Saudi Arabia’s GDP A Deep Dive: How the Kingdom’s Economy is Transforming in a Post-Oil Era

Saudi Arabia’s GDP A Deep Dive: How the Kingdom’s Economy is Transforming in a Post-Oil Era

Saudi Arabia’s Gross Domestic Product (GDP) has undergone a profound transformation in recent years, propelled by strategic economic reforms, massive investments in diversification, and a bold vision to reduce reliance on oil revenues. Once synonymous with petroleum wealth, the Kingdom now stands at the forefront of economic reengineering in the Middle East, driving growth across industries such as renewable energy, tourism, technology, and manufacturing. This deep dive reveals the dynamics shaping Saudi Arabia’s economic trajectory, the forces behind its shifting GDP composition, and what the future holds for one of the world’s most ambitious economic overhauls.

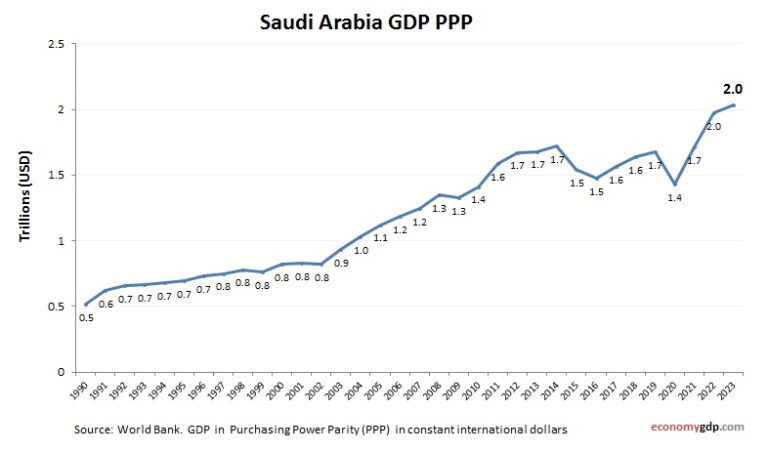

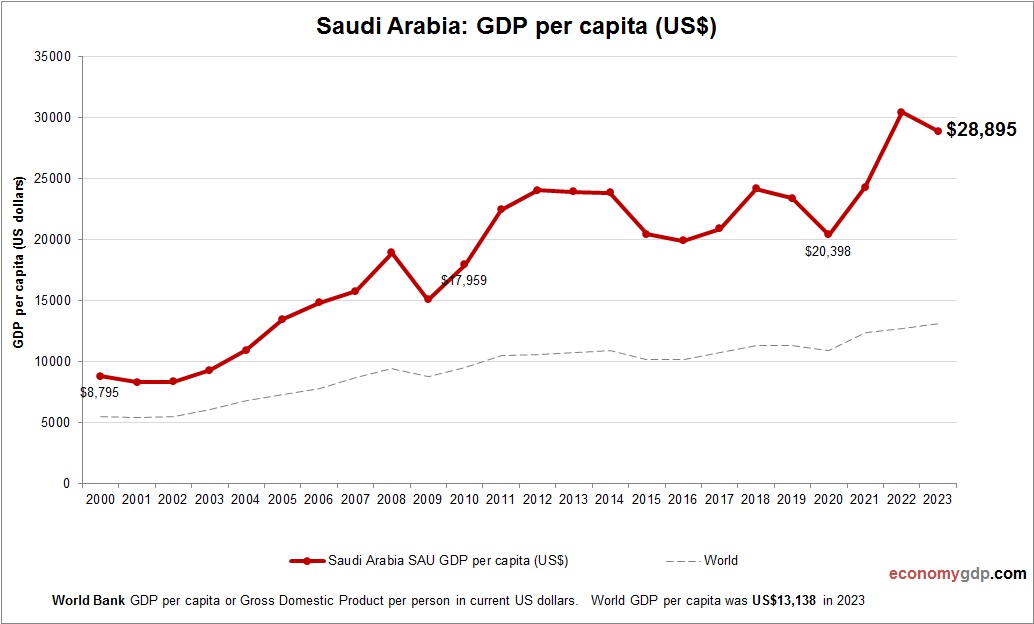

At the heart of Saudi Arabia’s GDP evolution lies Vision 2030 — the nation’s comprehensive reform agenda launched in 2016 under the leadership of Crown Prince Mohammed bin Salman. Designed to restructure the economy and empower private-sector participation, Vision 2030 targets a more resilient, diversified, and sustainable revenue base. The Kingdom’s GDP, valued at approximately $647 billion in 2023, reflects steady progress: real GDP growth averaged over 4% annually since 2016, despite global economic volatility and oil market fluctuations.

This resilience underscores the success of long-term planning and policy execution.

oil’s diminished share, renewables and non-oil sectors climb. Historically, hydrocarbons accounted for over 40% of GDP and nearly 70% of government revenue.

Yet, recent years have seen a marked decline in oil’s dominant role. In 2022, oil directly contributed about 12% to GDP, down from roughly 25% over the previous decade. This shift is intentional — a calculated move to harness energy resources for transformation rather than dependency.

Meanwhile, non-oil sectors now contribute over 63% of GDP, with services leading at 54%, driven by expanding finance, healthcare, education, and construction. The rise of the private sector — now responsible for over 60% of GDP — signals structural change: private enterprise is emerging as a cornerstone of economic vitality.

key sectors fueling growth

Energy transition is central to Saudi Arabia’s new economic narrative. Beyond traditional oil and gas, the Kingdom is emerging as a regional leader in renewable energy and green hydrogen.

Projects like NEOM — a $500 billion futuristic smart city powered entirely by renewable sources — exemplify this ambition. NEOM’s industrial zones aim to produce green hydrogen at scale, attracting global investors and positioning Saudi Arabia at the heart of the clean energy revolution. With a target to generate 50% of its energy from renewables by 2030, the country is redefining its energy identity.

Other high-growth sectors include tourism and entertainment, where aggressive openings have drawn international attention.

The opening of borders, tax incentives for foreign tourists, and the launch of projects like the Red Sea Project and Qiddiya entertainment city have already stimulated visitor numbers — surging from fewer than 10 million in 2016 to over 19 million in 2023. Hospitality, retail, and cultural industries now account for 8% of GDP, up from under 5% a decade ago.

Technology and digital innovation have also become critical pillars.

The government’s “Digital Saudi Arabia” strategy promotes fintech, e-commerce, and AI, supported by a growing startup ecosystem. Riyadh ranks among the top 10 global hubs for tech investment in emerging markets. The proliferation of high-speed broadband, startup incubators, and regulatory reforms have spurred innovation, with tech startups raising over $2.3 billion in funding between 2020 and 2023 — a tenfold increase.

labor market reforms and human capital development

Sustained GDP growth hinges on demographic shifts and labor market reforms. With a young population — 60% under age 30 — the Kingdom is investing heavily in education and workforce development. Initiatives such as Saudization policies aim to increase private-sector employment for nationals, raising the local workforce’s share from 54% in 2016 to 67% in 2023.

Vocational training programs, university-industry partnerships, and campaigns like “Quality of Life” are reshaping employment patterns, reducing youth unemployment (which fell from 27% in 2017 to 12% in 2023), and fostering a more dynamic, inclusive labor market.

infrastructure and foreign investment: catalysts for expansion

Strategic infrastructure development has been a linchpin of economic performance. Massive investments in transport, logistics, and urban renewal — including the expansion of Riyadh Metro and King Abdulaziz International Airport — have enhanced connectivity and global competitiveness. Foreign direct investment (FDI) surged to $21.3 billion in 2023, up 75% from a decade earlier, driven by regulatory transparency, tax incentives, and the Kingdom’s stable geopolitical position.

Multinational corporations including Microsoft, Emerson, and AstraZeneca have established regional headquarters or manufacturing facilities, reinforcing Saudi Arabia’s appeal as a regional business hub.

The durability of Saudi Arabia’s GDP growth rests on the effective interplay between vision, policy execution, and human capital integration. While challenges remain — including balancing rapid modernization with societal norms, managing fiscal sustainability amid volatile oil prices, and scaling private-sector enterprise — the trajectory is clear: from petroleum dependency to diversified resilience. With Vision 2030 well underway, the Kingdom’s GDP evolution is no longer just a statistical trend but a transformational testament to strategic foresight in action—one that is redefining economic futures across the Gulf and beyond.

Related Post

Diesel Creek Net Worth and Earnings

Juanfer Quintero: Redefining Innovation Through Storytelling and Strategy

Unlocking Justice: How Henderson County, TX Mugshots Reveal Arrests Sealed in Public Records