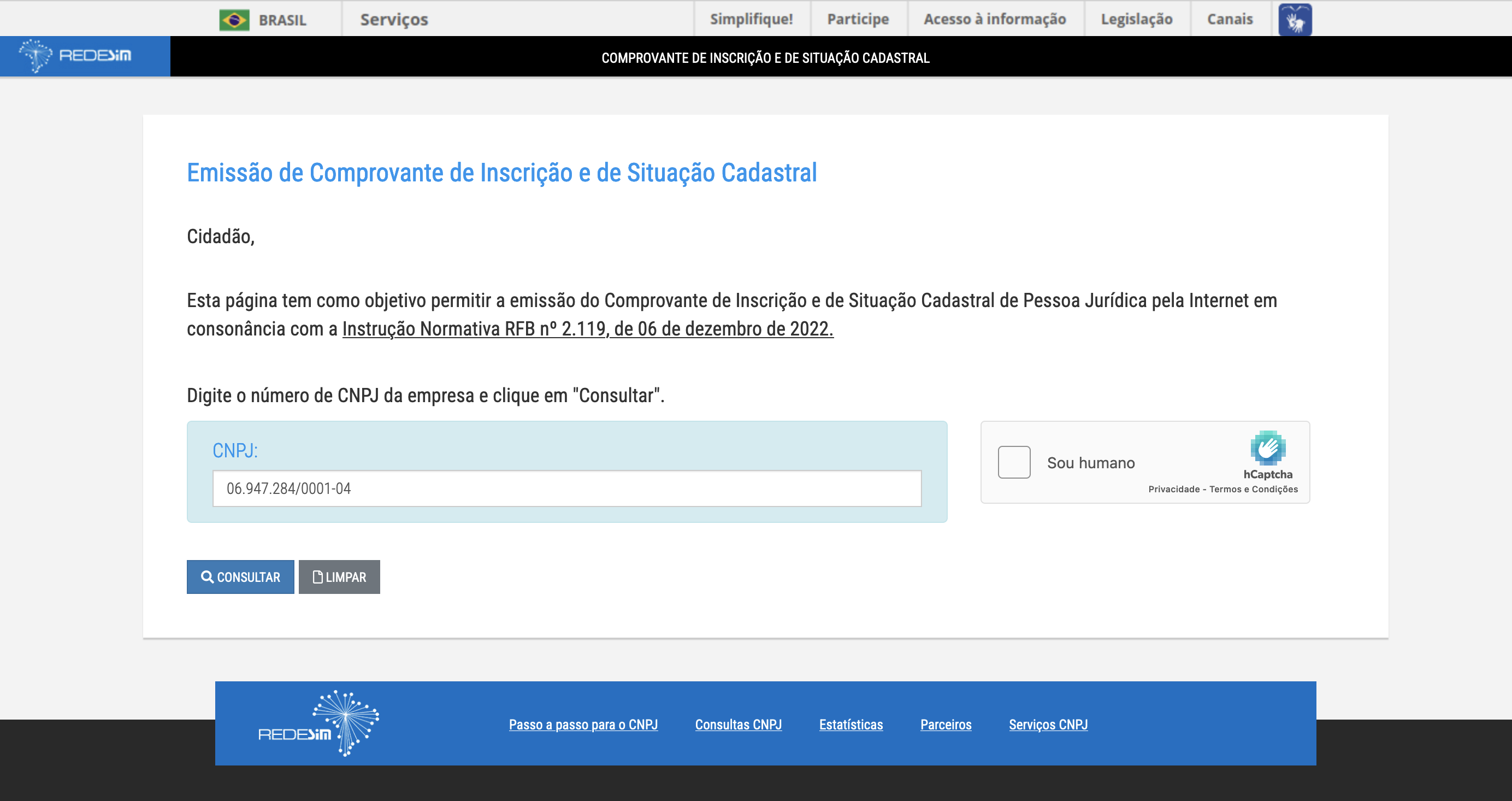

The CNPJ, or *Cadastro Nacional da Pessoa Jurídica*, is Brazil’s national tax identification system, mandated by law for all legal entities conducting commercial activity. Issued by Receita Federal (Brazil’s federal tax authority), each CNPJ number — consisting of up to 14 digits — uniquely identifies a company’s fiscal presence, enabling transparency in tax obligations, public procurement, and business licensing.For foreign investors and domestic firms alike, securing a valid CNPJ is the first critical step toward legal operation. As defined by Brazil’s tax framework, the CNPJ integrates identifiers from the legal entity’s name, activity (via NAE – Nomenclatura Ativa along Economic Activity), and unique numeric code, forming a secure digital fingerprint used across banking, logistics, tax reporting, and government services. For SC Operating Brazil, the CNPJ is more than administrative code — it represents operational legitimacy and market access.

Companies operating under this identification adhere to the rigor of Brazilian tax law, ensuring smooth interactions with federal and state authorities. “The CNPJ is the currency of legal participation in Brazil,” notes Dr. Carla Mendes, a Brazilian business law expert at the Instituto Brasileiro de Direito Empresarial.

“Without it, even the most promising ventures are cut off from essential infrastructure, credit lines, and public tenders.” The system’s structured design supports traceability, enabling authorities to monitor economic activity while safeguarding against fraud and informal operations.

SC Operating Brazil: Mission, Structure, and Strategic Footprint

Operating across critical Brazilian industrial and service sectors, SC Operating Brazil is a subsidiary entity dedicated to optimizing logistics, energy, and operational infrastructure in high-growth regions. As part of a broader multinational operating group (SC Group), its Brazilian arm aligns global operational standards with local market demands, leveraging CNPJ registration to embed compliance from day one.The company’s registered CNPJ reflects this dual focus: it functions as both a legal entity and a strategic partner in key sectors such as energy distribution, industrial vehicular services, and maintenance solutions. With operations concentrated in major hubs including São Paulo, Rio de Janeiro, and Minas Gerais, SC Operating Brazil supports thousands of direct and indirect jobs, partners with leading national firms, and contributes to regional economic development through capital investment and technological adaptation. Structurally, the subsidiary reports under standard corporate governance protocols.

Its organizational chart, accessible via official registration files, reveals a balanced leadership model featuring regional directors for operations, finance, and regulatory compliance. This hierarchy ensures localized responsiveness while maintaining alignment with overarching corporate risk and compliance policies, a feature indispensable for navigating Brazil’s complex regulatory mosaic.

Registration Insights: The Spanish-Specific Approach to CNPJ Acquisition

Acquiring a CNPJ in Brazil involves a meticulous process governed by Receita Federal, including legal name verification, tax status confirmation, and proof of registered address.SC Operating Brazil streamlines this inherently complex process through digitalized platforms while ensuring full compliance. Spanish-speaking entrepreneurs and multinational firms benefit from bilingual administrative support, simplifying documentation, audit preparation, and annual reporting obligations—key advantages for international players entering Brazil’s historically challenging market. Key Components of SC Operating Brazil’s CNPJ Profile

- **Activity Declaration (NAE)**: Registration requires specifying the economic activity via NAE codes, classifying operations as, for example, construction, transport, or energy. - **Compliance Mechanisms**: Ongoing obligations include periodic tax filings (e.g., DIFTCS, ICMS, CIDE), reporting to SPC-BR (Sistema Público de Controle), and renewal cycles every five years. - **Geographic Footprint**: While headquartered in strategic logistics centers, SC Operating Brazil maintains operational decentralization through regional service nodes, each properly documented under its CNPJ.

- **Digital Integration**: The subsidiary interfaces with Brazil’s digital government platforms (e-Social, SPED) ensuring real-time data synchronization and audit readiness. Impact on Brazil’s Industrial and Service Sectors

In energy infrastructure, through regulated service contracts and tax-accurate billing, the company supports stable supply chains critical for manufacturing and commerce. Moreover, by incorporating Brazil’s CNPJ system, SC Operating Brasil enhances transparency and accountability in local markets historically marked by informal practices. This alignment fosters trust among public and private stakeholders and supports Brazil’s broader economic formalization goals.

Strategic Advantages of a Structured CNPJ Framework

- **Operational Scalability**: Standardized reporting and compliance protocols allow for rapid expansion across Brazil’s diverse federal regions. “CNPJ isn’t just bureaucratic— it’s the key to integration,” states Ana Oliveira, CBISO at SC Operating Brasil. “With a valid identification, we’re not just doing business—we’re building trustworthy, traceable operations across the country.” Navigating Compliance and Growth in Brazil’s Regulatory Landscape

SC Operating Brazil’s CNPJ-driven model emphasizes proactive compliance — from timely TAG (Tax Identification Affirmation) updates to mandatory foreign exchange reporting under CONAB. The company’s compliance team, supported by advanced digital audit tools, ensures constant alignment with Ministry of Finance directives and state-level tax authorities. This disciplined approach enables SC Operating Brasil to respond swiftly to regulatory shifts.

For instance, recent updates to state sales tax (ICMS) harmonization were absorbed through integrated tax software, minimizing disruption and maintaining competitive pricing. Future Outlook: Digitalization and the Evolution of CNPJ in Brazil

For SC Operating Brazil, this shift promises enhanced efficiency, real-time oversight, and deeper integration with national systems. The company’s CNPJ infrastructure is poised to embrace these innovations—ensuring not just compliance, but leadership in Brazil’s next phase of corporate modernization. Regulatory agility, combined with robust corporate identity via CNPJ, positions SC Operating Brazil as a model of adaptive, responsible growth in one of Latin America’s most vital economies.

In sum, SC Operating Brazil’s CNPJ is far more than a tax ID—it is the foundation of legal legitimacy, operational resilience, and strategic credibility in a market defined by complexity and opportunity. Through disciplined registration, structured governance, and digital adaptability, it stands as a testament to how formal corporate identity fuels sustainable business success in Brazil’s dynamic economic landscape.

Related Post

Decoding the Hub: An In-Depth Look at the South Haven Michigan Menards and Its Regional Impact

Understanding the Age and Life of Hasbulla — From Born Genius to Global Curiosity

Is Cha Eun Woo Engaged? The Truth Behind The Rumors

The Science and Myth of Ross Geller’s Expertise: Nature vs. Nostalgia in a Cultural Icon