Passive Investing Done Right: How Profitable Strategies With 5Starsstockscom Simplify Your Stock Portfolio

Passive Investing Done Right: How Profitable Strategies With 5Starsstockscom Simplify Your Stock Portfolio

In today’s complex financial markets, timeless investing wisdom meets modern technology—offering individual and institutional investors equitable, low-effort pathways to wealth growth. At the forefront of this evolution are platforms like 5Starsstockscom, which empower users to harness passive stock strategies that demystify market participation. By combining disciplined strategies with user-centric tools, these platforms turn intricate investment concepts into accessible, repeatable systems—enabling smarter, stress-free wealth accumulation.

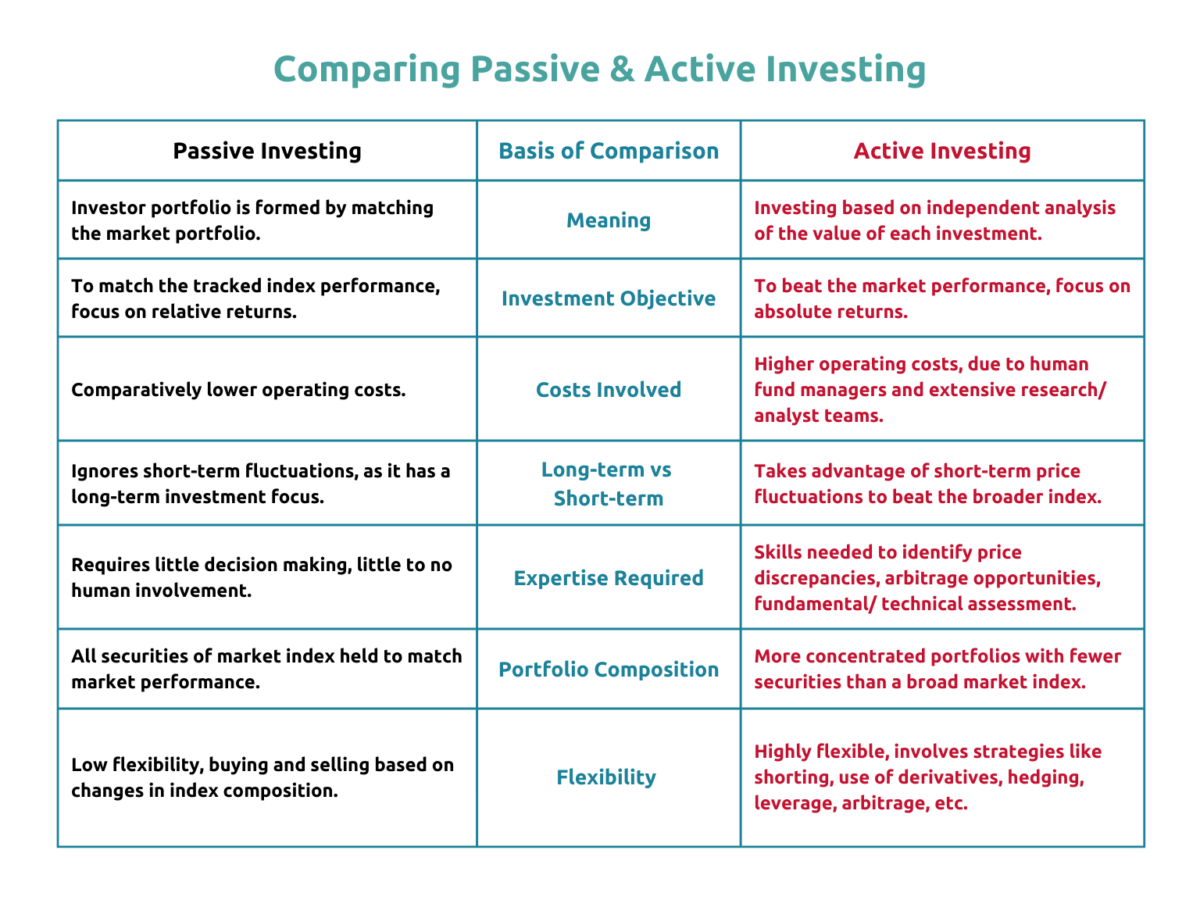

The core advantage of passive investing lies in its philosophy: rather than chasing daily market noise, investors align with long-term trends through well-researched, diversified holdings. This approach typically delivers lower fees, reduced emotional decision-making, and consistent exposure to proven market performers. For those seeking simplicity without sacrificing returns, platforms such as 5Starsstockscom deliver a compelling solution by integrating research, automation, and strategic framework into one streamlined experience.

Passive investing is not passive in the sense of passivity—it’s active in design. It leverages index-tracking, sector rotation, and risk-assessed rebalancing to build balanced portfolios that endure market swings. At the heart of this methodology is the principle that steady, market-aligned returns outperform erratic, high-risk speculation over five- and ten-year horizons.

Leading platforms simplify this process by curating and automating investment logic that once required deep expertise and manual oversight.

Core Principles of Profitable Passive Investment Strategies

Modern passive investing rests on several foundational principles, all amplified by platforms like 5Starsstockscom: - **Diversification through indices and baskets**: Rather than picking individual stocks, passive strategies spread risk across hundreds or thousands of equities. This reduces the impact of any single company’s poor performance. For retail investors, this means accessing global market exposure with minimal transaction costs and complexity.- Reduced fees are non-negotiable. Traditional active management often carries high expense ratios and hidden costs. Passive approaches, by design, minimize overhead, directly boosting net returns. Studies show even a 1% difference in fees compounds dramatically over decades, making cost efficiency a silent driver of wealth.

- **Long-term horizon as an ally.** Widely documented by financial experts, passive investing thrives on patience. Markets trends upward over time, rewarding consistent participation rather than timing short-term moves. The S&P 500’s historical average annual return—around 7% to 10%—shows the power of staying the course.

- **Minimized emotional intervention.** Market volatility triggers countless impulsive decisions. By removing daily noise, passive strategies insulate investors from fear and greed, enabling discipline that fuels compounding. - Automation and systematization. Successful passive investing today relies on tools that execute balanced allocations, periodic rebalancing, and tax-aware strategies without manual input.

Automated platforms like 5Starsstockscom deliver repeatable, scalable results across diverse investor profiles.

These principles converge to create a framework where even novice investors can achieve compound growth that matches expert hands—without the stress or expense.

How 5Starsstockscom Turns Strategy Into Simplicity

5Starsstockscom distinguishes itself by fusing research depth with intuitive user design. The platform does not merely offer stock recommendations; it delivers a complete passive investment toolkit tailored to long-term goals.Key features include: - Curated passive portfolios modeled on diversified index benchmarks, yet optimized for immediate deployment by individuals. These portfolios span sectors and geographies, ensuring broad exposure without requiring individual stock picking. - Smart automation in portfolio construction—leverage pre-defined rules for asset allocation, rebalancing, and tax efficiency without constant manual oversight.

This transforms passive investing from a passive “set it and forget it” model into a dynamic yet low-effort system. - Real-time market insights and alerts powered by proprietary analytics. Investors stay informed on market shifts affecting their holdings, enabling timely recalibration within a well-structured framework.

- Educational resources integrated seamlessly, demystifying passive strategies for new investors while offering advanced tools for seasoned users. This dual

Related Post

Tiffany Pollard Bio Wiki Age Flavor Of Love Big Brother and Net Worth

Satisfaction Unlocked: The Deep Emotional Weight Behind Finally Nailing Your Daily Wordle Answer

Sherry Baffert How is Bob Bafferts exwife faring after divorce

Anna Jobling dan Meerqeen Putus: Kisah Cinta Yang Kandas di Crossroads Emosi