Online Shop Business Permits: Your Step-by-Step Guide to Legal & Profitable Legal Setup

Online Shop Business Permits: Your Step-by-Step Guide to Legal & Profitable Legal Setup

Opening an online shop is not just about selecting products and designing sleek websites—it’s a legally binding journey requiring the right permits and registrations. In today’s crowded digital marketplace, one misstep in compliance can halt operations, invite fines, or even trigger shutdowns. Understanding the full landscape of required business permits is essential for entrepreneurs who want to build a resilient, legally sound e-commerce venture.

Launching an online shop without proper permits is akin to sailing without a license—unnecessary risk. Regulatory authorities across jurisdictions enforce strict rules governing digital commerce to protect consumers, ensure fair competition, and secure tax revenue. Permits serve as legal proof that your business operates in full compliance with local, regional, and national laws. Key reasons why permits are non-negotiable include:The Legal Labyrinth: Why Permits Matter for Your Online Business

Each jurisdiction defines its own set of mandatory licenses—from general trades permits to e-commerce-specific certifications. For example, the European Union outlines specific digital service provider registers, while U.S. states mandate sales tax permits for physical goods resale, often coupled with general business licenses.

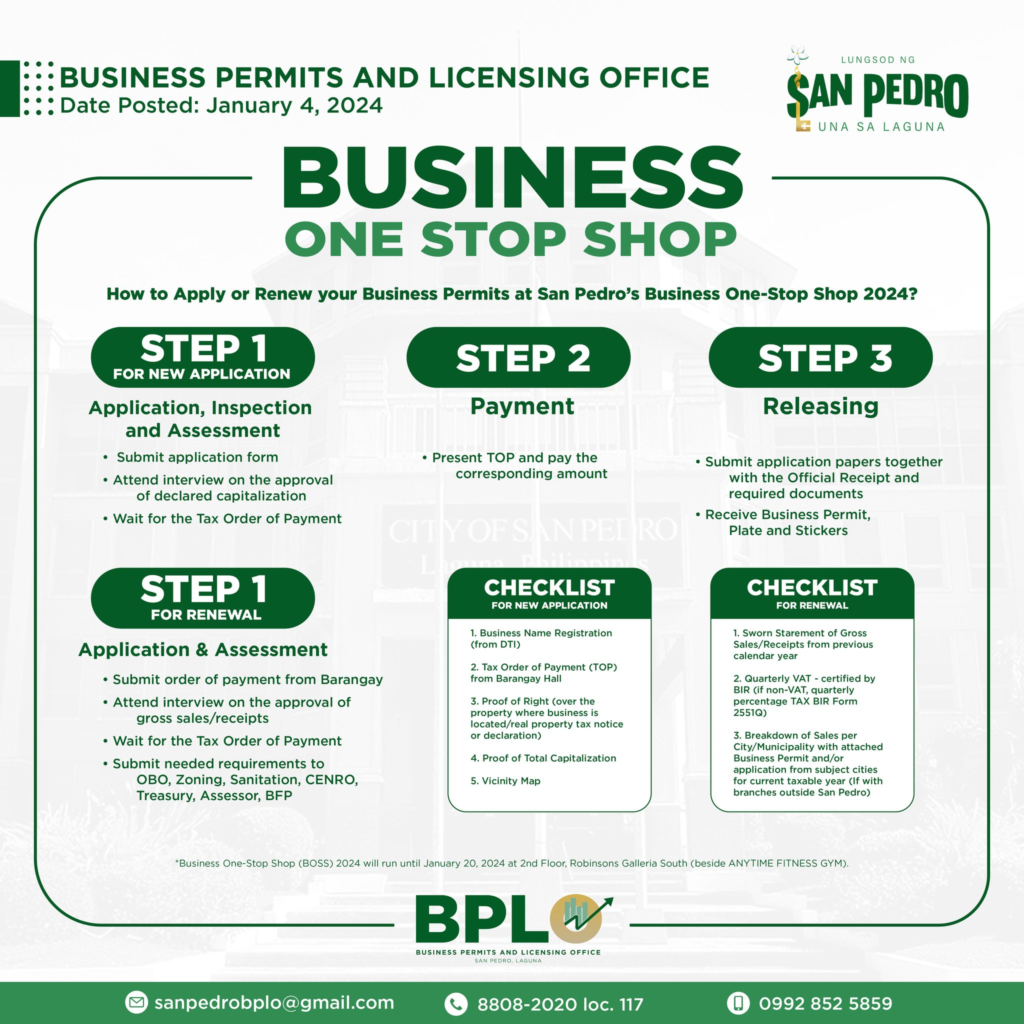

Ignoring these requirements can result in penalties ranging from thousand-dollar fines to platform delisting, damaged reputation, and legal liability. Navigating permit requirements can seem daunting, but breaking the process into clear steps transforms it into a manageable foundation for your business. Below is a foundational roadmap used by compliant online retailers worldwide.Step-by-Step: Securing Essential Business Permits for Your Online Shop

SEC or UK Companies House. This step establishes your official identity. Most countries require notarized formation documents before permitting online sales.

Some nations explicitly define this as a separate category requiring cybersecurity compliance and data privacy clauses.

This ensures smooth logistics and legal shipping permissions across borders.

Decoding Permit Complexity: Tips for Navigating Online Shop Legal Requirements

While the checklist provides structure, real-world implementation demands foresight and adaptability. Entrepreneurs must anticipate permit certifications as dynamic—regulations evolve with technological advances and consumer protection reforms.

Key best practices include:

- Consult official government portals before launch—many offer free compliance checklists and online application portals.

- Engage legal counsel or business incubators familiar with digital commerce laws to avoid costly oversights.

- Maintain up-to-date digital records: receipt tracking, customer data encryption, and audit trails support permissive validation during inspections.

- Automate tax collection systems where required, using integrated e-commerce platforms (Shopify, WooCommerce) that interface with tax authority databases.

Global Permitting Challenges: Adapting to Regional Legal Landscapes

Operating an online shop across borders amplifies compliance complexity. For instance, selling via Amazon or Etsy may trigger regional tax and customs obligations, but local permits often remain mandatory.

Key regional nuances include:

European Union

Member states demand VAT number registration via the Mini One-Stop Shop (MOSS) mechanism—simplifying cross-border sales but requiring precise EU-wide compliance. Non-EU sellers may need local Made-in-EU licenses for retail placement.United States

Each state enforces unique licensing cycles, taxation rules, and product regulations.Sales tax permits vary by region; California requires separate state and local permits alongside federal EIN validation. Remote sellers must also comply with state-specific consumer protection laws.

Asia-Pacific

Countries like Singapore enforce streamlined digital economy sandbox frameworks, while India’s Goods and Services Tax (GST) mandates mandatory registration at the state level for online retailers.China’s e-commerce rules demand occupational licenses and content compliance for marketplace listings—especially for media, goods, and travel sectors.

Beyond legal necessity, securing all required business permits transforms compliance from a barrier into a strategic asset. Legitimacy breeds consumer trust—71% of online shoppers cite business transparency as a key determinant in purchasing decisions, according to a 2023 Global Retail Trust Survey. Permits serve as verifiable proof of professionalism, reassuring customers and partners alike. Moreover, certified businesses unlock fintech advantages: banks and payment processors are more willing to onboard legally vetted shops, streamlining cash flow through faster disbursements and better credit terms. International scaling becomes smoother when local permits are already compiled. In essence, the legal setup becomes the foundation for growth, scalability, and global credibility—not just a compliance box to tick. When entrepreneurs treat permits as the first pillars—not afterthoughts—they position their online ventures not just to survive, but to thrive in an increasingly regulated digital economy. Turn Compliance Into Competitive Advantage: The Long-Term Value of Proper Permits

Related Post

Pieter Abbeel’s Student OpenAI Deep Research Head: Bridging Robotics and AI at Stanford

The Forecast Just Got Brighter: IIKCAL News: Meet Our Vibrant Weather Reporter Revolutionizing Local Broadcasts

Dauriac: The Cryptic Legacy of a Forgotten Genius in Modern Exploration

Current Est Time: The Pulse of Real-Time Precision Shaping Industries and Daily Life