Own Price Elasticity of Demand: The Hidden Sense of Value Shaping What We Buy

Own Price Elasticity of Demand: The Hidden Sense of Value Shaping What We Buy

When consumers glance at prices and decide whether to buy, their response isn’t random—it’s measurable. The economic concept of Own Price Elasticity of Demand (PED) reveals exactly how sensitive demand is to price changes, offering powerful insight into consumer behavior. PED quantifies the percentage change in quantity demanded in response to a percentage change in price, revealing whether a product is a necessity or a luxury, and whether demand bends sharply or remains steady when costs shift.

Understanding this metric transforms how businesses set prices, forecast demand, and craft strategies—ultimately revealing the rhythm of consumer choice across markets.

What Is Own Price Elasticity of Demand?

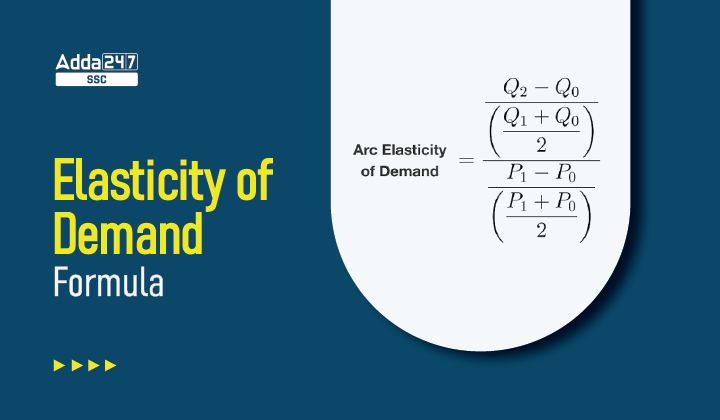

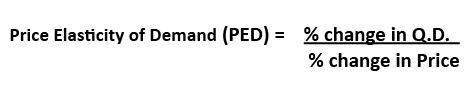

Own Price Elasticity of Demand (PED) is a key metric in microeconomics that calculates the responsiveness of consumer demand to changes in the price of a good or service. Defined mathematically as the ratio of the percentage change in quantity demanded to the percentage change in price, PED answers a critical question: how much will buyer behavior shift if prices rise or fall? The formula is straightforward: PED = (% Change in Quantity Demanded) / (% Change in Price) A value greater than one signals elastic demand—where small price adjustments produce large volume changes—while a value less than one indicates inelastic demand, where spending remains relatively stable even with price swings.

This metric is not just theoretical; it’s a practical compass guiding decisions in retail, policy, and marketing.

Measuring Elasticity: Elastic, Inelastic, and Perfectly Unresponsive

Elasticity values fall into clear categories, each with distinct market implications. A PED value above 1 means demand is elastic: consumers are highly responsive to price changes. If a bakery raises the price of artisanal bread by 10% and sales drop by 15%, PED equals 1.5—signaling elastic demand.

In contrast, a value under 1 indicates inelastic demand: buyers absorb price increases with minimal volume loss. For example, insulin for diabetics often registers PED below 0.5—small price hikes barely affect purchase volume. At exact responsiveness of 1, demand is said to be unit elastic, where revenue is maximized at the current price.

Perfectly inelastic demand (PED = 0) occurs only in extreme cases, such as life-saving drugs in emergencies, where quantity demanded remains unchanged regardless of cost.

Industry context shapes elasticity dramatically. Utilities and prescription medications typically exhibit inelastic demand because alternatives are scarce and needs are urgent. Conversely, non-essential items like luxury gadgets or designer apparel display elastic demand—buyers quickly shift purchases when prices rise.

Understanding these distinctions allows firms to predict revenue impacts: raising prices on elastic goods risks steep volume drops, while inelastic goods offer pricing power to boost margins.

Factors Influencing Demand Elasticity

Elasticity isn’t static; it evolves with market conditions, consumer psychology, and economic context. Several key factors determine how price-sensitive demand truly is:

- Availability of Substitutes: Goods with close alternatives—like coffee brands, generic vs. name brands—tend to be elastic.

When one brand raises prices, shoppers switch swiftly. A 2023 study in retail analytics found coffee with one affordable substitute sees a 20% demand drop at a 10% price hike—PED of 2.0.

- Necessity vs. Luxury: Basic goods such as salt or tap water display inelastic demand because survival or habit drives purchase.

Luxury items—high-end watches, premium spirits—show heightened elasticity. A 15% price increase on designer handbags often triggers a 25% drop in demand.

- Proportion of Income: Costs consuming a large income share amplify sensitivity. Buying a $1,000 laptop represents a major decision; a 10% price jump may prompt pause or avoidance.

Conversely, a $10 coffee increase affects purchasing power barely—demand stays strong despite a PED often below 0.2.

- Time Horizon: Short-term demand is often inelastic—consumers lack immediate alternatives. Over time, elasticity increases as buyers adjust: new shopping habits form, substitutes emerge, or budgets shift. Immediate post-tax hikes on gasoline see small volume drops, but sustained increases reshape commuting and storage behaviors.

- Definition and Perception of Necessity: Even essentials can become elastic when framed as optional.

For instance, organic produce often sees responsive demand as prices rise, especially among budget-conscious shoppers—showing perception shapes elasticity.

These dynamics illustrate that elasticity isn’t a fixed trait of a product, but a fluid response shaped by context, alternatives, and consumer priorities.

Real-World Applications: From Retail Shelves to Government Policy

Own Price Elasticity of Demand is not just an academic tool—it drives decisions across sectors. Retailers leverage elasticity data to optimize pricing strategies: low-elastic products sustain higher markups, while elastic goods require competitive pricing to prevent volume slippage. E-commerce platforms dynamically adjust prices in real time based on elasticity signals from user behavior analytics.

In public policy, governments use PED to evaluate the impact of tax changes.

Imposing a sin tax on sugary drinks, for example, relies on elasticity forecasts: if demand is elastic, higher taxes reduce consumption and improve public health with minimal revenue loss. Yet, placing heavy taxes on inelastic goods—such as gasoline or cigarettes—can generate steady tax revenue without drastically dampening purchases.

Brick-and-mortar stores tailor promotions using elasticity insights: seasonal sales on electronics—highly price-sensitive—couple discounts with urgency to drive volume. Airlines segment pricing using PED, offering premium fares for business travelers (less elastic) and steep but strategic discounts for leisure travelers (highly elastic), maximizing load factors.

Why Businesses Can’t Ignore PED’s Signal

Treating Own Price Elasticity of Demand as a mere number risks misaligned pricing and lost revenue.

A luxury skincare brand raising prices without elasticity research may alienate loyal customers and drive them to alternatives. A supermarket lowering everyday essentials further deepens customer loyalty by keeping pricing in sync with value perception. Elasticity acts as a diagnostic: it reveals whether a price hike threatens volume, and whether deep discounts truly unlock growth.

In volatile markets where consumer preference shifts rapidly, elasticity isn’t optional—it’s the foundation of sustainable pricing strategy.

Market researchers commonly use surveys, transactional data, and controlled experiments to measure PED. A/B testing price points on digital platforms reveals real-time demand shifts, while historical sales data across price changes charts behavioral patterns. Econometric models isolate price effects from external noise, ensuring accurate elasticity estimates.

The Strategic Power of Understanding Price Sensitivity

Own Price Elasticity of Demand illuminates the delicate dance between price and demand—revealing not only how consumers react but how businesses must adapt.

From the elasticity of everyday staples to rare inelastic necessities, this metric empowers firms to anticipate market behavior, optimize revenue, and align pricing with true consumer value. In an era where competition is fierce and consumer attention fleeting, mastering PED is more than an economic advantage—it’s a strategic imperative. As markets evolve, so too does the story of price sensitivity, guided by the precise lens of Own Price Elasticity of Demand.

Related Post

How ElManualDelPendejo Redefines Technical Clarity in Professional Writing

Is A Banana Really a Berry? The Surprising Answer No One Expected

Wild N Out’s Female Cast Members: Redefining Comedy, Charisma, and Cultural Impact in Skit Comedy

Drew McIntyre Contemplating Multiple Options as Contract Nears Expiration