Quarters in Fiscal Year: The Rhythm Behind Economic Decision-Making

Quarters in Fiscal Year: The Rhythm Behind Economic Decision-Making

Each fiscal year unfolds in four distinct quarters, each delivering critical financial insights that shape government budgets, corporate strategies, and broader economic expectations. Understanding the dynamics of Fiscal Year Quarters is essential—not just for policymakers and accountants, but for any stakeholder navigating the pulse of national and global economies. From revenue projections to spending allocations, every quarter offers a snapshot of financial health and direction, guiding tactical choices across sectors.

Fiscal Year Quarters—typically spanning three-month periods within a 12-month cycle—serve as the backbone of fiscal discipline and forecasting. Unlike calendar months, which shift annually, fiscal quarters provide consistency, enabling accurate month-over-month comparisons. For national governments, quarterly reporting translates into transparent monitoring of public expenditures, tax inflows, and deficit management.

For businesses, it reveals seasonal spending patterns and profitability trends crucial for cash flow planning.

Breaking Down the Fiscal Year’s Quarterly Framework

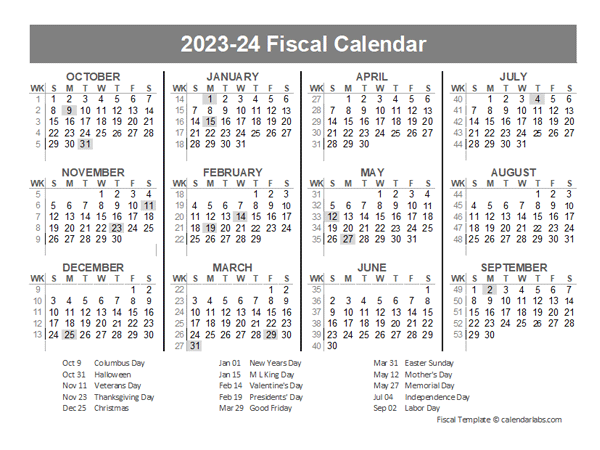

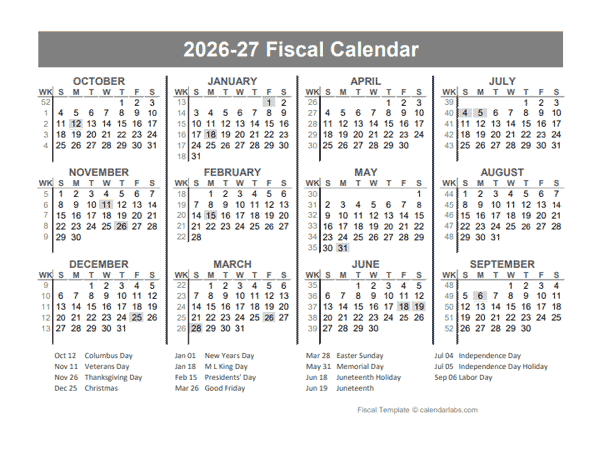

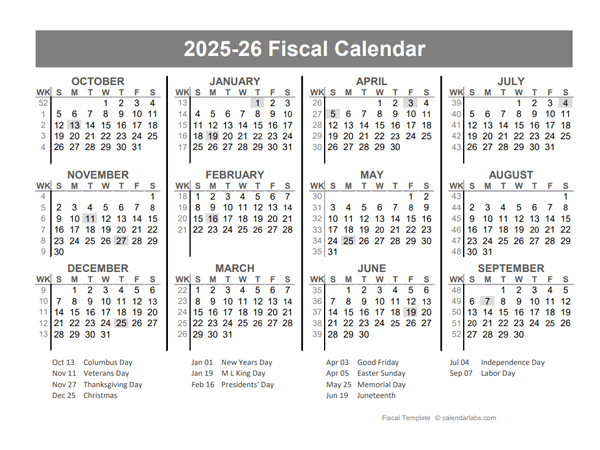

The standard fiscal year is divided into four quarters:- Q1 (January–March)

- Q2 (April–June)

- Q3 (July–September)

- Q4 (October–December)

This rhythm allows analysts to discern trends with precision. Quarterly fiscal performance reveals critical indicators: tax collection volumes, transfer payments, program expenditures, and revenue shortfalls. Transparency in these data points strengthens accountability, especially when governments face pressure to balance budgets or respond to economic shocks.

During periods of recession or growth, quarterly results serve as early warning signals or indicators of fiscal resilience.

Q1: The Season of Commitments and Reserve Management

Q1 sets the fiscal tone, often marked by government appropriations and advance spending. With annual budgets in place, this quarter focuses on executing already-approved programs—payroll for public servants, ongoing infrastructure projects, and interest payments on debt.For corporations, Q1 may show early revenue signals from holiday sales, though the closing fiscal window limits extensive new investment cycles. Key drivers: - Finalization of fiscal year budgets - Upfront expenditure disbursements - Early assessment of revenue flows

During Q1, fiscal authorities closely monitor cash reserves. In the U.S.

federal budget, for instance, the Treasury releases quarterly statements that project revenue and spending through the year, helping markets anticipate liquidity needs. For businesses, reviewing Q1 results reveals quarter-over-quarter revenue momentum, informing inventory decisions and workforce planning.

Q2: The Acceleration Phase and Mid-Year Outlook

As fiscal momentum picks up, Q2 becomes a period of acceleration for revenue collection and spending execution. Tax collections tend to surge as employment reaches peak levels and economic activity picks up.Governments often use this window to reinvest in public services or fund targeted stimulus before mid-year. Notable patterns: - Rising payroll and income tax receipts due to full fiscal year employment - Implementation of infrastructure bill expenditures - Corporate planning shifts toward Q2 cost management

Economists prize Q2 data for its predictive power—trends emerging here often signal whether the year will meet growth or contraction benchmarks. Retailers and manufacturers analyze mid-year sales trends, while governments assess program effectiveness, adjusting targets as needed.

In emerging markets, Q2 can also reflect post-rainy-season agricultural spending or energy investment cycles.

Q3: The Peak Spending and Seasonal Surge

Q3 represents a fiscal peak in many economies, driven by both public and private sector activity. For governments, this quarter brings full-scale program rollouts—education funding, summer employment programs, and expanded unemployment benefits. The federal deficit calculus sharpens as expenditures climb and revenue begins to plateau before year-end.Seasonal influences: - Back-to-school spending peaks, boosting retail and supply chain demand - Capital projects typically reach completion milestones - Energy and commodity markets react to pent-up industrial demand

Businesses track Q3 closely as a litmus test for profitability. Walmarts and Target report quarterly earnings rising on back-to-school and holiday prep spending. Municipalities audit payroll and service delivery to ensure alignment with projected Q3 budgets.

Meanwhile, the stock market often shows volatility tied to quarterly profit reports, reflecting investor sensitivity to fiscal momentum.

Q4: The Climax of Consumer Activity and Fiscal Reflection

Q4 prevails as the year’s most financially impactful quarter, dominated by retail, transportation, and gift economies. Consumer spending—typically 70% of U.S. GDP—reaches its zenith, powered by Black Friday, Cyber Monday, and year-end bonuses.Government disbursements also peak, with stimulus payments, holiday bonuses, and infrastructure project closings driving significant outlays. Quarterly highlights: - Top quarter for retail sales, tech, and home improvement - Government economic impact reports leaked before official release - Businesses hype year-end promotions and inventory turnover

This quarter’s data shapes year-end audits and fiscal evaluations. Governments use Q4 results to adjust 2024 forecasts, factoring in holiday-related debt or surplus trends.

For investors, Q4 earnings reveal sector resilience—though inflation and interest rate pressures often temper gains. Retailers measure success not just in revenue, but in customer retention and supply chain efficiency honed through the year.

Across all four quarters, fiscal reporting remains the transparent thread binding government and markets alike. Automated data platforms now release real-time quarterly updates, increasing accessibility and analytical depth.

Yet challenges persist: political gridlock can delay budget finalization, skewing Q1 expectations. Recession or global crises disrupt typical patterns, forcing agencies to pivot rapidly. Still, the structured quarterly cycle ensures fiscal accountability remains a cornerstone of economic stability.

The rhythmic cadence of fiscal quarters underpins strategic foresight, turning raw numbers into actionable insight. From quarterly budget approvals to year-end assessments, each period serves as a milestone in the ongoing narrative of public and private financial health. In an era of volatility and rapid change, understanding Quarter in Fiscal Year dynamics is not merely beneficial—it is essential.

Related Post

Ian Hecox Reveals the Truth Behind His Partner: Who Is He With?

299 Pesos Spend: How 299 Mexican Pesos Equate to Dollars in Real Value and Global Purchasing

Steve Jobs and the Creation of the iPhone: How a Vision Redefined a Generation

Murata God Panel Revolutionizing Power Management: Deep Dive into Latest Innovations