Santander Business Financing: The Fast Lane to Business Growth, Powered by Instant Capital

Santander Business Financing: The Fast Lane to Business Growth, Powered by Instant Capital

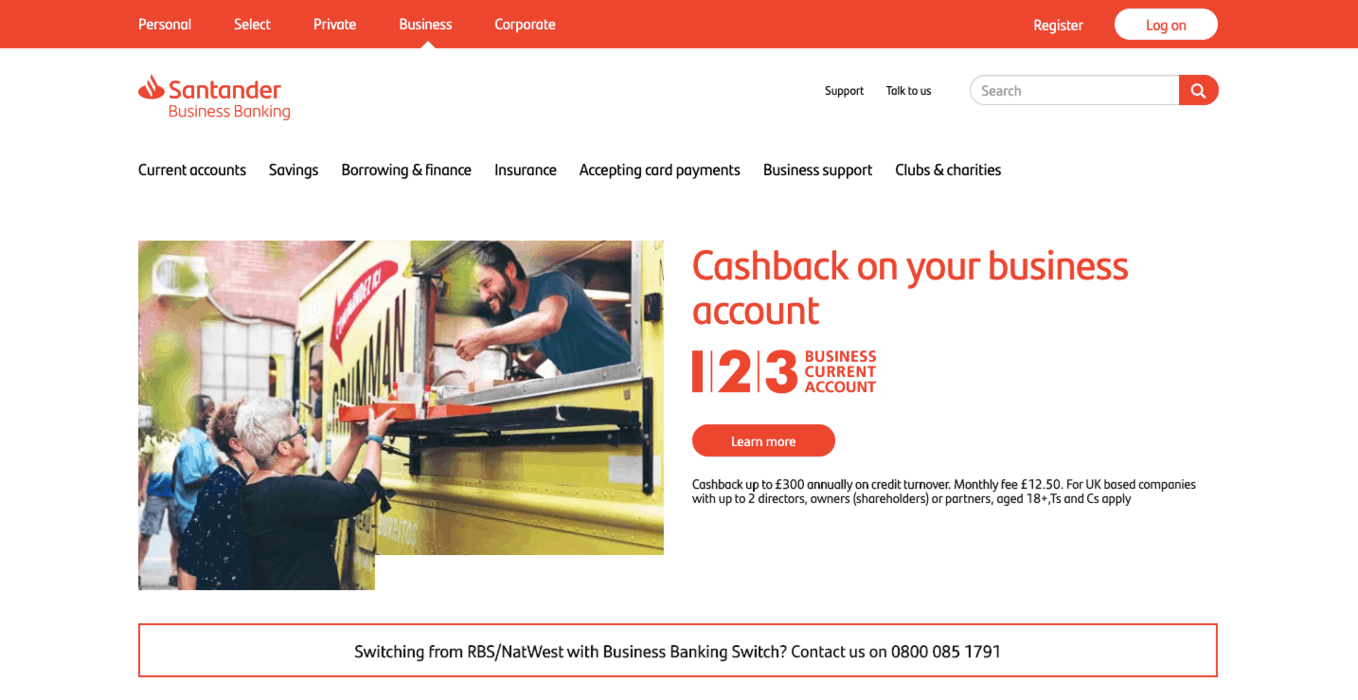

When every moment counts and cash flow shortages stall progress, access to timely business financing can be the difference between stagnation and expansion. Santander Business Financing has emerged as a strategic partner for entrepreneurs and mid-sized companies seeking agile funding solutions to fuel growth. By combining competitive terms, flexible repayment options, and personalized service, Santander enables businesses to seize opportunities without founder burnout or disrupted operations.

From bridging short-term gaps to financing long-term investments, the platform positions itself as a vital engine for modern entrepreneurship—now more accessible than ever.

What makes Santander Business Financing stand out is its customer-centric design and speed. Unlike traditional banking channels burdened by lengthy approval processes, Santander offers streamlined application workflows optimized for quick disbursements.

As business leader and Santander client, Elena Torres, notes, “The ability to access capital in under 48 hours changed how we scaled our supply chain—no more guessing games, just reliable support when we needed it.” This real-time access empowers businesses to seize market chances before competitors do, reinforcing Santander’s reputation as a growth enabler.

Flexible Funding Options Tailored to Every Business Stage

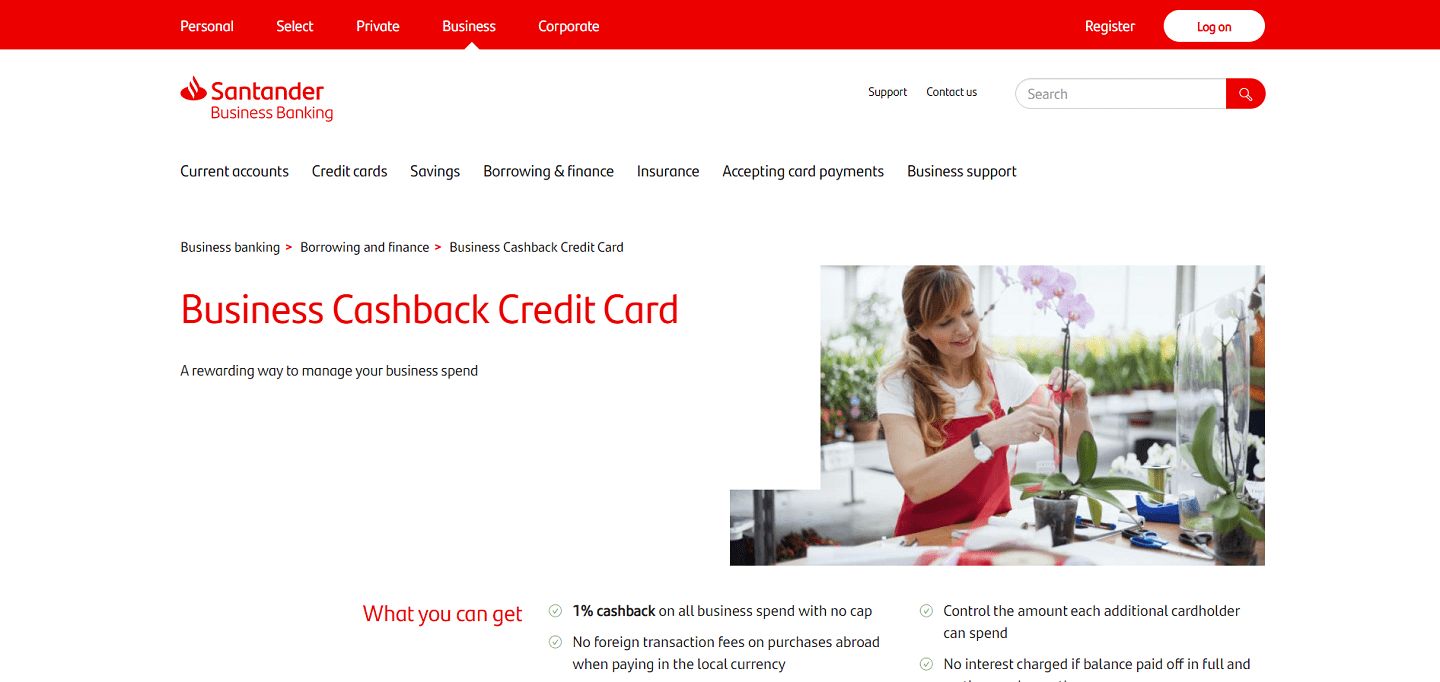

Santander Business Financing delivers a diverse portfolio of products designed to match varying business needs—whether launching a new project, expanding operations, or managing seasonal cash flow. Key offerings include: - **Working Capital Loans**: Designed for ongoing operational needs, these flexible lines of credit help companies maintain smooth day-to-day functions without liquidity crunches.- **Equipment and Technology Financing**: For businesses investing in upgrades or digital transformation, Santander provides long-term, low-interest loans tailored to asset lifecycle planning. - **Commercial Real Estate Financing**: Supporting expansion or relocation, the platform offers structured financing options backed by professional valuation and flexible terms. - **Payables Financing**: A cash-flow optimization tool that accelerates receivables and extends payables on a favorable schedule, improving working capital naturally.

Each product is backed by Santander’s credit assessment expertise, ensuring decisions reflect a deep understanding of market dynamics and business viability.

One of the platform’s most compelling advantages is its ability to assess risk holistically. By analyzing cash flow patterns, revenue history, and business fundamentals, Santander provides tailored terms that reflect actual performance rather than rigid formulas—giving even newer businesses a fair shot at support.

Streamlined Access Without Compromising Expertise

In today’s fast-moving commercial landscape, speed and simplicity define successful financing. Santander Business Financing delivers both through a user-friendly digital portal and dedicated business advisors. Clients can submit applications online, receive instant feedback, and get funding within days—an operational efficiency unmatched by traditional lenders.This digital agility, paired with personalized consultation, reduces friction and builds trust. The client support network is a cornerstone of the service. Unlike impersonal transactional banking, Santander assigns dedicated business advisors who understand industry-specific challenges.

These experts guide clients through product choices, documentation support, and strategic planning, turning funding into a collaborative growth process.

Efficiency isn’t limited to speed—it extends to cost transparency. Santander Business Financing provides clear, upfront pricing with no hidden fees, enabling businesses to forecast expenses accurately and plan confidently.

This clarity reduces financial uncertainty and empowers smarter decision-making.

Real-World Impact: How Businesses Are Accelerating Growth

Across industries, businesses are leveraging Santander’s financing to drive tangible results. A regional retail chain used a working capital loan to expand inventory ahead of a holiday surge, increasing sales by 22% in two quarters.A fintech startup secured equipment financing to upgrade its servers, enabling a 40% faster user onboarding process. A manufacturing firm gained access to long-term technology financing, modernizing production lines and cutting operational costs by 18%. These cases reflect a broader pattern: timely capital isn’t just about liquidity—it’s about unlocking strategic options.

With Santander, businesses obtain more than funds; they gain the leverage to innovate, hire, expand internationally, or adopt automation. The platform responds to evolving business needs with scalable, customized solutions.

Why Santander Business Financing Stands Out in a Crowded Market While multiple lenders offer business loans, Santander differentiates itself through integrated excellence.

Its deep roots in commercial banking provide superior risk assessment and pricing throughout. The platform blends cutting-edge technology with seasoned financial insight, creating a hybrid model that balances automation with human expert support. Santander’s commitment to transparency cuts through ambiguity.

Clear communication about terms, repayment schedules, and eligibility criteria builds credibility. The digital interface is intuitive, with real-time progress tracking that demystifies the process. Meanwhile, the advisory team brings experience tailored to specific sectors—from hospitality to manufacturing—offering strategic guidance beyond capital.

Moreover, Santander Business Financing supports long-term partnerships, not one-off transactions. As businesses grow, the platform adapts, offering expanded credit lines, new products, and ongoing financial planning help—ensuring continuity as ambitions scale.

Getting Started: A Simple Path to Rapid Funding

Accessing Santander Business Financing requires a straightforward, step-by-step process optimized for efficiency.Most applications begin online through a dedicated business portal, where firms complete digital forms with access to past transaction history, financials, and operational details. This data feeds into automated underwriting engines that assess creditworthiness rapidly. For businesses with stronger relationships—either through existing Santander banking ties or repeat interactions—personalized support streamlines verification.

Client advisors proactively guide documentation submission, clarification, and approval coordination, reducing delays. Funds typically arrive within 48 to 72 hours, enabling immediate use without operational disruption.

Prequalification checks are also available via mobile or web, offering instant insights into approximate approval likelihood and key terms.

This asynchronous assessment empowers business owners to progress confidently, knowing where they stand before committing full applications.

The Road Ahead: Santander Business Financing as a Growth Catalyst

Santander Business Financing is more than a lending product—it is a strategic partner in business evolution. By delivering fast, transparent, and tailored funding, it addresses the critical need for agility in today’s competitive marketplace.Every business, whether scaling a startup or modernizing a legacy operation, benefits from a financing solution built on trust, expertise, and innovation. As markets shift and opportunities multiply, the ability to respond quickly and confidently determines success. Santander Business Financing equips entrepreneurs and business leaders with the capital they need when they need it—turning challenges into milestones and vision into reality.

In an era where every moment shapes growth, this financing platform is already helping businesses build momentum, one loan at a time.

Related Post

Unveiling the Career of Valverde Maria: A Film Luminary Explored

From Fire and Fury to Family: The Unusual Bond of Tony Hinchcliffe and His Relationship with Pete Hinchcliffe