Petrobras Stock Forecast: What's Next For PETR4?

Brazil’s state energy champion Petrobras (PETR4) stands at a pivotal crossroads, with analysts turning sharp focus on a complex forecast shaped by global energy dynamics, domestic policy shifts, and internal operational milestones. The company’s stock trajectory hinges on evolving crude prices, investment discipline, and the pace of its upstream expansion—factors that now converge in a detailed outlook projecting both cautious optimism and structural challenges. As Petrobras navigates post-pandemic demand cycles and the green transition, understanding the drivers behind its near-term performance becomes essential for investors and energy observers alike.

Global Energy Shifts and Petrobras’ Strategic Position

Petrobras operates in a volatile but opportunity-rich environment where rising global energy demand—particularly in emerging markets—intersects with the accelerating push toward decarbonization.The International Energy Agency’s latest reports confirm that oil demand is expected to plateau by the late 2030s, but short-term shortages in key supply regions continue to support pricing resilience. For Petrobras, this duality presents a strategic imperative: maintaining output stability in core offshore fields while increasing capital efficiency and expanding low-carbon ventures. “The company’s ability to balance short-term production efficiency with long-term energy transition investments will define its stock performance over the next 12–18 months,” noted analyst Marcus Almeida of São Paulo-based credence investment firm, EnergyStrat.

Crude price volatility remains the most immediate catalyst for PETR4’s valuation, with Brent currently trading around $82 per barrel—a critical threshold that supports bullish sentiment without fostering reckless risk-taking. Historical patterns show that when prices stabilize near $75–$85, Petrobras typically trims earnings volatility and boosts shareholder returns through dividends and share buybacks. However, analysts caution that prolonged exposure to low prices could delay frontier exploration and slow LNG expansion projects, both vital to long-term growth.

“The market rewards Petrobras when it delivers consistent cash flow, not just volume,” said Elisa Mendes, head of energy equities at Rio-based investment bank Nova Partners.

Upstream Momentum: The Core Engine of Forecast

At the heart of the PETR4 forecast lies the company’s upstream performance, projected to drive the bulk of future earnings. The pre-salt basin remains Petrobras’ strategic goldmine, where Haybox and Búzios developments are ramping new production capacity.Expected output from these fields is forecasted to grow by 12–15% annually through 2025, supported by improved reservoir recovery rates and advanced drilling technologies. “This resurgence in deepwater output directly reduces import dependency and strengthens Brazil’s energy sovereignty,” explained petroleum engineer Rodrigo Figueiredo, Petrobras’ former vice president of Exploration and Production. Key projects under review include the upcoming Bacia do Espírito Santo expansion, which could add 500,000 barrels per day within three years, and ongoing digital transformation initiatives aimed at cutting operational costs by up to 20%.

These efficiency gains are projected to improve the company’s free cash flow margin to over 40%—a threshold analysts view as essential for sustaining both dividends and ordered capital returns.

Downstream stability: refining and petrochemicals as resilience anchors

Beyond crude output, Petrobras’ diversified downstream portfolio—encompassing refining, distribution, and petrochemicals—acts as a crucial buffer against upstream fluctuations. The company’s refining complex in São Paulo and Rio de Janeiro maintains a tight feedstock advantage, processing heavy crude into high-margin products tailored for local and regional demand.With global refining margins narrowing, Petrobras’ integrated model ensures steady revenue, particularly on gasoline, diesel, and polyethylene exports. The petrochemicals segment, anchored by the customs deferral program, continues to expand, offering higher-margin exposure to plastics and derivatives. Analysts project this sector’s contribution to EBITDA to rise from 35% today to nearly 45% by 2026, driven by new export capacity and partnerships with Asian chemical buyers seeking reliable feedstock.

“This segment isn’t just a stabilizer—it’s a growth vector independent of oil price swings,” stated Mariana Costa, a consultant at McKinsey & Company advering on Latin American energy markets.

Policy, Politics, and the Path to Sustainable Returns

Brazil’s evolving regulatory landscape introduces both opportunities and uncertainties for Petrobras. Government policies supporting energy security—including tax incentives for upstream investment and streamlined environmental licensing—have improved project economics.However, persistent debates over environmental regulations and sovereign wealth fund allocations create fiscal headwinds. Recent legislative proposals to increase state equity stakes in strategic assets have raised investor concerns about future capital flexibility, though Petrobras maintains its dividend policy remains non-negotiable. “The government’s dual role—as major shareholder and regulator—adds complexity,” observed legislator and energy analyst Luciano Ferreira.

“Clarity in policy frameworks will reduce volatility and reinforce long-term investor confidence.” Meanwhile, Petrobras’ commitment to reducing flaring, cutting methane emissions by 30% by 2027, and investing in CCS pilot projects aligns with global ESG standards. “Sustainable execution strengthens credit ratings and attracts ESG-focused institutional capital,” emphasized sustainability officer Ana Souza in the company’s latest ESG report.

Financial outlook: balanced growth with controlled leverage

Financial metrics underpin the stock’s near-term narrative.Petrobras’ Q

Related Post

1952 Births: The Silent Generation’s Everyday American Heroes Who Shaped a Nation

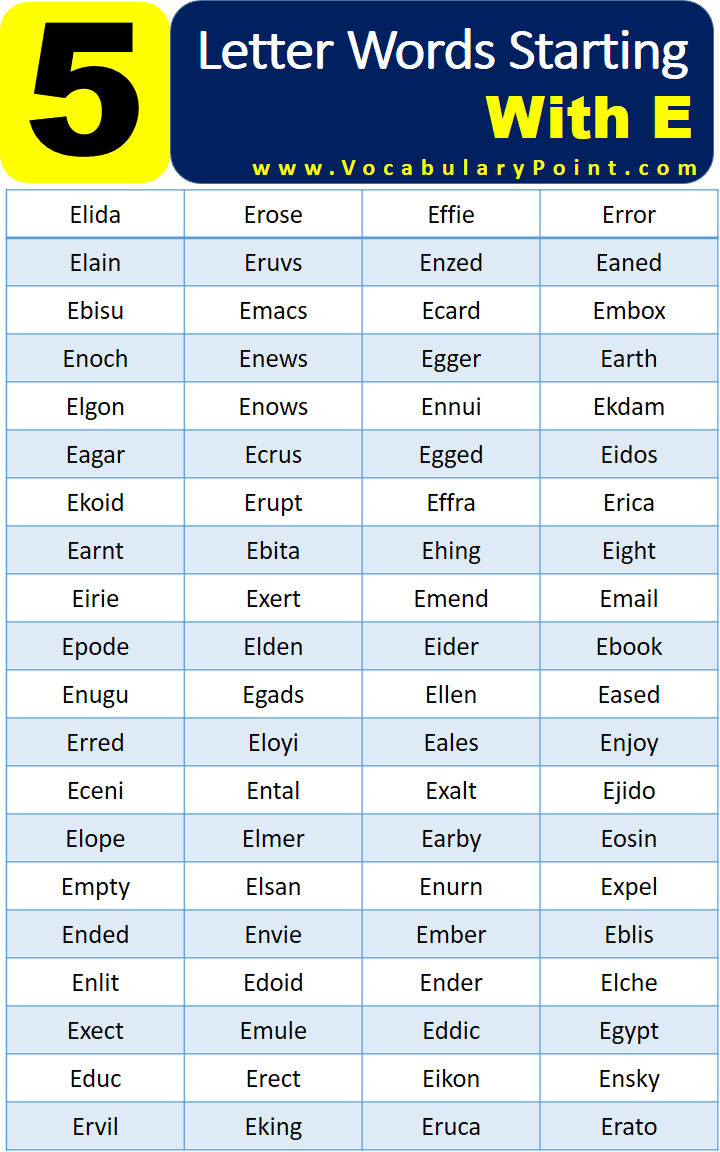

Are You Using This 5-Letter Word Starting With E Wrong? Find Out Now

Honoring Life and Legacy: A Deep Dive into Sheboygan Obituaries Reveal Community Challenges and Connections

Fortran 2023 Unleashes Modern Power: A Pioneer in High-Performance Computing