Pi Network KYC: The Latest Updates That Could Redefine Your Digital Future

Pi Network KYC: The Latest Updates That Could Redefine Your Digital Future

As the global digital economy accelerates, trust and regulatory compliance are emerging as the linchpins of cryptocurrency adoption. Nowhere is this more evident than in Pi Network’s ongoing evolution, particularly its enhanced Know Your Customer (KYC) verification process. Recent developments in Pi Network KYC signal a pivotal shift—transforming a once-open, community-driven project into a more secure, regulated ecosystem where verified users unlock greater value.

These updates not only tighten security but directly impact how individuals engage with one of the world’s most ambitious blockchain experiments. For users navigating the fine line between speculative investment and legitimate financial participation, understanding Pi Network KYC’s latest trajectory is no longer optional—it’s essential.

At the core of Pi Network’s growth strategy lies its commitment to regulatory compliance, and the latest KYC enhancements reflect this priority.

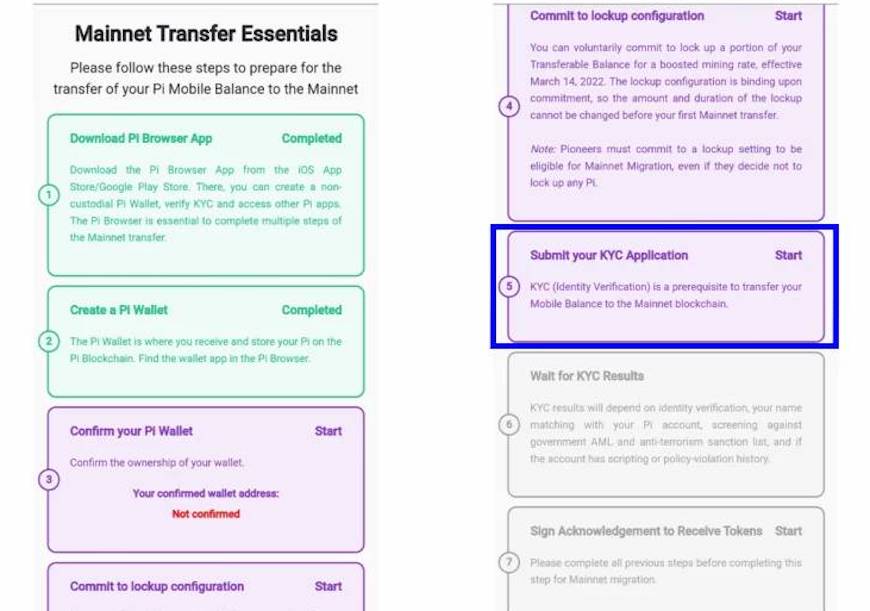

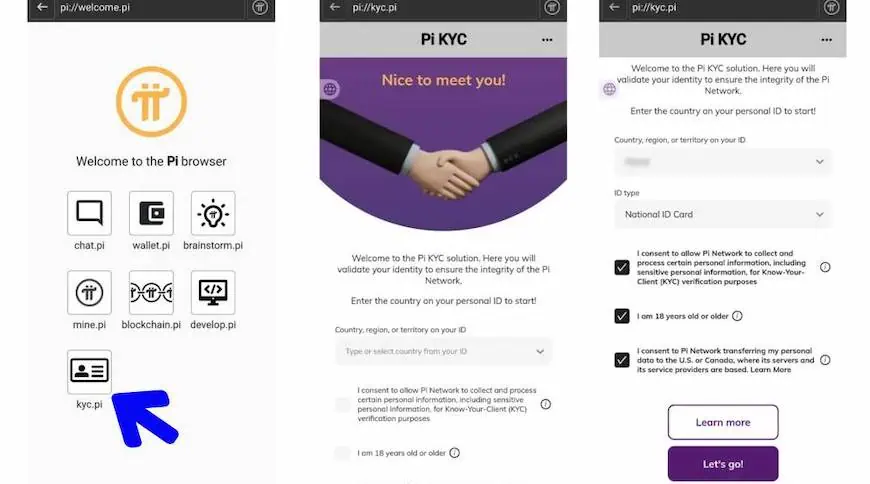

Pi Network launched its KYC verification system in 2022 as a progressive step toward mainstream acceptance, requiring users to prove identity before accessing full transaction privileges. Over time, this framework has matured: as of early 2024, Pi Network has expanded its KYC requirements to include tiered verification levels, enabling enhanced features like loan access, larger trade limits, and integration with institutional partners. These upgrades aim not just at curbing illicit activity but at building a transparent, accountable platform where user trust is verifiable and enforceable.

Then, in 2022, Pi introduced a mandatory KYC phase, requiring government-issued ID verification to activate full node functionality and transaction permissions. This move significantly elevated network integrity. By 2023, Pi expanded KYC to include optional but incentivized identity validation for premium features.

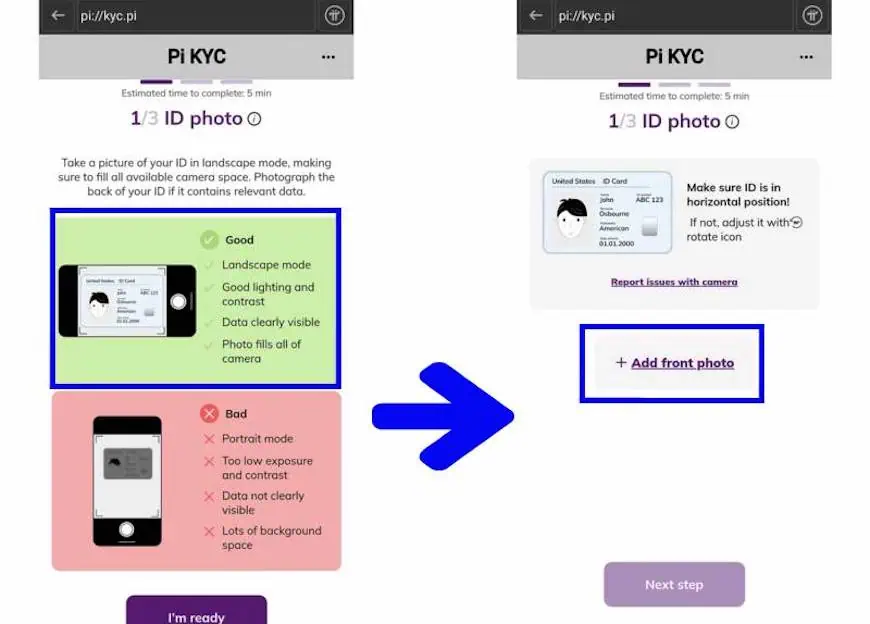

In 2024, the network deepened compliance through automated, AI-assisted verification integrations, enabling near real-time ID validation while preserving user privacy through advanced cryptographic standards. Each stage reflects a deliberate tightening of controls without sacrificing the platform’s foundational ethos of accessibility.

One of the most consequential updates in 2024 is the implementation of multi-layered KYC tiers.

Users now register at baseline with basic verification, unlocking standard operations like network participation and small trades. Those who opt into enhanced KYC—providing additional documentation such as address proof or biometrics—gain access to higher liquidity pools, institutional investor channels, and expanded financial instruments. “Our goal is not to restrict, but to enable responsible growth,” stated a Pi Network official in the 2024 annual developer report.

“By classifying user risk profiles, we reduce exposure for both the network and its participants, creating a safer ecosystem for all.” This tiered approach balances openness with accountability, appealing to both retail explorers and institutional stakeholders seeking regulated exposure. Enhanced Security: Protecting You in a Volatile Market

KYC verification significantly reduces the risk of account takeover, fraud, and money laundering—threats that plague open crypto platforms. Pi Network’s expanded KYC framework ensures that only verified users execute significant transactions, minimizing exposure to phishing, scams, and unauthorized activity.

For users, this translates to safer storage conditions, greater peace of mind, and stronger protection of assets. “Every verified user is a step toward a more resilient Pi Network,” explains cybersecurity expert Dr. Elena Torres, who advises fintech startups.

“With better identity assurance, the network becomes less of a playground for bad actors and more of a trusted marketplace.”

Broader Financial Opportunities on the Horizon

As KYC integration deepens, Pi Network unlocks previously restricted access points. Institutional partners, already constrained by FIAT compliance needs, now view Pi as a viable bridge between fiat readiness and blockchain innovation. Retail users who complete tiered KYC can access stablecoin lending, cross-border remittance features, and even tokenized derivatives—tools that transform passive holdings into active financial instruments.For example, verified users can now earn interest on Pi’s native Pi Token through secured lending pools, or use KYC-verified identity as collateral in decentralized finance (DeFi) applications. “The old barrier—open, unverified—a user’s path to full participation is now defined by verification, not exclusion,” notes a Pi community leader.

Building Trust with Regulators—and Users

One of the most underappreciated impacts of Pi Network’s KYC progress is its role in cultivating legitimacy.By proactively meeting regulatory expectations, Pi positions itself not just as a cryptocurrency, but as a compliant, real-world financial technology. This shifts public perception: what once was seen as a “get-rich-quick” scheme is evolving into a credible platform aligned with global standards. For regulators, Pi’s transparent, user-verified system offers a model for integrating blockchain innovation within existing legal frameworks.

For everyday users, it means greater confidence in the network’s legitimacy—a critical factor in long-term adoption.

Recent developments emphasize that Pi Network is no longer self-contained. Its KYC evolution reflects a broader industry trend: crypto projects must balance decentralization with regulatory maturity to survive and thrive.

As payment networks, stablecoins, and decentralized identity gain traction, verified KYC processes like Pi’s become the fiduciary backbone enabling real-world use cases. The network’s push toward regulated access doesn’t dilute its community spirit—it strengthens accountability, broadens utility, and turns skepticism into participation.

In essence, Pi Network’s KYC journey is far more than administrative compliance.

It is the infrastructure behind a more secure, trusted, and scalable digital finance frontier—one where identity verification empowers individuals, deters bad actors, and paves the way for Pi Token and its ecosystem to reach their full potential. For users, staying informed about these updates is not simply about maintaining access—it’s about aligning with a platform committed to growth through trust, transparency, and technological progress. In an era where legitimacy defines value, Pi Network’s KYC evolution is not just upstream—it’s destiny.

Related Post

The Spanish Kings Cup: A Legacy of Royal Pride and Competitive Football

Mary Wiseman Nude: A Bold Reckoning in Art, Iconography, and Cultural Perception

Jackie Brucia Now And Then: Unpacking a Career Defined by Resilience and Evolution

10 Things You Didn’t Know About Sydneylint’s OnlyFans Empire: Prepare to Be Stunned