PSEI Indonesia: Financial Revamp Explained – Reinventing Management for Long-Term Growth

PSEI Indonesia: Financial Revamp Explained – Reinventing Management for Long-Term Growth

Indonesia’s corporate sector is undergoing a transformative financial revamp driven by the PSEI (Public Sector Investment and Economic Strategy) framework, a comprehensive initiative aimed at modernizing public and private financial governance. This strategic overhaul, guided by new regulatory standards and digital integration, seeks to enhance fiscal transparency, optimize capital allocation, and drive sustainable economic resilience. The pivot reflects a growing recognition that outdated financial systems no longer suffice in a rapidly evolving economic landscape marked by digital innovation and global market volatility.

At its core, PSEI Indonesia represents a paradigm shift in how nations manage public and private capital. The revamp emphasizes data-driven decision-making, real-time financial monitoring, and risk mitigation strategies calibrated to Indonesia’s unique economic milieu. Industry analysts note that “this isn’t just about budget adjustments—it’s a full-scale recalibration of financial discipline and strategic foresight,” according to Rika Suhardiman, senior economist at the Indonesia Economic Policy Institute.

“The framework transforms financial management from a reactive function into a proactive engine for growth.”

Key pillars of the PSEI financial revamp include:

- Integration of advanced digital platforms for real-time fiscal tracking and reporting, reducing delays and errors in public expenditure management.

- Implementation of stricter audit protocols and independent oversight mechanisms to enhance accountability.

- Adoption of ESG (Environmental, Social, Governance) criteria in investment evaluations, aligning financial policy with sustainability goals.

- Capacity-building programs for public officials and corporate financiers to master new tools, data analytics, and risk assessment models.

- Strengthened public-private collaboration to leverage private sector efficiency within state-led infrastructure and development projects.

The restructuring is already yielding measurable impacts. Pilot programs in major infrastructure sectors—such as transportation and renewable energy—demonstrate cost savings of up to 18% through improved budget forecasting and reduced waste.

“Digital dashboards, powered by AI, allow stakeholders to visualize spending patterns and identify inefficiencies within minutes,” explains Budi Putra, head of Indonesia’s Ministry of Finance’s Digital Financial Division. “This level of transparency transforms planning from guesswork into evidence-based strategy.”

Real-world applications highlight how the revamp strengthens economic resilience. In East Java, the provincial government deployed PSEI-aligned financial systems to streamline disaster relief fund disbursement, cutting processing time from weeks to days.

Similarly, state-owned enterprises (SOEs) undergoing privatization are adopting PSEI standards to attract foreign investment with clearer governance and measurable returns. “Markets reward predictability,” notes Dr. Siti Maulida, financial systems advisor.

“When financial data is honest, secure, and accessible, investor confidence rises—directly fueling long-term stability.”

The initiative also addresses structural weaknesses exposed during global economic fluctuations. By embedding dynamic risk modeling and scenario analysis, PSEI enables agile responses to interest rate shifts, currency volatility, and supply chain disruptions. “Investors and citizens alike now see Indonesia not as a high-risk frontier, but as a refined investment destination,” says Farid Wahyudi, Director of PSEI Indonesia Task Force.

“Our revamp delivers not just balance sheets, but benchmarks for trust.”

Critical to success is the human element: training programs across government agencies and corporate institutions ensure that personnel can harness updated systems effectively. Module curricula integrate fintech literacy, cybersecurity awareness, and strategic financial modeling, reinforcing a culture of accountability from boardrooms to field offices. “Technology alone won’t drive change,” stresses Dr.

Maulida. “It’s the people empowered by their knowledge that turn data into decisions.”

Looking ahead, Indonesia’s PSEI financial revamp sets a regional precedent, demonstrating how coherent policy, technological integration, and institutional reform can unlock economic potential. With ongoing refinements and expanded scope, the framework positions the nation to meet 21st-century challenges—from infrastructure demands to climate adaptation—with stronger fiscal foundations and greater public trust.

The financial revamp is more than a bureaucratic update; it’s a strategic reawakening. By anchoring policy in data, technology, and inclusivity, Indonesia is building a financial ecosystem resilient enough to sustain decades of growth. As public and private sectors converge around shared metrics and transparency, PSEI Indonesia emerges not merely as a reform agenda, but as a cornerstone of national economic sovereignty.

Related Post

Chilis Raises the Heat This Veterans Day 2025 with Exclusive Deals and a Bold Menu Preview

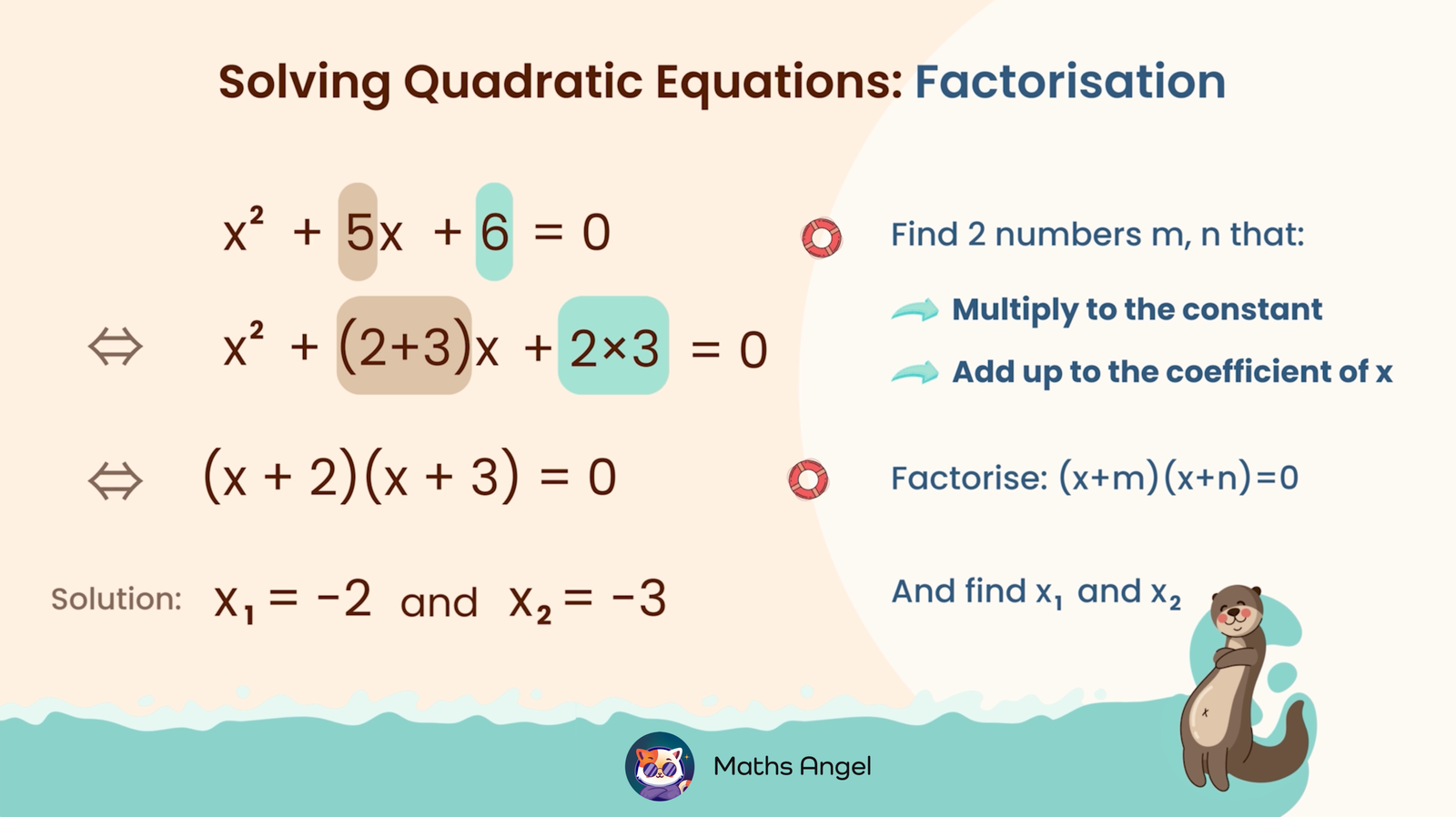

Master the Art of Solving Cubic Equations: The Step-by-Step Guide to Factorising Cubics

Atlético Grau Vs. Universitario: Tactical Analysis and Key Battles in Peruvian Football Clashes

How Old Is James Charles? Unveiling the Dermatologist’s Birth Date and Career Timeline