Pagostore Garena: The Backbone of Mobile Payments Powering Southeast Asia’s Digital Economy

Pagostore Garena: The Backbone of Mobile Payments Powering Southeast Asia’s Digital Economy

In the fast-evolving landscape of digital transactions, Pagostore Garena stands as a cornerstone of secure and efficient payment processing across Garena’s sprawling ecosystem—from gaming platforms like Garena Free Fire to e-commerce, in-app purchases, and community-driven marketplaces. Operating at the intersection of finance, technology, and regional consumer behavior, Pagostore Garena has redefined how millions of users in Southeast Asia conduct billions of microtransactions daily. Its seamless integration, fraud intelligence, and hyper-localized support have made it a gold standard in the Southeast Asian fintech space.

Unlike generic payment gateways, Pagostore Garena specializes in serving high-volume, low-visibility microtransactions typical of gaming and mobile services—transactions that demand speed, reliability, and impeccable security. As one system architect explained, “We’re not just processing payments—we’re enabling frictionless experiences tailored to how Southeast Asians engage with digital content.” This tailored approach is critical given the region’s unique digital habits: frequent small-dollar purchases, mobile-first identities, and intense user expectations for instant gratification.

At its core, Pagostore Garena delivers a robust suite of payment APIs and SDKs designed for rapid deployment across diverse entry points—be it within apps, online stores, or community-based marketplaces.

The platform supports multiple payment methods, including credit cards, e-wallets, bank transfers, and increasingly, real-time payment systems integrated with national financial infrastructure. This diversity ensures accessibility across varying levels of digital banking penetration, making it inclusive for both digitally savvy users and those transitioning into digital finance.

One of Pagostore Garena’s defining strengths lies in its advanced fraud prevention architecture.

Operating in a region where digital fraud remains a persistent challenge, the platform leverages machine learning algorithms and behavioral analytics to analyze transaction patterns in real time. By identifying anomalies and risk indicators before they escalate, Pagostore Garena maintains transaction approval rates above 99% while minimizing false positives—a vital balance for user trust and business continuity.

Industry analysts have consistently highlighted Pagostore Garena’s scalability as a key differentiator.

“In a market where user bases can surge unpredictably—especially during game events or promotional campaigns—Pagostore Garena’s infrastructure dynamically adjusts to handle spikes without latency,” noted Dr. Lina Tan, fintech researcher at the ASEAN Digital Economy Institute. “This elasticity ensures that commerce flows uninterrupted, preserving both user experience and merchant trust.”

The platform’s success is also rooted in its strategic focus on localized customer support and developer enablement.

Pagostore Garena provides intuitive documentation, responsive technical teams, and near 24/7 incident management—resources that empower developers and merchants to integrate payment systems efficiently. For Garena’s ecosystem players, this means less technical friction and faster time-to-market for new monetization models.

Beyond gaming, Pagostore Garena is expanding into adjacent fintech domains, including subscription billing, peer-to-peer transfers, and merchant disbursements.

This diversification reflects a strategic vision: to position Pagostore not merely as a payment processor, but as a full-stack financial services enabler for digital communities.

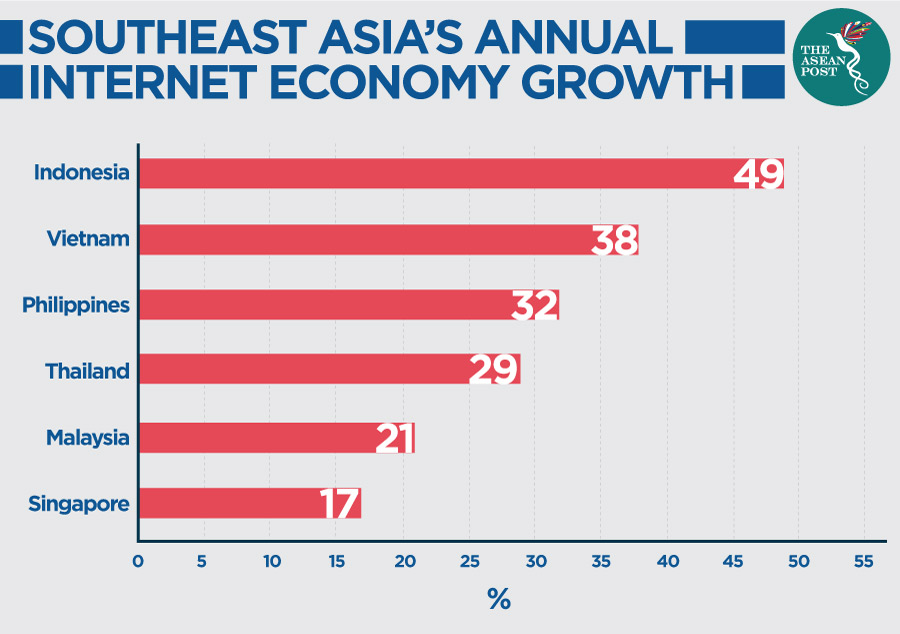

As Southeast Asia’s digital economy continues its exponential growth—projected to reach $1 trillion by 2030—Pagostore Garena is shaping how transactions are secured, processed, and experienced. By combining cutting-edge technology with deep regional insight, it ensures that even the smallest in-app purchase feels seamless, safe, and instantly rewarding.

In doing so, Pagostore Garena is not just facilitating commerce—it’s empowering a generation of digital entrepreneurs and gamers across the region.

Deep Dive: How Pagostore Garena Powers Garena’s Vast Digital Ecosystem

Garena’s success across titles like Free Fire, Mobile Legends, and BenBarak hinges on a vibrant in-game economy where millions of users trade virtual goods, skins, and exclusive content daily. Pagostore Garena serves as the payment engine behind these transactions, enabling real-time conversions between local currencies and in-game assets.For example, during peak sales events such as Garena’s annual In-Game Mall campaign, the platform processes thousands of concurrent microtransactions with sub-second response times—critical for sustaining user engagement and transaction momentum.

The integration begins at the merchant end: Garena’s developer portal offers plugin-based SDKs that allow seamless embedding of Pagostore’s payment flows directly into game stores, in-app menus, or live events. This tight coupling reduces development overhead while ensuring compliance with regional payment regulations and currency conversion protocols.

Developers report significantly shorter implementation cycles—from weeks to days—thanks to Pagostore’s pre-built modules and tiered pricing aligned with volume.

Security is paramount: Pagostore Garena employs end-to-end encryption, tokenization of sensitive card data, and multi-factor authentication layers to protect user funds and merchant revenue. Biometric login options and session token management further safeguard against account takeover, a persistent threat in mobile-heavy environments.

“Securing microtransactions without sacrificing speed is an art,” said a senior Pagostore engineer during a tech webinar. “We’ve engineered systems where cryptographic verification happens in milliseconds—without detectible latency.”

Fraud detection is equally sophisticated. Pagostore Garena’s AI-driven engine analyzes over a hundred behavioral variables per transaction—geolocation patterns, device fingerprints, purchasing history, and network anomalies—to assign real-time risk scores.

This proactive model reduces chargebacks and counterfeit transactions by more than 40%, improving merchant trust and customer satisfaction.

Liquidity management represents another cornerstone of Pagostore Garena’s architecture. Through real-time treasury integrations with local banks and regional payment networks like NVI in Vietnam or DHI in Indonesia, the platform maintains optimal cash reserves across geographies.

This liquidity agility ensures merchants never face payment bottlenecks, even during massive promotions or flash sales.

The backend infrastructure leverages containerized microservices deployed across high-availability cloud zones in Singapore, Malaysia, and Thailand, minimizing latency for users across Indonesia, the Philippines, and Thailand. Redundancy protocols ensure system uptime even during regional outages, reinforcing Pagostore Garena’s reputation as a resilient backbone for Southeast Asia’s digital economy.

Challenges and Innovations in Southeast Asia’s Payment Landscape

Southeast Asia’s digital payment environment is among the most fragmented and complex globally. With over 100 million unbanked or underbanked users and more than 200 million active mobile wallet accounts, the challenge lies in unifying diverse financial infrastructures—ranging from national central bank initiatives like Indonesia’s QRIS to country-specific solutions such as Thailand’s PromptPay and the Philippines’ GCash.Pagostore Garena answers this challenge with adaptive integration layers that abstract regional idiosyncrasies behind a unified API interface.

This abstraction allows Garena’s titles to support local payment methods—from gamelan-inspired virtual credit systems in Indonesia to QR-based settlements in Malaysia—without requiring separate backend code per market. “We design for flexibility, not rigidity,” explains a Pagostore regional product lead. “Our systems adapt to the local payment ecosystem, not the other way around.”

Additionally, Pagostore Garena actively collaborates with central banks and licensed financial institutions to explore emerging formats like central bank digital currencies (CBDCs) and cross-border payment interoperability.

Early pilot programs with Vietnam’s digital dong sandbox and Thailand’s digital wallets signal a strategic push toward interoperable, future-ready payment rails. These efforts align with regional policy goals to increase digital transaction penetration and financial inclusion.

Despite progress, hurdles remain.

Regulatory fragmentation, inconsistent internet access in rural zones, and varying consumer trust levels across demographics continue to shape adoption patterns. Pagostore Garena addresses these through tiered localization strategies—such as voice-guided payment interfaces for low-literacy users and offline payment buffering in areas with spotty connectivity.

The Path Forward: Pagostore Garena and the Future of Digital Commerce in Southeast Asia

Looking ahead, Pagostore Garena is poised to expand its role beyond transaction processing into broader financial inclusion and creator monetization.Garena’s push into community-driven economies—where players exchange assets, offer in-game services, or launch niche market

Related Post

Pagostore Garena Top Up Your Game Credits

Pagostore Garena Top Up: Your Go-To for Seamless In-Game Purchases

Divya Bharti: A Cinematic Journey Through India’s Golden Hindi Cinema

The Journey of a Music Industry Professional: From Avis faulty laugh to Jordan Bratman’s Industry Mastery